April 22, 2024 | Two Big Lies

Happy Monday Morning!

We typically try to steer clear of politics in these weekly musings. However, there were two big lies told by the Trudeau government this past week, both of which relate back to housing, the key focus of my work.

The federal budget announced this past week brought no reduction in spending, shocking I know. However they did find new revenue sources, they will be increasing taxes on capital gains. Under the current tax rules, if you sell an investment for a profit, only half (50%) of the capital gain is included in your taxable income. The budget will increase the capital gains inclusion rate to two-thirds (66.7%) for capital gains realized on profits above $250,000 for individuals.

However, here’s where things get interesting. There is NO $250,000 exclusion for capital gains earned inside corporations and trusts. Any capital gains realized inside a corporation is automatically taxed at the higher inclusion rate!

The Trudeau government says this will only impact the richest 0.13% of Canadians, and they need to pay their fair share!

This is big lie number one.

We are told the move will only impact 40,000 wealthy taxpayers, yet the budget document also says 307,000 corporations will be stuck in the crosshairs. Not to mention estate sales, second properties, etc.

Small business owners and professionals who are incorporated such as doctors, dentists, RMT’s, chiropractors, will all be hit. Yes Realtors, and lawyers will also be hit, but let’s be honest there’s not much sympathy for Realtors and lawyers.

So let’s focus on doctors.

Many of them earn an income through a personal incorporation. They do not get a pension. One of the main benefits of being incorporated is they get to invest retained earnings inside the corporation, typically through a holding company, which is another form of retirement savings in addition to an RRSP. All of their investment dollars will now be taxed at a higher rate.

What message are we sending here? We are desperately short doctors in this country. We need more doctors. We should raise taxes on them!

Why are we framing doctors as some sort of rich tax cheats?

Let’s turn our attention to big lie number two.

The Trudeau government says they are going to build 3.9 million homes by 2031.

Just for context, the record high for annual housing completions in this country is 274,000 set back in 1974. The federal government is promising 3.9M homes by 2031. That’s more than DOUBLE the record high, and you’d have to do it 7 years straight with interest rates at their highest levels in 20 years!

They would need to build 1528 homes per day, or 64 homes per hour for 7 straight years, no weekends off.

This housing supply target is beyond parody. Here’s what I can tell you from my everyday conversations with builders, developers, pre-sale realtors, and commercial lenders. Housing starts are rolling over hard, and this is not even remotely showing up in the data yet. There are a lot of developers going bust, it’s just a matter of going through the litigation process, it takes time. There is more pain to come.

From my good friend Jordon Scrinko, one of the top pre-sale brokers in the GTA.

GTA precon sales across the board in Q1 2024 are on pace to see 1000 units sold. The 10 year average is 5100.

So here’s the funny thing.

The federal government says they’re going to build 3.9 million homes in 7 years, how? With what money? By increasing capital gains they are discouraging investment, the very investment dollars that go into new housing development!

