May 18, 2021 | Moister Madness

Turns out that April was an better month than March to buy property. May is even moreso. June and July could be worse. And the last thing you ever want, we’re told, is to in a bidding war with a hungry, desperate, house-lusty Millennial.

Here are the stats: sales across the country down 12% last month. Prices up more than 2%. Months of inventory edged higher from 1.7 to two (normal is five). As reported here some days ago, action in Toronto and Van stalled and there’s evidence we may have hit peak house after an utterly-raunchy early rutting season.

Even CREA sees it. “There is growing evidence that some of the extreme imbalances of the last year are beginning to unwind, which is what everyone wants to see happen,” says head poohbah realtor god Cliff Stevenson. And Wave Three of Covid has a lot to do with that, along with gently-rising mortgage rates and the looming enhanced stress test (June 1).

But this remains a dangerous time to thrust your toe into the real estate gene pool.

TD has come up with some sobering evidence on how an oversized annual property price increase has microwaved moister brains. Seems FOMO is so rampant now young buyers are willing to take extreme risks to become the owners of monster mortgages and inflated homes. The bank found more than half of those under 35 are fine with offering more than a seller is asking – compared with just 18% of people 55+. In fact a third of the kids are ready to pony up between fifty grand and $100,000 more than list.

Of course, this is their first foray into homeownership and the wondrous world of realtors. But those above fifty have something unique… experience. The gray hairs know markets ebb and markets flow. The most important lesson is probably this: it’s not different this time. It never is. Not yet, anyway.

However this Covid housing mania continues. A majority of Canadians understand buying a home is less attainable now than two years ago, but enough generational desperation remains to keep the fires burning. The 5.25% stress test coming in a couple of weeks may be fanning that.

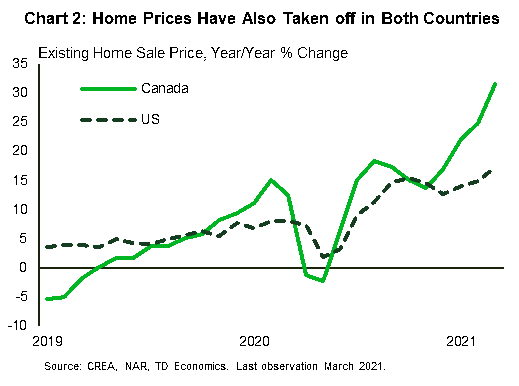

It’s worth remembering how massive an impact residential real estate has on Canadian society. Its share of the GDP is greater than the entire oil & gas and mining sectors. Over-investment in housing has helped tank RRSP contributions and throttle funds going into TFSAs. Many will regret that. House sales over the last couple of years were up 75% in Canada, compared with 13% in the US. Residential prices here just climbed 32% while the increase Stateside was 17% – and even that has caused Americans to gag.

In fact, in the entire developed world house price inflation has been the greatest in little Canada, where a couple of cities (guess which ones?) are ranked among the least affordable on the planet. And in a country with more moose and beavers than Tim Hortons customers.

Look at this bank chart of Canadian and American prices. Have we lost our minds?

Of course we have. We’re obsessed. We have young adults who believe asking prices are just starting points and happily indebt themselves. Human nature is on full display – the more things rise and become out of reach, the more we covet them. FOMO, says another TD report, “appears to have been more of a driver in Canada” than in the States. And this…

The fear of missing out not only lends itself to prospective home buyers pulling forward homeownership plans, but it can also stoke increased speculative activity. Sharp sustained increases in home prices can draw in potential real estate investors aiming to reap the benefits of these gains. While much of the activity in 2020 appears to be from home buyers looking to live in the home, recently, there are signs that speculators are contributing to price growth. The Bank of Canada has chimed in stating that there are indications of excess exuberance in the Canadian housing market. This could perhaps partly explain why home prices in Canada have grown at roughly double the US rate over the past few months.

Back to experience for a minute. America had a real estate crash back around 2006. Prices nationally dipped as much as 32% (as they did in Canada’s last crash in the early 1990s). But here the housing dip surrounding the credit crisis was far more muted. In other words, a lot of 30-something US Millennials remember what a disaster home ownership was for their parents, especially those shouldering a monster debt. It’s a lesson most Canadians have yet to learn.

Well, what next? Should your daughter make that bully offer, or get into a bidding war for a beater house in Bunnypatch? Are you going to spot her a giant down paymen?

If you believe what got us here – pandemic, WFH, emergency rates and FOMO – will continue, go ahead. But I’d take the other side of that trade.

STAY INFORMED! Receive our Weekly Recap of thought provoking articles, podcasts, and radio delivered to your inbox for FREE! Sign up here for the HoweStreet.com Weekly Recap.

Garth Turner May 18th, 2021

Posted In: The Greater Fool