December 23, 2020 | Merry Vaxmas

Christmas Eve eve. We crave good news. So, here we go.

It’s got a few names. Like, ‘vaccine lift.’ And ‘game-changer.’ Of course there’s the standard, ‘pent-up demand.’ The always-welcomed, ‘unleashed torrent’. And my new fav, ‘permanent reopening.’

This is the current econo-lingo being used to describe where we are, where we’re going. So even as the country swoons into a series of maudlin Christmas days, snow, lockdowns, gray and red zones, Zoomy, boozy days, mutated pathogens and hockey deprivation, there is hope. Tons of it. All pandemics are temporary. They pass. You know this. And the 2020 version – say the economists – will soon start puddling away like disgusting moist little bat drool that it is.

Now why the optimism in the midst of a Second Wave that has Jason Kenney and Doug Ford sounding like socialists?

Well, the virus was always going to fade but the historic development of new vaccines has put everything on fast-forward. First Pfizer. Today Moderna, Then the Oxford serum. Millions then billions of doses being turned out, distributed and administered, creating herd immunity, lessening the instance and severity of disease, rescuing the health care system, allowing lockdowns to end, bolstering consumer confidence, reigniting human society, fluffing the GDP and, yes, unleashing that torrent of money governments have thrown around.

The result, according to the latest Bloomberg survey, is for annualized GDP growth of almost 5.5% in the last three quarters (nine months) of 2021. That’s yuge. A big hike over the 3.8% last forecast. It’s historically significant. Compare it (5.5%) to growth of just 2% in 2017, 3% in 2016 and 1% in 2017. In fact the last time we hit a number like this was back in 2007.

The vax is the flame. But the tinder is money.

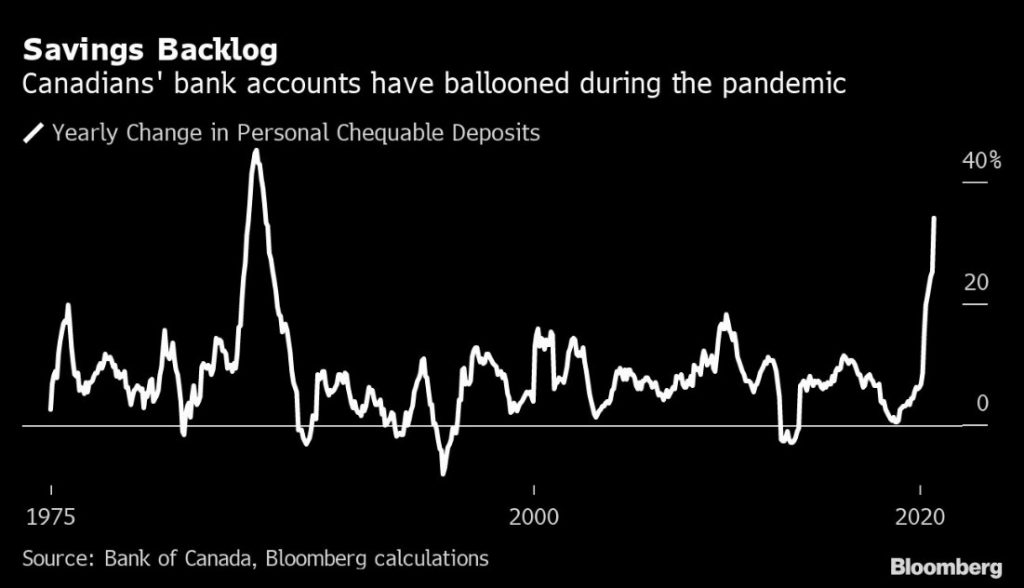

There’s a big pile of it. Just look at the stories lately of cake-ladies and students who earned barely $5,000 in 2019 but were sent CERB cheques totalling $12,000 or $18,500 in 2020. The feds doled out more than $250 billion in direct cash transfers to individuals, which CIBC says has resulted in a $90 billion pile of money in savings accounts. In fact Bloomberg now estimates there is $103 billion sitting in Canadians’ personal chequing accounts – a 34% ballooning in a single year, and the most in three decades. Yikes.

Now in Canadians’ chequing accounts: $103 billion

When will the money-hoarding stop and the spending begin?

Not until the stores open again, of course. In locked-down Ontario that will happen around the end of January. Combined with this there needs to be a lot of vaxing on a wide-scale basis, plus some indication Covid infections have peaked and started to wane. Even now there are faint glimmers. NB’s premier says his province will be virus-free and open again in mere weeks. In NS there are but 35 souls out of a million population who are sick, with zero in hospital. Are these harbingers?

The economists add they’re sure the T2 gang will keep on spending as no government in history has done before. Your grandchildren may curse and blaspheme you, but in the meantime it’s a free-money-no-pants-fiesta. So combined with the mountain of personal savings and a central bank that crashed rates and is buying up $4 billion a week in government bonds to artificially suppress yields, this is a formula for growth.

Laurentian Bank economist Dominique Lapointe sums it nicely: “In the case of a permanent reopening starting toward the end of the second half of 2021, the elevated household savings rate could unleash major pent-up demand, especially on the services side of the economy.”

There it is: ‘permanent reopening.’

So what could go wrong to prevent this from happening?

Two things.

The vax might not work. Or you might not take it.

Then we send that dog to slime your face.

STAY INFORMED! Receive our Weekly Recap of thought provoking articles, podcasts, and radio delivered to your inbox for FREE! Sign up here for the HoweStreet.com Weekly Recap.

Garth Turner December 23rd, 2020

Posted In: The Greater Fool