To fight inflation, the Fed hiked short-term interest rates by 0.25% in March – and they are expected to hike rates by another 0.5% when the Fed meets next on May 3rd.

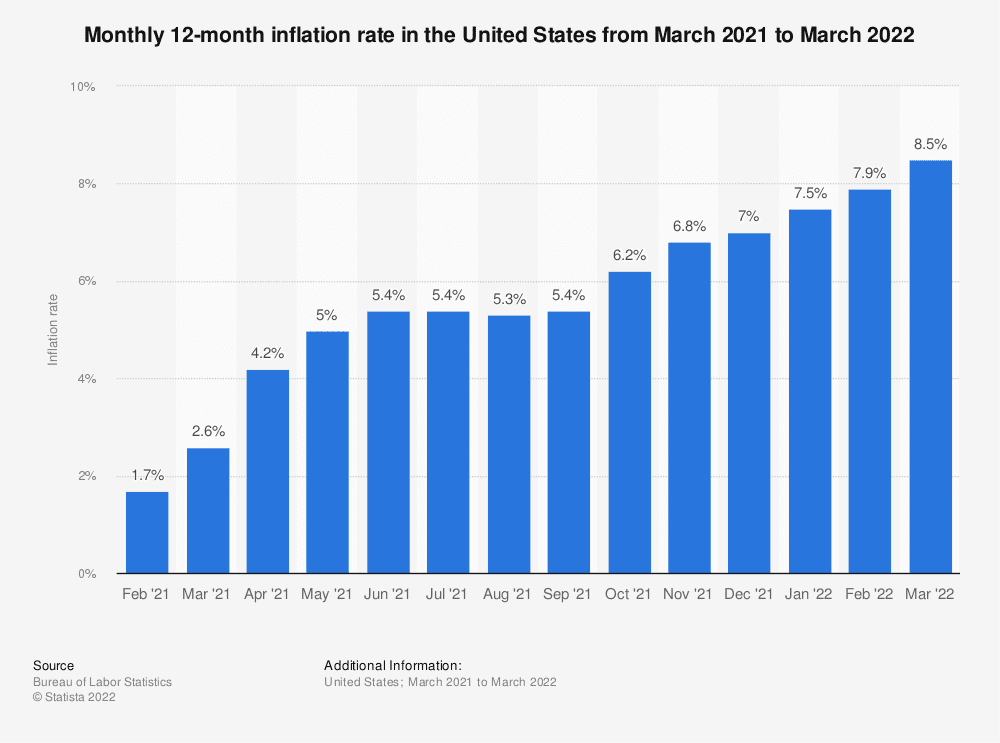

Does the Fed keep raising rates because inflation is at 8.5% and rising?

Or does the Fed stop raising rates because of today’s announcement that the U.S. economy CONTRACTED by -1.4% in Q1 2022 – and that a recession and job losses are now in the cards?

Kill Inflation – or Kill the Economy?

Due to the prospect of higher rates ahead, the Dow Jones Industrial Average (DJIA) has fallen 11% since it hit an all-time high in January 2022.

The fact that the DJIA climbed by 614 points (1.88%) today – which was the same day the -1.4% negative GDP statistic was announced – could be our best clue.