November 2, 2021 | After the Shock and Awe, Round-Tripping to Financial Disappointment

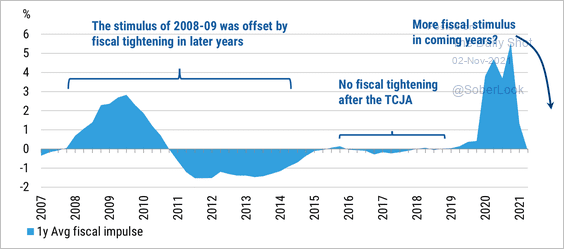

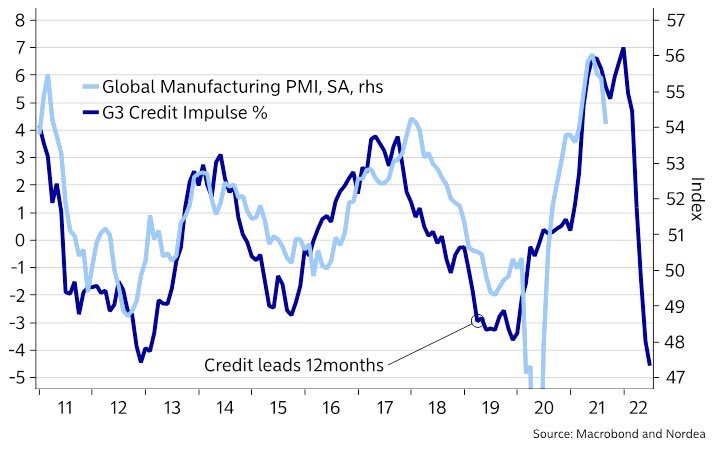

As the U.S. Fed huddles for another what-trick-do-we-try-next meeting, the much-theorized transmission mechanism for monetary policy remains apathetic. As shown below since 2010, the credit impulse (movement of credit through the banking system to the private sector) in the world’s three largest global economies-U.S., China and the Eurozone (dark blue), which drive the lion share of global demand, peaked in the first half of 2021 and has plunged over the past six months. Global manufacturing (in light blue) historically has followed with a lag of 12 months.

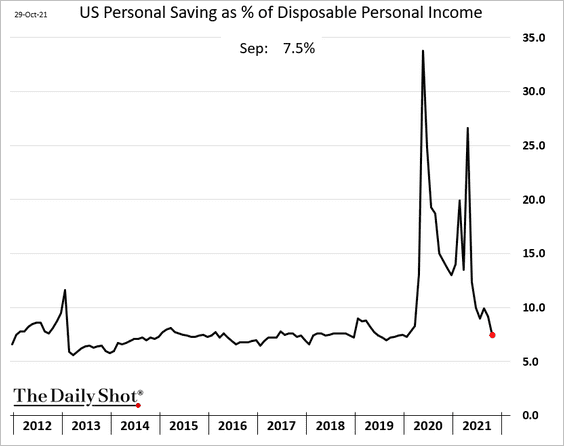

At the same time, the U.S. fiscal impulse (government spending) below since 2007 faces a cliff for the ages. Even if another spending package is approved, the comedown from 2020-21 will be intense.

Despite trillions in U.S. government transfers to moderate and lower-income households in 2021, the household savings rate as a percentage of disposal income, below since 2011, round-tripped back near the lows of the last decade in September. Hand-out money has been spent and, with it, a big chunk of future demand too.

As Hoisington Management noted in its Q3 Review and Outlook, 2021:

“In the third quarter, economic growth slowed sharply, registering a fraction of the growth rate in the first half. Coincidentally, consumer confidence fell sharply as consumers cut back significantly on their buying plans as expectations for increases in future income slumped. This slowdown occurred just one quarter after $2 trillion of debt-financed government transfer payments were made to moderate- and lower-income households. Although the size of this operation was larger than the “shovel ready projects” of 2009 and the 2018 tax cuts that were also debt-financed, the effects of the massive additional increase in debt did not last any longer.

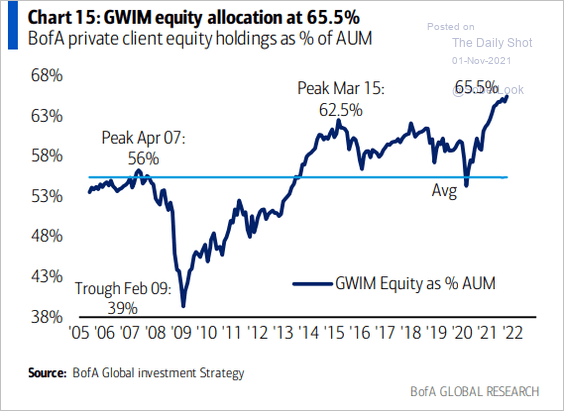

Record fiscal and monetary injections have achieved a record concentration of household exposure to equities at the highest valuations ever. As shown below, since 2005, the equity weight as a percentage of assets under management at broker/dealers hit a record 65.5% in October, as cash and bond allocations fell to the lowest in more than 30 years.

