April 19, 2021 | The Shadow

Budget Day. This won’t take long, despite the fact the doc ran more than 720 pages and took two years to arrive.

The feds are addicted to spending. No wonder grey Bay Streeter Bill Morneau couldn’t hack it any more. Chrystia and Justin are taking deficit and debt to levels nobody ever thought possible. The red ink in the last year (spending over revenues) was $354 billion. Next year the shortfall will still be $154 billion. In fact half a decade from now (best case scenario) it will still be $31 billion a year. If interest rates increase in the meantime (they will), this gets worse.

Recall that under Mr. Trudeau (the younger) our nation will accumulate more debt than all of the 22 former prime ministers (including Trudeau the older) combined. The ratio of federal debt to the economy will rocket to 51%. With provincial debt added it’s 100%.

New spending is $101 billion. A big chunk of that is for child care which will add $8 billion a year in new, forever, program spending. That’s in addition to the $24 billion a year currently sent to parents, so you can guess where the Libs are looking for support.

Where does the money come from? Borrowing, not taxes.

There’s no GST hike, no capital gains tax inclusion increase, no new tax bracket for rich bloggers, no wealth tax, no jump in corporate taxes – nothing but the previously-announced hits on digital platforms and the luxury car/boat tax.

And what about the bubble real estate market that’s made homes unaffordable to so many?

Too bad, kids. Not only do you inherit a fat trillion in debt, but you get to rent forever, or move to Elliot Lake and raise elk. Not a single thing to cool off speculation other than the 1% foreign-owner tax we heard about long ago – before the foreigners bailed out. In fact, the feds are giving $40,000 interest-free loans to homeowners in yet another greeny retrofit program worth over $4 billion.

Conclusions: the housing market runs hotter. Your financial portfolio grows fatter. The wealth divide expands. The vote-buying goes vertical. It won’t be long now.

______________________________________________________________

“So,” I said, baring a toned, athletic and muscular upper shoulder, “how many have you jabbed today?

“Six hundred and forty-one,” she said. And in went number 642. I asked her if she was a volunteer or a health care professional. A family doctor, she replied. Then we talked about what life must be like for her colleagues in distant, diseased Ontario. Turns out her best bud is a gynecologist who has been pressed into emergency service in the ICU of a major Toronto hospital. “Whatever it takes,” she said. “So glad we are here.”

The squeeze and I got the Pfizer stuff on the weekend. Dorothy had spent the previous few days watching TV images of pop-up clinics in TO hoods where hundreds of people waited four or five hours for their chance to be vaxxed. It looked chaotic, disrespectful, disorganized and worrisome. Things weren’t helped much when some friends came by the house and relayed the experience of their high rise-living daughter in one of the “hot” Toronto postal codes.

A vax van arrived one day last week and announced over loudspeaker that 400 doses were on board, first come-first served. It was, she said, a desperate stampede.

Well, the inoculation centre in Halifax was in a hockey arena with a big sign outside telling people not to arrive until five minutes before their appointment. There was no line. But there was a greeter who thanked us for coming, then an iPad checkin, then the jabs, then 15 minutes in a recovery area patrolled by a nurse. Then out – twenty minutes in total.

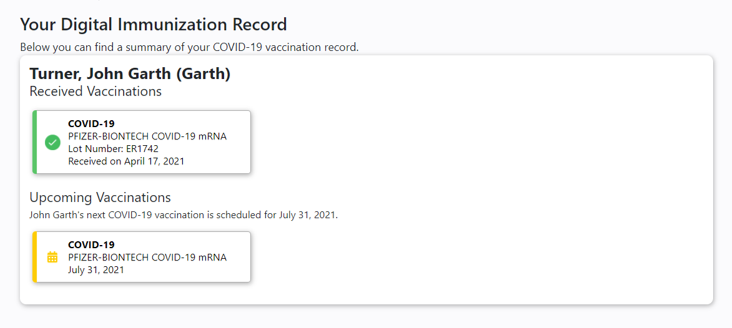

Five minutes later the vax receipt arrived by email, along with confirmation of the hard appointment for the second dose, 105 days hence.

Side effects? A sore arm for a day, then nothing. “That means the antibodies are being created as your defence against Covid-19,” said the literature we left with. So now I’m full of these little suckers.

It’s been four months since I flew out of Toronto just as that city was shutting down for four weeks. It hasn’t opened since. Now things have devolved amid chaotic and conflicting policies and government announcements. Infections are at a pandemic high, the hospitals are seriously stressed and a five-year backlog for elective surgeries has evolved. Don’t get breast cancer or be in a car crash, in other words. There are over 50,000 active Covid cases in Ontario with 2,000 people in the hospital and over 700 in ICUs, the majority on vents.

NS is far smaller (one million compared to 14.5), but the numbers are tiny: 49 cases in total, two people in hospital, none in intensive care. There were 7 new cases on the weekend, which was kind of high. While my fancy corporate offices on the 53rd floor of a bank tower at King & Bay have been silent for more than a year with colleagues stuck at home, my wee bank by the sea has been full of employees and community groups. We shuttered for three weeks last April, but soon realized that was extreme.

So why has Covid – now decimating the Main Street economy of our biggest province – been a non-event in the East? How can people in NS be casual and decent about the vaxxing process when folks are treated like cattle in the Big Smoke?

Simple. Quarantines. For more than a year now (with the exception of a few months the Atlantic Bubble was in place) nobody can enter Nova Scotia without spending 14 days eating storm chips and watching Oprah in isolation. No shopping. No visitors. No walking around the block. It’s a total pain in the butt. And it’s been a defensive measure which kept the slimy little pathogen at bay. Now people are proud of it.

So far this year, as a result, one elderly woman died of the virus. In Ontario, sadly, two dozen perish each day. Premier Ford blames the feds for a vaccine drought. The prime minister argues back that doses have run 50% ahead of schedule. It’s political. Sad. Businesses across the province are on life support. It will be a miracle if any hair salons or restaurants are left standing by the time they’re allowed to reopen – maybe in May. Perhaps longer. The events of last weekend when the premier had to walk back provisions on Saturday that were announced on Friday only added to the confusion.

Well, as far as your money, investments, portfolio go, Ontario, BC, Saskatchewan and other places still crippled by Covid don’t much matter. The reopening of the American economy and the inevitable spread of vaccines across the world have pushed financial assets to record highs, amid massive government stimulus and central bank coddling. That will continue. Stay invested.

Meanwhile let’s come out of this long shadow understanding what we did right, and wrong.

STAY INFORMED! Receive our Weekly Recap of thought provoking articles, podcasts, and radio delivered to your inbox for FREE! Sign up here for the HoweStreet.com Weekly Recap.

Garth Turner April 19th, 2021

Posted In: The Greater Fool

Next: Budget Day »