Touted as a safe haven for holders of cryptocurrency, the Luna/TerraUSD system failed spectacularly, going from a peak value of $18 billion in early May to close to zero.

Is the cryptocurrency structure going to recover from this collapse?

The five largest stablecoins have been revealed to be the exact opposite of stable. Based on a premise that either there was sufficient collateral backing these coins, or in the case of TerraUSD an algorithm that would hold the value at or near US$1 for the token, the crypto investment community had supported these coins by placing tens of billions of dollars there.

The largest stablecoin, Tether, was worth over $80 billion before May 11. USD Coin was worth $48 billion, Terra was $18 billion while Binance held $17 billion for investors and Dai was smallest at $7.8 billion. The total of just these five reached over $170 billion, an amount not far from Elon Musk’s total net worth.

But then on May 11 TerraUSD lost two-thirds of its value. Supposedly “anchored” at $1 the trading price dropped to 31 cents.

The Anchor Protocol was supposed to hold the stablecoin constant with the promise that any funds deposited in the Luna-USDT could always be exchanged for $1. Most of the sense of security comes from an algorithm that trades these tokens between Luna and Terra to maintain the peg.

The purpose of stablecoins is to provide a medium of exchange for traders holding crypto like Bitcoin who want to avoid going back to US dollars when they sell some of their holdings. Fiat money, as the crypto fans call currencies like the US dollar, are considered to be evil because governments manipulate currencies.

So, these traders put their faith into stablecoins instead.

The problem that stablecoins are supposed to solve is seen with Bitcoin. Bitcoin, with a current market value of about US$30,000, is poorly suited for transactions because of the difficulty of transferring Bitcoins and its large price volatility.

The total value of all Bitcoin, with about 19 million issued, is about $570 billion. The second largest cryptocurrency, Ethereum, is worth about $250 billion.

Do Kwon, a Korean, is known as the founder of Luna and TerraUSD. Kwon established the Luna Foundation Guard (LFG), a non-profit, to hold crypto assets to back these tokens. As of May 7th, there were 80,394 Bitcoin at the LFG. This holding, worth $3 billion, was gone in just a few days of trading.

Source: Bloomberg

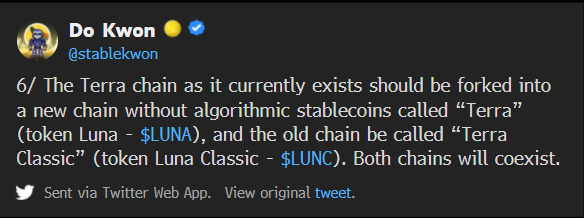

After apologizing for the losses, Kwon proposed to “fork” the chain under the Terra Ecosystem Revival Plan 2 announced on Monday May 16.

Here is the tweet:

Source: Bloomberg/Twitter

The ultimate impact on Bitcoin and Ethereum is unclear. The crypto system has proven to be resilient in the aftermath of past scandals.

The phrase Caveat Emptor seems appropriate.

Hilliard MacBeth

The opinions expressed in this report are the opinions of the author and readers should not assume they reflect the opinions or recommendations of Richardson Wealth or its affiliates. Assumptions, opinions and estimates constitute the author’s judgment as of the date of this material and are subject to change without notice. We do not warrant the completeness or accuracy of this material, and it should not be relied upon as such. Before acting on any recommendation, you should consider whether it is suitable for your particular circumstances and, if necessary, seek professional advice. Past performance is not indicative of future results. The comments contained herein are general in nature and are not intended to be, nor should be construed to be, legal or tax advice to any particular individual. Accordingly, individuals should consult their own legal or tax advisors for advice with respect to the tax consequences to them, having regard to their own particular circumstances.. Richardson Wealth is a member of Canadian Investor Protection Fund. Richardson Wealth is a trademark by its respective owners used under license by Richardson Wealth.