As government bond prices have declined on expectations of aggressive rate hikes from central banks, fixed mortgage interest rates (priced off bond yields), have leapt. After rising sharply during the pandemic, high home prices have now combined with higher interest rates to drive a 30.5% year-over-year increase in US mortgage payments to the end of March (charted below in red, courtesy of The Daily Shot).

This is a massive rate of change and a marked departure from the year-over-year trends in 2020 (when interest rates fell) and 2021 (when they flatlined).

In Canada, affordability is much worse (graphed below through the first half of 2021). The median home price nationally has risen from $580,000 in 2019 to $880,000 in 2022, and five-year fixed mortgage rates from 1.4% in 2021 to over 4% today (as I discussed here in Mortgage math matters). The median Canadian monthly mortgage payment for the median home has doubled from about $1855 in 2020 to more than $3660, while real household incomes have flatlined.

When home prices overshot income gains by much lesser amounts in the late 1970s and 1980s, the disconnect was short-lived before median home prices fell more than 30% nationally.

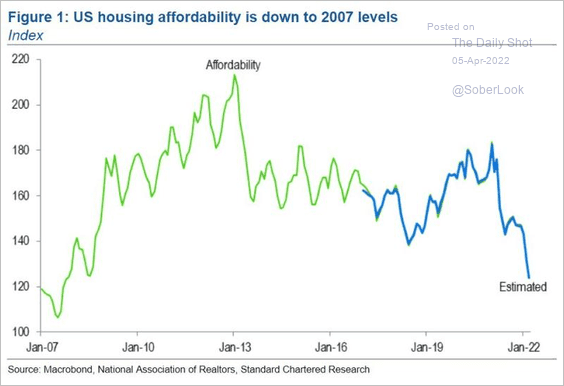

The median US home price went from 4.2x the median household income in 2019 to 5.6x by 2021. As interest rates have jumped, home affordability (shown below) is now fathoming the 2007 cycle lows from which home prices began a 40% multi-year decline nationally.

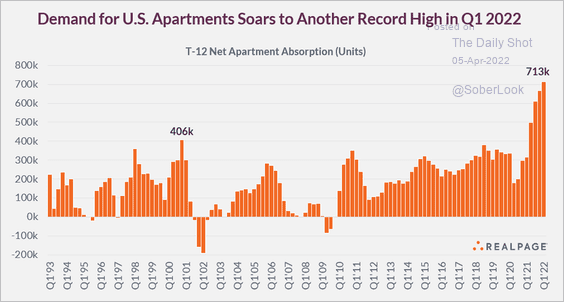

Not surprisingly, demand for rental apartments hit a record high in the first quarter of 2o22.

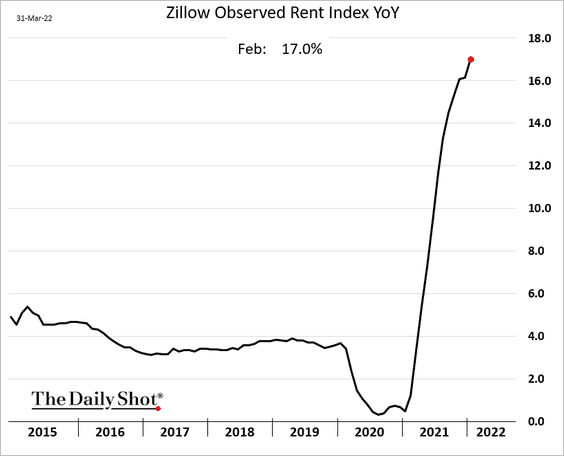

Median national rents have increased 17% year-over-year (the US below).

Still, higher rents notwithstanding, as in 2005-2008, it remains cheaper to rent today than to own a single-family home (shown below since 2000). Historically, this measure has been an insightful indicator of the relative risk and reward in home prices.

Eventually, the math does matter, and word on the street is that Canadian home sale prices dipped in March as the number of transactions fell.

