June 3, 2022 | Canadian Banks Declare Premature Victory Over COVID

Canadian banks declared victory, prematurely, over the COVID-19 crisis by reporting increased profits, in most cases, and raising their dividends.

The looming interest rate increases powered by the central banks and the markets did not deter the banks in their optimism.

Are Canadian banks adequately prepared for higher interest rates and a recession?

A closer look at the earnings reports of the Canadian banks shows that they were able to increase profits by an accounting device that allows them to estimate their future loan losses and adjust their reserves for expected losses. In every case, except for CIBC, the banks reported much lower loan loss provisions which allowed them to show higher profits and to increase dividends.

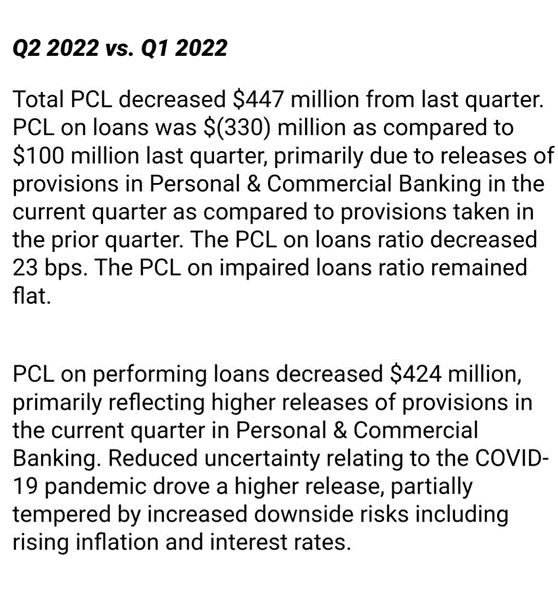

For example, here’s the Royal Bank of Canada (the brackets () indicate a negative number):

Source: Royal Bank of Canada

Obviously, the Royal Bank is aware of rising inflation and interest rates as they mention that in the last sentence of this excerpt from their earnings report. But they decided, after considering all of that, to “release” $447 million worth of provisions which go directly into boosting earnings.

Total RBC earnings for the quarter were $4.3 billion, up by $238 million from the prior year. This was a gain of 7 percent year-over-year. But, without the contribution of $447 million from reduced provisions this quarter, the earnings increase would have been a modest decrease instead.

This provisions number is simply an estimate of expected future loan losses for the loans outstanding with the bank as required by the regulator and accounting rules. But the regulators leave it to the bank to decide how much is an adequate provision for credit loss. The large banks all have sophisticated computer models that can project the size of the losses the bank will suffer, based on the experience from previous recessions and credit cycles and predictions of GDP growth, interest rates and many other factors. So, the computers told management that it was fine to lower provisions dramatically at this time.

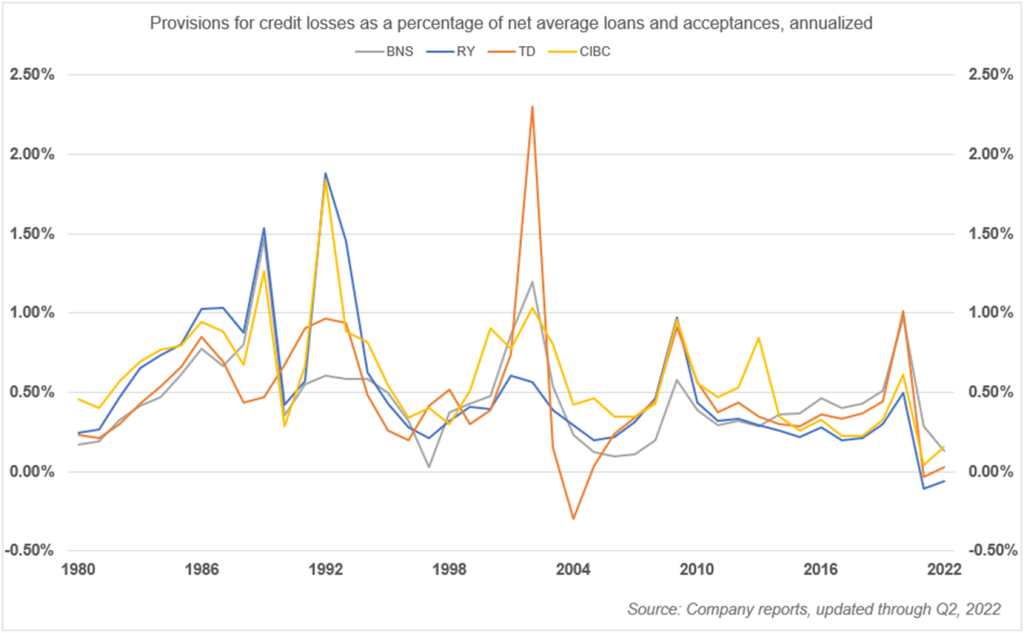

Most of the banks’ management teams lowered provisions at a rate that has not been seen since 1980 with one exception:

The chart shows clearly how aggressive banks have been in taking their provisions lower, after the increases that they instituted during 2020 when it was thought that the COVID-19 recession would impact their customers’ ability to repay loans. When there were very few defaults, mostly due to an injection of cash from the federal government of close to $400 billion, banks breathed a huge sigh of relief and declared the end to the crisis.

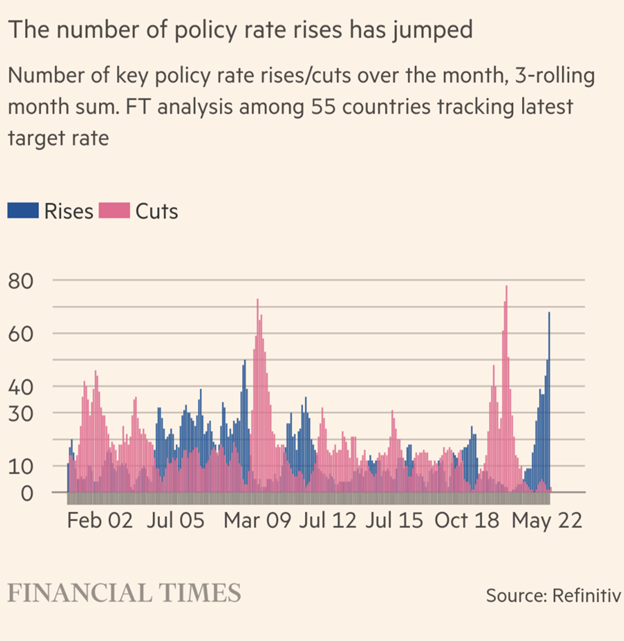

But now the banks face a new crisis. Inflation is soaring and central banks must raise interest rates:

Higher interest rates will push some borrowers over the edge, given the high level of indebtedness in Canada.

The increase in rates may also trigger a recession if the central banks are determined to get inflation under control.

It is much too early for the banks to signal the “all clear” for this cycle.

Hilliard MacBeth

STAY INFORMED! Receive our Weekly Recap of thought provoking articles, podcasts, and radio delivered to your inbox for FREE! Sign up here for the HoweStreet.com Weekly Recap.

Hilliard MacBeth June 3rd, 2022

Posted In: Hilliard's Weekend Notebook