June 12, 2023 | The Firm Grip of Tiff Macklem

Happy Monday Morning!

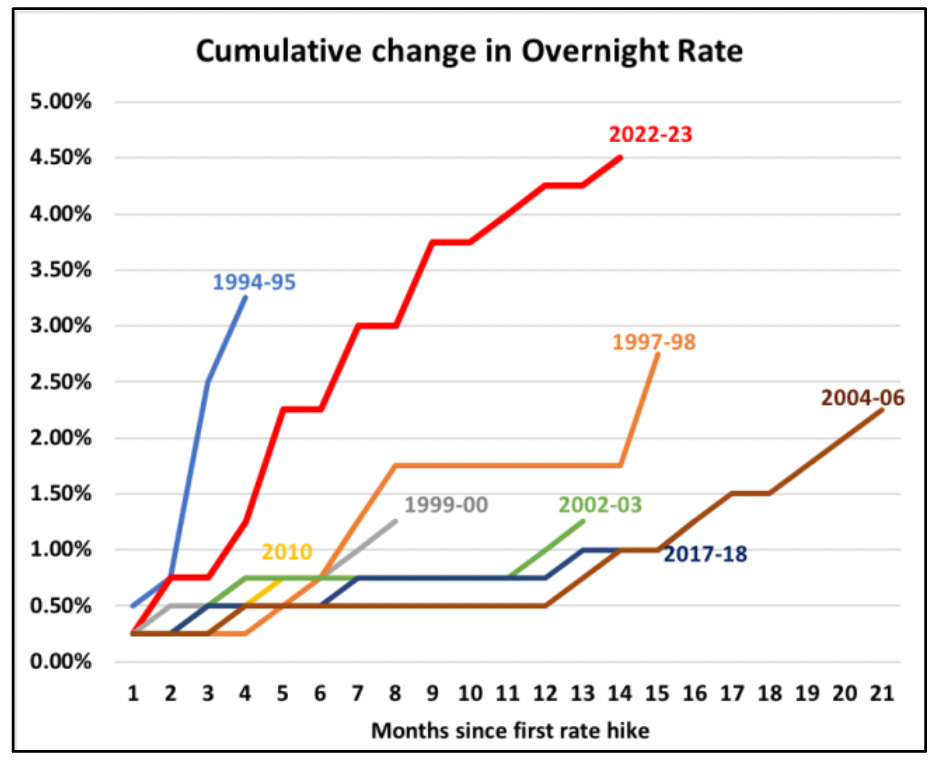

The Scotia guy was right, and the Bank of Canada delivered with another rate hike. It was only 25bps but the signal sent shockwaves through the bond market. It’s incredibly rare for a central bank to raise rates, pause, and then start hiking again. Pauses are almost always met with inevitable rate cuts. This is unprecedented territory. This is already the largest cumulative rate hiking cycle since the 1980’s.

Please don’t send me a long email explaining that rates are still low compared to the 80’s and that we need to keep hiking. In May of 1980 the average sales price in Canada was $65,947 and household debt to GDP hovered around 50%. The typical family had four kids and a big house with one income earner. This is not the 1980’s.

Today the average sales price sits at $715,000 and you have to pack multiple generations under one roof just to service the mortgage. Household debt is hovering near an eye watering 105% of GDP. These interest rates are going to hit hard. Don’t be fooled by lagging data artificially inflated by mind blowing levels of immigration. One third of households have not seen an increase in their monthly mortgage payment, but it’s coming.

Leading economic data such as building permits are telling a much different story. They’re down 18.8% to $9.6B in April, the lowest level since December 2020. Developers are pulling back aggressively as the cost of capital surges.

Housing supply is being choked to death under the firm grip of Tiff Macklem. Residential investment has plunged 15% on an annualized basis and is now down 20% relative to Q1 2022. This is the steepest contraction since the 1990’s. The great big housing boom is over, thanks for playing.

Markets are pricing in at least one more rate hike this year, and no cuts until late 2024. This will be a test of attrition for the highly leveraged, and it’s likely going to get worse in July. In case you missed it, deputy of governor at the Bank of Canada, Paul Beaudry, delivered an incredibly hawkish speech last week.

Here’s Paul:

By our meeting in April, we were beginning to see some signs that more tightening might be needed and so we discussed the possibility of increasing the policy rate. At that time, we were concerned about elevated core inflation and the tightness in the labour market—including strong wage growth. We also discussed the possibility that consumer demand could be more robust than expected.

The data since April have tipped the balance. The accumulation of evidence—across a range of economic indicators—suggests that excess demand in the Canadian economy is more persistent than we thought, and this increases the risk that the decline in inflation could stall. That’s why we decided to raise the policy rate.

Let’s start with economic growth, which rebounded in the first quarter of 2023 to 3.1%. Consumption growth, in particular, was very strong at 5.8%, with household spending on both goods and services sharply higher. This surprised us.

I don’t know about you, but Central banks being surprised about incoming data is never a good sign. Although their track record remains questionable. Let’s not forget the transitory inflation debacle.

Nonetheless, as we’ve discussed over the past few weeks Tiff and Co are playing tug of war with the federal government. As the Bank of Canada works to crush demand, the federal government is still stimulating. Another $20B of deficit spending was passed via Bill C-47 this past week. Finance Minister Freeland is still shovelling cheques in the mail. Her comments post rate hike, “We are coming to the end of this difficult path out of the Covid economy. The destination is stable, low inflation and steady, strong growth. And that is the direction that we are heading.”

I’ll take things that won’t happen for 500 Alex.

STAY INFORMED! Receive our Weekly Recap of thought provoking articles, podcasts, and radio delivered to your inbox for FREE! Sign up here for the HoweStreet.com Weekly Recap.

Steve Saretsky June 12th, 2023

Posted In: Steve Saretsky Blog

Next: Full Cycle Bearings »