This wealth effect is destined to be fleeting too. Those who believe in permanently high plateaus or that cycles can’t be timed espouse constant equity exposure regardless of price and valuation for fear of missing out. As always, they are the most emboldened in this thesis when markets vie for all-time highs.

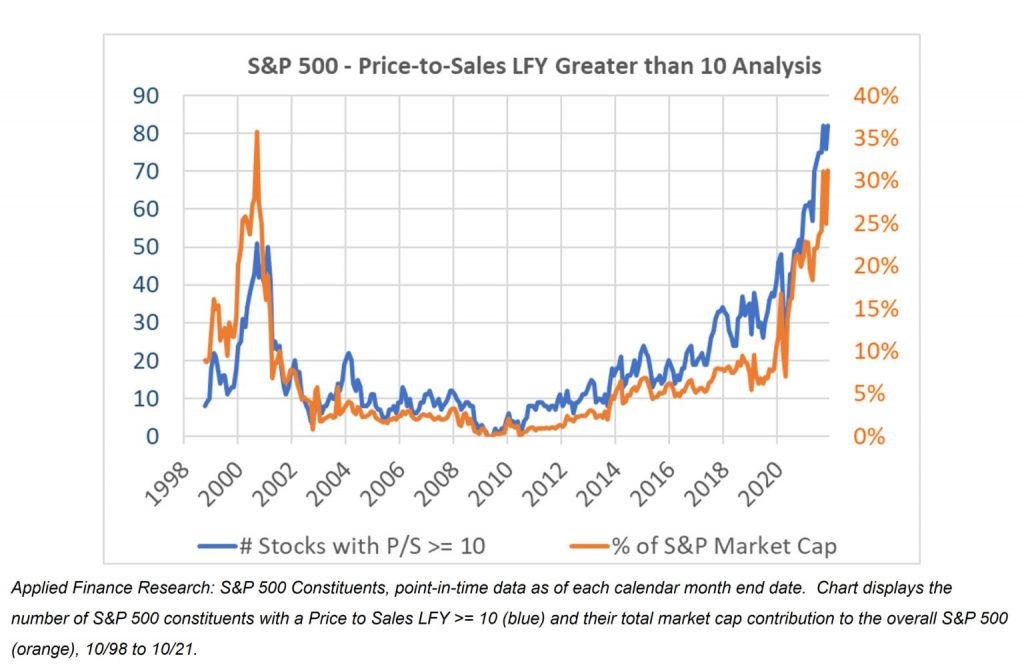

As shown below, since 1999, the number of S&P 500 companies trading today with a price to sales ratio of more than 10 is above 35% (blue line) compared with 25% at the cycle peak in 2000. After the 2000-02 collapse, most commentators agreed that the 2000 top was the most egregious stock bubble of all time. Before the fall, then, as now, most remained sanguine in the belief that ‘things are different this time.’

Canada’s stock market has a much smaller tech sector, but we still crashed pretty much in lockstep with the S&P 500 in 2000-02, 2007-09 and 2020. Decoupling is not reality.

My partner Cory Venable’s chart below of the TSX since August 2000 offers a big picture reminder of why market cycles matter and bubbles eviscerate years of previous ‘outperformance’ in the end.

Those who confidently bought the ‘diversified’ basket of TSX stocks in August 2000 (at above-average valuations) were ravaged by multi-month bear markets that halved their capital twice in the first nine years. By 2012, if they held on, they were back to where they had started a dozen years earlier. Then, in March 2020, it took just 15 trading days for the Canadian market to round-trip back to its August 2000 level.

The rapid price reflation in the past year does not make up for lost time, and bear markets do not restart bull cycles after just one month of losses. Animal spirits have been elevated over the past year, not crushed, and asset valuations remain worse today than those that launched the secular bear in 2000.

History assures us that we have not tested the 11,000 level for the last time, and those that ride the next loss cycle will need years to recover their losses. After the shock and awe, financial disappointment will be lasting.

STAY INFORMED! Receive our Weekly Recap of thought provoking articles, podcasts, and radio delivered to your inbox for FREE! Sign up here for the HoweStreet.com Weekly Recap.

Danielle Park November 2nd, 2021

Posted In: Juggling Dynamite

Very prescient and insightful article Danielle. Meanwhile, to make matters worse nearly all Canadians are also drowning in various types of debt (mortgages, credit cards, personal loans, car loans, HELOCs, etc, etc) and inevitably heading towards financial disaster. People who thought the 2008 GFC was bad are going to be shocked by the magnitude of the next bear market…