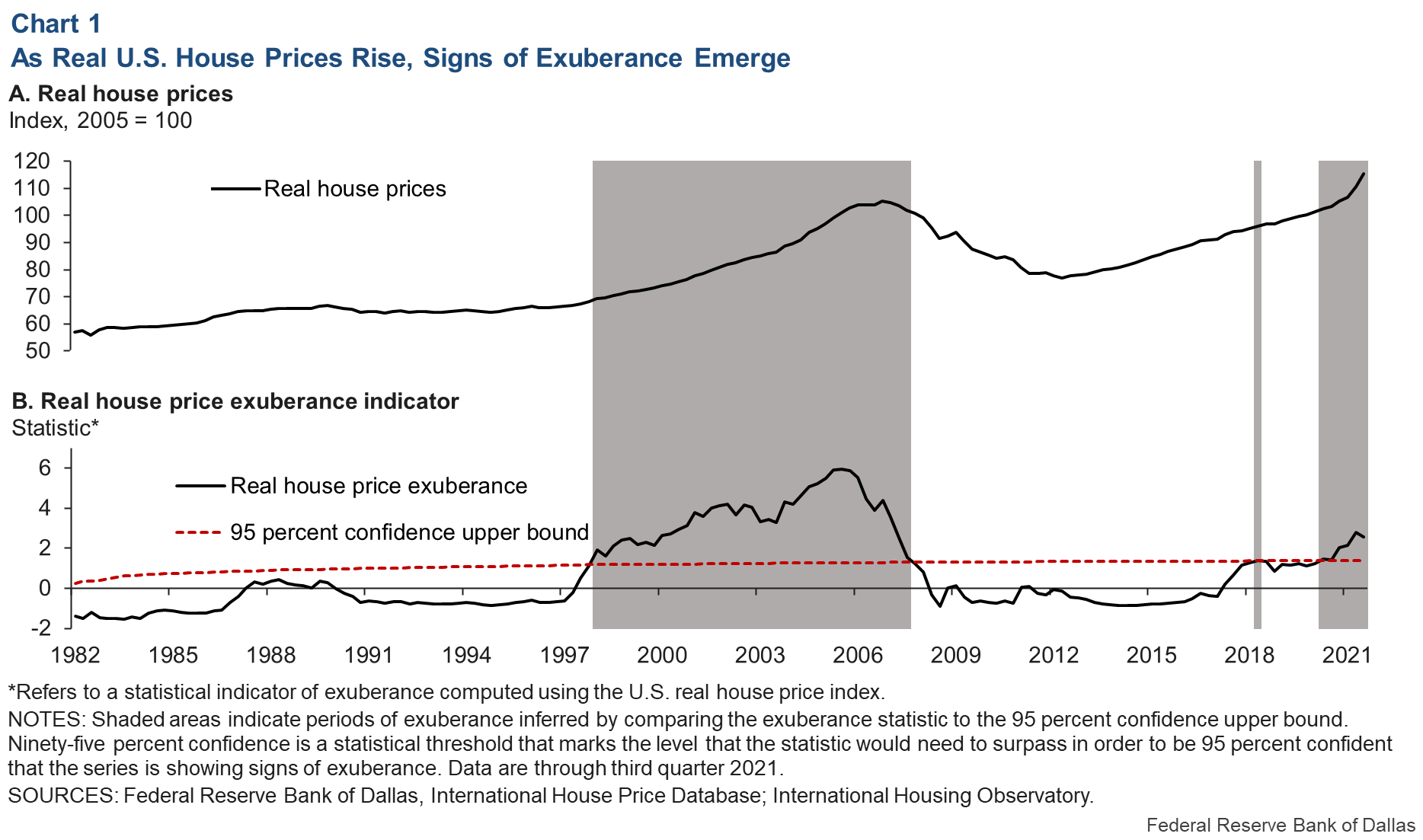

Even perenially myopic central banks see magnified downside risk in housing and the highly levered economy. This week, the Dallas Fed issued a report entitled Real-Time market monitoring finds of brewing housing bubble. Here’s a taste:

Our evidence points to abnormal U.S. housing market behavior for the first time since the boom of the early 2000s. Reasons for concern are clear in certain economic indicators—the price-to-rent ratio, in particular, and the price-to-income ratio—which show signs that 2021 house prices appear increasingly out of step with fundamentals.

While historically low interest rates are a factor, they do not fully explain housing market developments. Other drivers have played a role, including pandemic-related U.S. fiscal stimulus programs and COVID-19-related supply-chain disruptions and associated policy responses. The resulting fundamental-driven higher house prices may have fueled a fear-of-missing-out wave of exuberance involving new investors and more aggressive speculation among existing investors.