June 6, 2020 | Trading Desk Notes June 6, 2020

A Key Turn Date occurs when a number of different markets all reverse direction at the same time…giving us a very valuable window into market psychology. At the risk of being scorned by psychologists I’d say that a KTD may be an example of synchronicity in the markets…when “meaningful coincidences” are a manifestation of some sort of “universal” decision making.

I’ve always been fascinated with inter-market relationships...for instance, if crude oil is trending lower I would expect the Canadian Dollar and the Norwegian Krone to be soft…and if they aren’t I would look for reasons why. When a number of different markets all reverse direction on or about the same date the “not so subtle” message is that something BIG has happened…as was the case around March 23rd following the Fed’s, “Whatever it takes” message.

The March KTD signaled that market psychology was turning away from fear and had begun to move toward greed. “Risk off” was being replaced by “risk on.” This pivot created an extreme “V” shaped reversal on the price charts…which is very hard to trade.

As the “risk on” market psychology was sustained following the March KTD many people, including me, thought we were seeing a bear market rally…so we either didn’t buy into it or we shorted it…anticipating that “bullish enthusiasm” would hit a brick wall and fear would return. At the very least we anticipated that the “risk on” rally would have a correction. Such a correction would result in some sort of a “W” chart pattern which would be a confirmation that a bottom had been made.

Actually we did have a “correction” in the “risk on” rally that showed up as a 2nd KTD in mid-May (albeit much less obvious that the March KTD.) This 2nd KTD may have been a confirmation that the “psychological lows” were made in March…that the first leg of the “risk on” rally was from mid-March to the end of April and the 2nd leg began in mid-May. The important thing is that following the 2nd KTD market psychology had a greater willingness to take on risk and/or to “divest” risk hedges.

The XLF ETF made a low in mid-March, rallied but then rolled over into the mid-May KTD…since then it has had a stronger 2nd leg rally.

The Euro/Swiss spread is a classic risk barometer. The Euro has been falling steadily against the Swiss for more than 2 years. It turned sharply higher in mid-May.

The US Dollar index rallied hard into the mid-March KTD as capital sought safety. For the next 2 months the USDX chopped sideways but it has been weaker since the mid-May KTD…as “risk on” market psychology sells USD and buys other currencies.

Gold fell ~$250 from early March into the mid-March KTD lows...then rallied to new highs by mid-April. It made an 8 year weekly high close on the 2nd KTD in mid-May but has drifted lower since then…perhaps as market psychology sees less need for a risk hedge at this time. (Note: global buying of gold ETFs surged in April and May to an All Time High…people bought more gold ETFs in the first 5 months of this year than in any previous full year period.)

The Australian Dollar and the Canadian Dollar both tumbled hard in early March but reversed sharply on the mid-March KTD. Their rally ran out of steam late April / early May but they both began a 2nd leg higher on the mid-May KTD.

WTI turned higher with a lot of other markets in mid-March but was beset with its own unique problems and made a lower low in late April. The initial rally from those lows stalled in early April but then a 2nd leg higher began on the mid-May KTD.

The 10 year Treasury note had ignored the “risk on” rally in the equity markets throughout April and early May, but prices reversed down on the mid-May KTD and took a noticeable slide lower this week.

Stock option volatility rose to astonishingly high levels (the existential fear of a pandemic) then reversed on the mid-March KTD. Vol rose again in mid-May but quickly reversed on the 2nd KTD and has subsequently fallen to the lowest levels since early February.

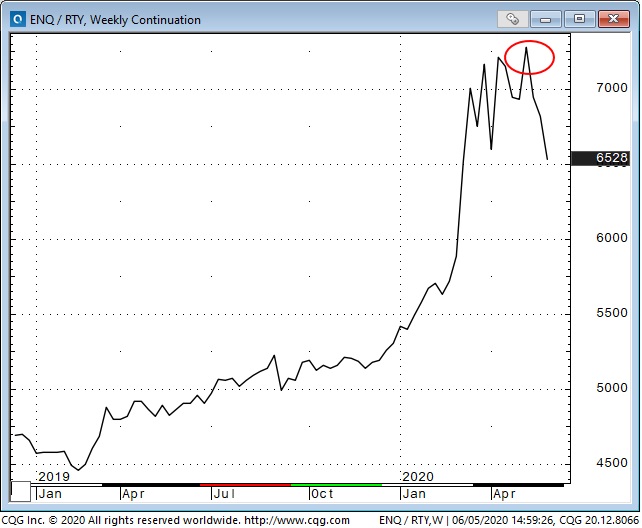

The Nasdaq 100 was flying relative to the Russell 2000 after the mid-March KTD (see my May 16th TD Notes.) Since then there has been a relative “rotation” out of the leading tech stocks and into the “broader market” as market psychology has been willing to take on more risk.

My short term trading: I ended last week short CAD and was stopped for a small loss very early Monday morning. I’ve had a string of small losses the past few weeks trying to “catch” a reversal in the “risk on” mood. I’m flat at the end of this week.

My son Drew Zimmerman and I use the futures market to trade currencies, metals, interest rates, stock indices, energy and other commodities. Please give us a call or send us an email if you’d like to know more about trading futures.

Victor Adair

SVP and Derivatives Portfolio Manager

PI Financial Corp

Canada

PI Financial Corp. is a Member of the Canadian Investor Protection Fund. The risk of loss in trading commodity interests can be substantial. You should therefore carefully consider whether such trading is suitable for you in light of your financial condition. In considering whether to trade or the authorize someone else to trade for you, you should be aware of the following. If you purchase a commodity option you may sustain a total loss of the premium and of all transaction costs. If you purchase or sell a commodity futures contract or sell a commodity option or engage in off-exchange foreign currency trading you may sustain a total loss of the initial margin funds or security deposit and any additional fund that you deposit with your broker to establish or maintain your position. You may be called upon by your broker to deposit a substantial amount of additional margin funds, on short notice, in order to maintain your position. If you do not provide the requested funds within the prescribe time, your position may be liquidated at a loss, and you will be liable for any resulting deficit in your account. Under certain market conditions, you may find it difficult to impossible to liquidate a position. This is intended for distribution in those jurisdictions where PI Financial Corp. is registered as an advisor or a dealer in securities and/or futures and options. Any distribution or dissemination of this in any other jurisdiction is strictly prohibited. Past performance is not necessarily indicative of future results

STAY INFORMED! Receive our Weekly Recap of thought provoking articles, podcasts, and radio delivered to your inbox for FREE! Sign up here for the HoweStreet.com Weekly Recap.

Victor Adair June 6th, 2020

Posted In: Victor Adair Blog

Next: This Week in Money »