December 7, 2020 | The Gush

The first trickles of vax will arrive soon. Good. Cannot come soon enough. After all, I spent the last year growing a manly handlebar moustache (to divert attention from the rest of my chops) and hiding it under a mask is criminal. It longs to blow in the wind. We’re all being asked to sacrifice.

Apparently, however, the slimy little pathogen has been doing a lot to grease people’s savings accounts. It raises some serious questions about Ottawa’s pandemic spending orgy and (as you know) helps explain why real estate would boom during an historic recession.

The latest Nik Nanos poll is telling. In the middle of the Second Wave and record infections, Canadians are feeling positively frisky. Consumer confidence sits at the highest level in eight months – since way back when life was normal in March. Now 45% believe real estate prices – currently at all-time highs – will be higher still in six months. Two-thirds believe their jobs are secure. And, as you may know, financial markets have been on a tear – with stocks hitting peaks during the best November ever.

This makes no sense. The economy sucks. Millions are still unemployed. Airlines, restaurants and tourism are kaput. Toronto’s locked down. Drake is missing. The virus news gets worse daily (except for Drake). And yet personal finances are… improving? Huh?

Look at the recent report from the OECD, comparing us to the rest of the industrialized world. Household incomes in Canada actually rose in Q2 by a massive 11%. Compare that to big drops in what families earned in Britain, France, the US or Germany. Weird.

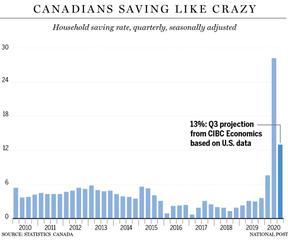

When it comes to savings, things become more detached from reality. Before Covid households were putting away 3% of what they earned, about half the long-term average. Then the bug struck. The economy was turned off. Unemployment spiked. Recession ensued. And the savings rate surged from 3% to 28%. Stunning. Since then it has declined to 14%, still twice the amount socked away annually over the previous forty years.

Source: Statistics Canada, National Post

A CIBC report says this amounts to a $90 billion pile of dough. And all those hard-hit businesses have squirreled away another $80 billion. The guys at online EQ Bank confirm it – savings accounts there are brimming with $4 billion, up a billion in a few months.

How did this happen?

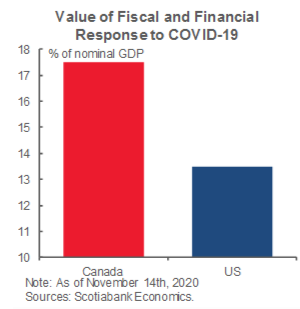

Simple. The federal government went completely nuts when the virus showed up, with the prime minister hitting the SPEND button as no politician had done before. This is how we got a $383-billion one-year deficit, which is $327 billion bigger than any shortfall ever seen before. Canada has spent more money on virus mitigation than any other nation, on a per-capita basis, and also as a share of the economy. The cash found its way into houses, into financial assets and has stuffed personal and corporate bank accounts. Worse, it seems to have flowed disproportionately into the hands of higher-income earners. You know. Folks like you. The WFH crowd.

“A lot of that money went toward people who didn’t need it, who just banked it,” says economist Philip Cross. “Quite rightly, we told people that we would compensate them for lockdowns that were beyond their control. But we did more than compensate.” It’s like my suspender-snapping, portfolio manager Buddy Ryan wrote on the blog last weekend – this has created a K-shaped recovery. Some people are doing great. Many are bearing the brunt.

Look at Justin Trudeau’s pandemic spending, compared with that of the USA:

Source: Scotiabank Economics

Says CIBC economist Benny Tal: “This is the first recession that income is actually rising, reflecting the fact that government transfers were actually larger than the amount of money lost in the labour market.” Meanwhile businesses and organizations have been pocketing the free bucks associated with emergency business loans. Just as those claiming hardship got $2,000 a month in CERB cash, so corporations with their hands out have been given no-strings $40,000 loans to spend, invest or save. They need only give back thirty grand, keeping ten as a Trudeau gift. (Now the limit’s been raised to $60,000, with the grant portion increased to $20,000.)

On Monday Deloitte economist Craig Alexander said the deficit this year will probably hit $400 billion. Last week the FM, Chystia Freeland, said the T2 gang is planning on spending $100 billion more next year and beyond on a ‘reimagined’ economy.

‘Never let a crisis go to waste.’ Now you know what that means.

What are the implications of this?

You’re already seeing some of it. Combined with vax optimism, this river of largesse flowed into financial markets, helping kick assets to new levels. Ditto for houses, especially now that CBs have crashed interest rates to historic lows, inflating real estate. Likewise for building materials (priced a 2×4 lately?), appliance sales, quads, bikes, sleds and now even Christmas trees.

Coming as soon as the economy reopens, retailers revive, lockdowns end and shopping returns is a tsunami of consumer spending, especially since experts say most of the Trudeau cash is idling in chequing accounts. This will help goose economic growth in later 2021 and again in 2022, now estimated to top 5%. That’s huge.

And with it all will come more expensive real estate, an urban condo revival, plumped-up investment portfolios, a serious return of inflation and, inevitably, higher interest rates as the bond market starts calling the shots. Oh, more taxes, too. And you’ll have to buy new pants to wear back to the office. So save money for that.

Now, I’m off to find moustache wax. It’s a thing. Really.

STAY INFORMED! Receive our Weekly Recap of thought provoking articles, podcasts, and radio delivered to your inbox for FREE! Sign up here for the HoweStreet.com Weekly Recap.

Garth Turner December 7th, 2020

Posted In: The Greater Fool