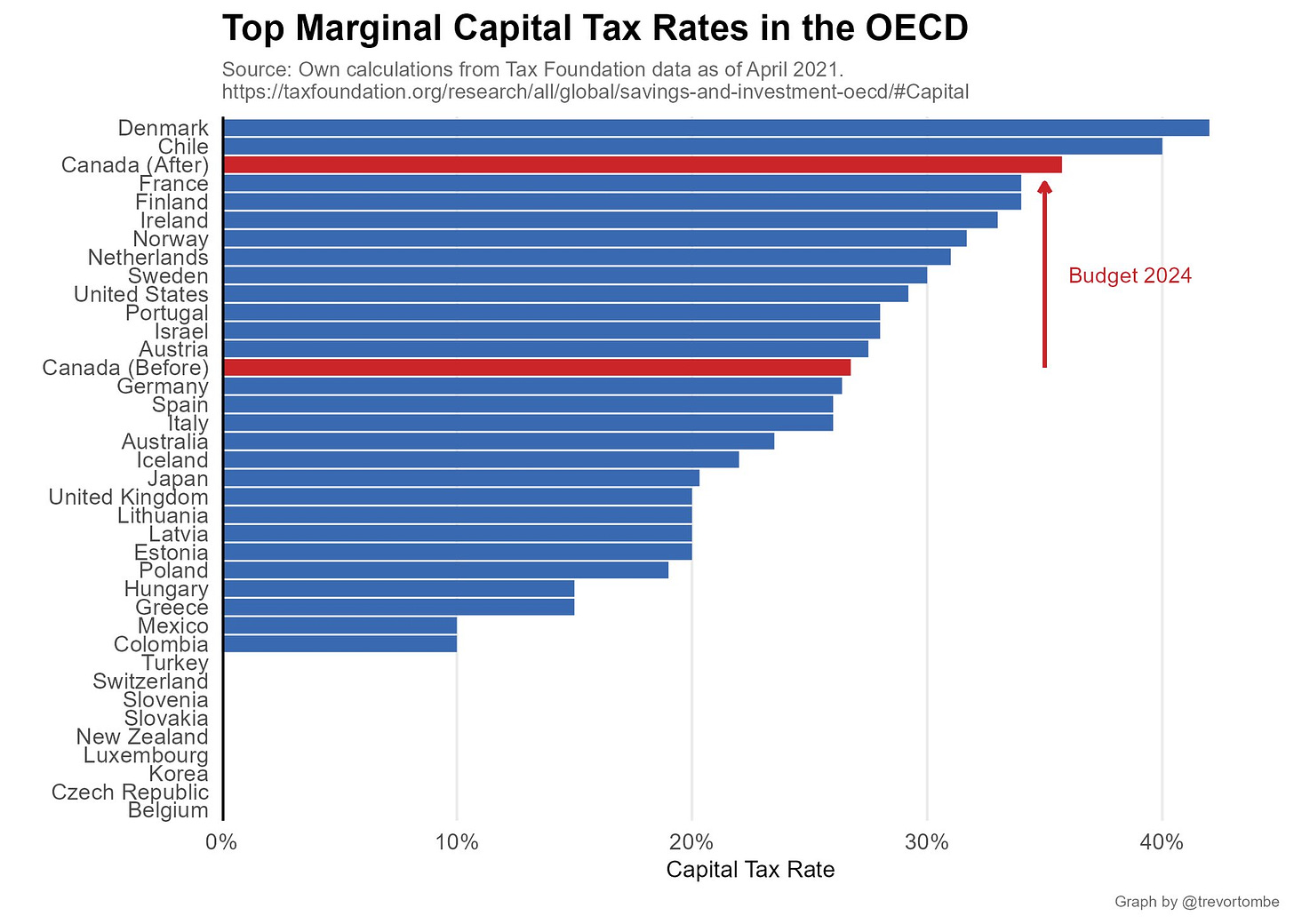

Canada now has the third highest capital gains tax rates in the OECD.

The increased taxation will pull $19B of investment dollars out of the economy and into government coffers, further sapping productivity in this country.

Look there are a lot of reasons housing is unaffordable in this country. Two decades of low interest rates, decades of underbuilding, a flood of foreign buyers, money laundering, reckless fiscal policy, and excessive population growth, just to name a few.

Raising taxes on entrepreneurs, small business owners, and professionals isn’t going to make anyone else better off, nor will it help little Johnny get on the housing ladder. The definition of insanity is to keep doing the same thing over and over and expecting a different result, more taxes are not the solution.

STAY INFORMED! Receive our Weekly Recap of thought provoking articles, podcasts, and radio delivered to your inbox for FREE! Sign up here for the HoweStreet.com Weekly Recap.

Steve Saretsky April 22nd, 2024

Posted In: Steve Saretsky Blog

Should there actually be an increase of new homes being built, this will cause an increase of demand for skilled trades which are already in short supply and also for raw materials which will drive up the prices. The cost of the new homes will be out of reach for the people who require them.