March 31, 2023 | Commercial Real Estate is the Next Domino

If there is another shoe to fall for the troubled regional banks, commercial real estate is a likely catalyst.

Reports arrive daily that many sectors, especially office towers, continue to struggle to meet their commitments.

Regional banks hold most of the debt for commercial real estate.

As of mid-week, the banking crisis was shuffled to the back page. No new candidates to be the next Silvergate, Silicon Valley, Signature or Credit Suisse had emerged as fresh bait for commentators ready to proclaim the imminent demise of capitalism.

The troubled First Republic Bank (FRC), which caters to the very wealthy, gained about 25 percent on Monday morning. But FRC, at about $14, was still down more than 90 percent from its August 2022 high of $168.

First Republic Bank is famous for at least two things. First, the publicity stunt that was arranged by Wall Street banks, led by JP Morgan CEO Jamie Dimon, to inject $30 billion in new deposits into FRC after the bank had suffered deposit outflows of $89 billion. And second, FRC was the bank that wired the $130,000 payment from Donald Trump to former adult-film actress Stormy Daniels just before the 2016 Presidential election.

But some astute observers are not reassured by the absence of fresh panic. Substantial debts at commercial real estate properties threaten to trigger new concern later this year.

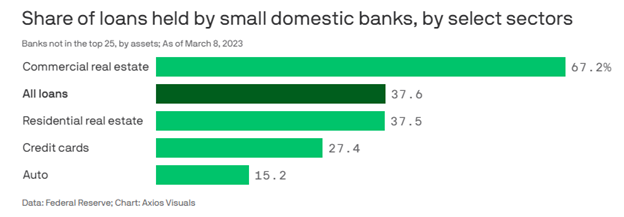

The connection between commercial real estate and regional banks is close because most of the debt owed by commercial real estate borrowers — and there’s a lot of it — is held by small and mid-sized regional banks.

About $270 billion in real estate debt is coming due this year. According to Emily Peck of Axios Markets, commercial real estate is the problem:

Source: The Federal Reserve/Axios

And the problem in commercial estate resulted from the decade-long policy of zero interest rates by the Fed and Bank of Canada, which drove up prices for office towers, rental buildings, and shopping malls. As one participant told me about three years ago, “At two percent they’re giving the money away for free, how can I say no?”

But if many aggressive players are armed with cheap money and decide to plunge into an asset like real estate a price bubble follows. And when prices eventually fall, the debt endures but asset values erode, creating a crisis for lenders and borrowers.

In the commercial sector, the borrower can just walk away from the loan and turn the asset over to the bank, as Canadian giant Brookfield (BN) did earlier this year with two office towers in Los Angeles. Brookfield is the largest landlord in downtown Los Angeles and holds properties in Manhattan, Toronto, Canary Wharf and Calgary. Brookfield has market cap of $51 billion and debt of $314 billion.

If lenders refuse to renew loans and borrowers walk, regional banks will have a lot of assets to sell and very few buyers. Banks could be left holding the bag.

And the next time there might not be any bailout.

Hilliard MacBeth

The opinions expressed in this report are the opinions of the author and readers should not assume they reflect the opinions or recommendations of Richardson Wealth or its affiliates. Assumptions, opinions and estimates constitute the author’s judgment as of the date of this material and are subject to change without notice. We do not warrant the completeness or accuracy of this material, and it should not be relied upon as such. Before acting on any recommendation, you should consider whether it is suitable for your particular circumstances and, if necessary, seek professional advice. Past performance is not indicative of future results. The comments contained herein are general in nature and are not intended to be, nor should be construed to be, legal or tax advice to any particular individual. Accordingly, individuals should consult their own legal or tax advisors for advice with respect to the tax consequences to them, having regard to their own particular circumstances.. Richardson Wealth is a member of Canadian Investor Protection Fund. Richardson Wealth is a trademark by its respective owners used under license by Richardson Wealth.

STAY INFORMED! Receive our Weekly Recap of thought provoking articles, podcasts, and radio delivered to your inbox for FREE! Sign up here for the HoweStreet.com Weekly Recap.

Hilliard MacBeth March 31st, 2023

Posted In: Hilliard's Weekend Notebook