November 25, 2020 | Missing the Mark

Less than six weeks left in this miserable year. And it will end in a funk. Virus. Lockdowns. Crappy Christmas. Too much Zoom. Not enough hugs. Darkness. Winter.

Ellen wrote me yesterday. “I can’t take it,” she said. “Give me one compelling reason why I should not sell everything, go to cash or dump my savings in some low-rate GIC. At least I will still have my money next year, Mr. Broker Man.”

See what fear does to people? No wonder so many financial commentators truck in it. Fear sells. It’s the strongest emotion and motivator. If you’re in the business of flogging gold, annuities, newsletters or paid research, scaring the poop out of people is good for business. Peter Schiff, Marc Faber, David Rosenberg, Martin Armstrong, Nouriel Roubini. The merchants of doom are all over the financial press these days. Leading Ellen stray.

How have the warnings panned out?

Not so good. An advisor in NYC who goes by the moniker of ‘The Reformed Broker’ has a nice twist:

Talking people out of investing for their future because of this or that macro concern will always be a long-term loser, even if there are moments along the way where it looks temporarily smart. Everyone understands that there are potential drawdowns and negative developments that could occur. It doesn’t take talent to continuously harp on them. Smart people allocate assets, take appropriate risks and accept the uncertainty that comes along with the territory – they don’t twitch like squirrels every time someone snaps a twig in the forest.

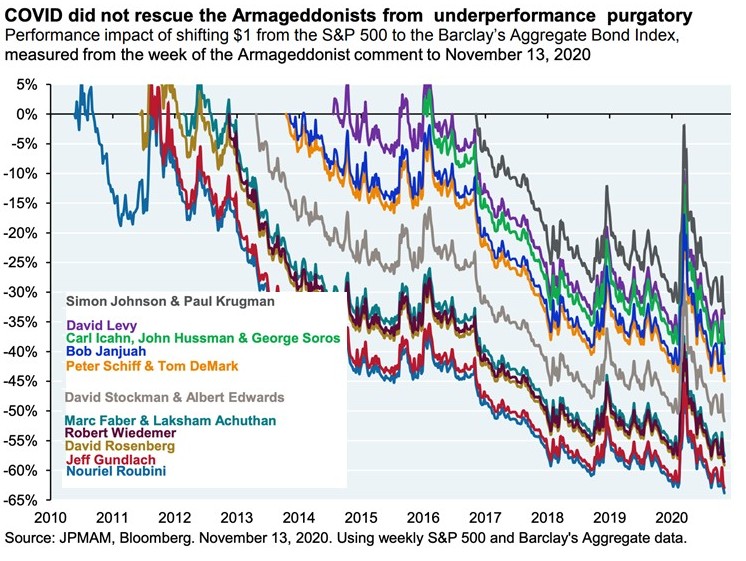

By the way, here’s a little summary for you of how the financial terrorists have done over the last few years. If you followed their advice, eschewed growth assets like stocks or equity ETFs and hid only in the safety of risk-free bonds, here’s the scorecard:

Click to enlarge. Source: The Reformed Broker

As you can see, following any one of these guys would have cost you. Big. For most people the greatest risk remains running out of money, not losing it. They need growth. Listening to the growls of the bears is a failed strategy now, as it has been in the past. Remember history. Black Monday. Nine Eleven. Y2K. 20% mortgages. The credit crisis. Dot-com crash. Wars. Recessions. And now, again, disease. It is flattery to believe you live in a time of unique risk, or are special for the daunting challenges you face. You don’t, and you’re not. Get over it.

How to invest? In a balanced fashion, with about forty per cent of a portfolio in fixed income or safer assets. Nothing has changed. Put about half of that into a combo of government, corporate and provincial bonds with 15% in preferreds pumping out a 5% dividend and destined to rise with rates, and the remainder in high-yield cash. The rest of the portfolio should be growth assets, roughly a third Canadian, a third US and a third international with a small (5%) REIT component. The more you have to invest, the more complexity can be built in – adding a health care ETF, for example, plus small cap exposure. And don’t forget to hedge against the loonie with a quarter in US-denominated assets.

Be diversified. ETFs are best. Mutual funds cost too much, lack liquidity and can surprise you with taxable distributions. Individual stocks increase volatility and risk, and should be avoided unless you have a seven-figure nestegg, large enough to achieve diversification. Exchange-traded funds are cheap, efficient and liquid. Just don’t buy too many. No moderate portfolio should have more than 15 or 16 positions.

Be tax smart. Understand how to use RRSPs for tax-shifting. Always stuff your TFSAs. Take the free RESP money. Income-split with a spousal retirement plan or a spousal loan. Consider tapping into home equity to diversify and get a tax-deductible borrowing.

When to invest? When you have the money. Timing the market is impossible. 2020 should have taught you that. It sure made the bears look like fools and charlatans.

What not to do? Never chase returns or faddish investments. Never pursue the hot tip your BIL gave you. Don’t expect to retire happy on your company group RRSP or CPP/OAS. Unless you love KD. Don’t buy an annuity when rates are this low. Be wary of insurance floggers, since most people need only a simple, cheap term plan. Never sign up for an educational savings gig with one of the baby vultures. Never seek investment advice from TNL@TB. Avoid silver, gold and crypto. Don’t let the virus or the nihilists win.

And don’t be Ellen.

STAY INFORMED! Receive our Weekly Recap of thought provoking articles, podcasts, and radio delivered to your inbox for FREE! Sign up here for the HoweStreet.com Weekly Recap.

Garth Turner November 25th, 2020

Posted In: The Greater Fool

Next: All Eyes on the Greenback »