April 22, 2021 | 3 Forces Driving Gold and Miners Higher

Gold and miners were the investing world’s doormats for the last year, but they’ve been gaining traction recently.

Let me show you three forces driving gold higher and two of my favorite ways to play it.

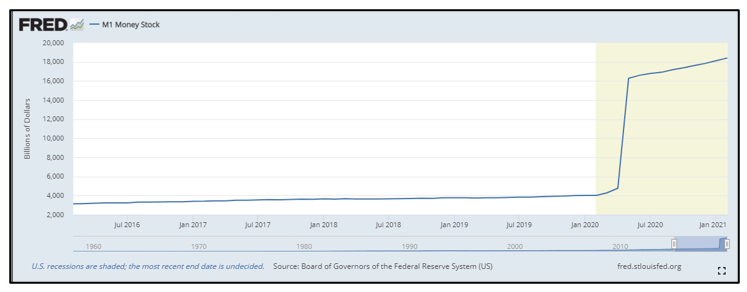

Force 1: Money Printing

When the Federal Reserve panics, it prints money. And last year’s pandemic-induced shutdown of the economy made the Fed panic like a nine-tailed cat in a roomful of rocking chairs.

You may have heard that M1 — the broadest measure of America’s money supply — soared last year. Well, it didn’t stop. Take a look at this Federal Reserve chart.

|

Over the course of one year (February 2020 to February 2021) — because March data isn’t in yet — M1 soared by an astounding 357%!

How this impacts gold: You can print money from here to the moon, but you can’t print gold.

When you increase money supply, that means there is more money chasing more real assets (like gold) and other stuff people want to buy. So, guess what that did to inflation?

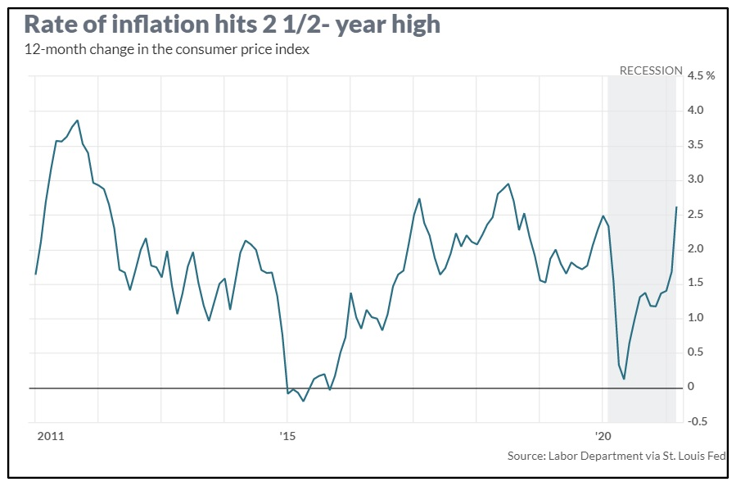

Force 2: Inflation

With a flood of money sloshing around in the system, it’s no wonder that consumer prices rose in March by 0.6%, up for the fourth month in a row. But the jaw-dropping thing is that the pace of inflation hit the highest level in two and a half years. Take a look at this chart from Marketwatch.com …

|

Inflation over the past year surged to 2.6% from 1.7% in the prior month. That’s the highest level since the fall of 2018.

How this impacts gold: The yellow metal has long been seen as a safe harbor against inflationary storms (because you can’t print gold).

Rising inflation has follow-on effects on other factors that can push gold higher. And that brings us to our third source.

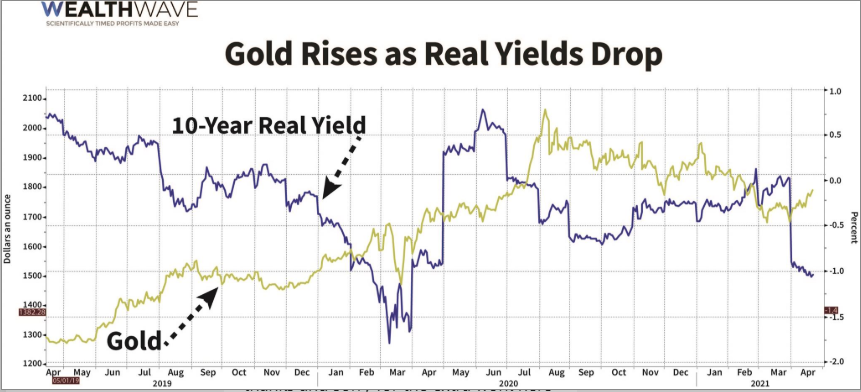

Force 3: Negative Real Yields

The real yield on the 10-year U.S. Treasury is negative and getting more so. It is computed by adjusting the yield on a bond by inflation. So, as inflation goes up and 10-year yields don’t follow — the real yield turns negative.

This has a direct effect on gold. In fact, many market watchers believe the real yield directly affects the price of gold. Let’s take a look …

|

You can see that as the real yield started plummeting at the end of March, gold started moving higher in earnest.

How this impacts gold: One of the complaints bears make about gold is that it pays no interest. Well, now, neither do many bonds! And when you consider inflation, even 10-year U.S. Treasuries are yielding less than zero.

How Can You Play This?

You can buy individual gold miners, developers and explorers. But if you don’t want to do all the research — and take the risk of individual stocks — you can buy an exchange-traded fund (ETF) of the best gold-leveraged stocks.

Take a look at the performance of the VanEck Vectors Gold Miners ETF (NYSE: GDX) and the VanEck Vectors Junior Gold Miners ETF (NYSE: GDXJ) against gold itself since March.

|

You can see that gold is up 2.87%. Junior gold miners, as tracked by the GDXJ, are up 10.9%. That’s nearly four times the performance of the metal. And senior gold miners, as tracked by the GDX, are up 17.67%. That’s more than SIX times the performance of the underlying metal.

That’s because miners are leveraged to the metal. That is, while gold prices go higher, their mining costs remain relatively the same. So, they make wider and wider profits on every ounce. And these ETFs are baskets of the best senior and junior gold miners.

Any way you want to play it, this is a great time to get long gold and long miners.

All the best,

Sean

STAY INFORMED! Receive our Weekly Recap of thought provoking articles, podcasts, and radio delivered to your inbox for FREE! Sign up here for the HoweStreet.com Weekly Recap.

Sean Brodrick April 22nd, 2021

Posted In: Wealth Wave