June 17, 2020 | Tiff Talk

Tiff would be a swell name for a guy on your rowing team at Harvard. Or as CO of the cadet corps at your boarding school. Ditto for your daughter’s tennis or dressage instructor at the Club.

Well, here he is. Patrician, steady, old-school solid. Now in charge of the Bank of Canada, Tiff Macklem is all about creds, not surprises. Economist. Banker. PhD. His father was CFO at Birks. Nurtured in Montreal’s tony Westmount. He’s worked in the Department of Finance, headed a major business school, repped us at the G7 and has served as deputy governor of the central bank. If you’re looking for a good time, lose his number.

Now Tiff is presiding over an economy on its knees. No BoC boss ever – save the guy who just left, briefly – had to deal with a global pandemic, eight million people on the dole, a cratering GDP, forced economic shutdown or a tripling of the jobless rate in two months. There is no playbook. No precedent. Nobody to ask for advice. What the Tiffer does next will impact a slew of citizens.

He testified before our lame, hobbled, shameful, held-to-ransom Parliament this week. “What we really want to avoid,” he said, “is a non-recovery.”

“The biggest risk to Canadians becoming insolvent is not having a job. Monetary policy has lowered interest rates to reduce the interest costs Canadians are facing. That is the best contribution we can make to getting Canadians back to work, which is the best thing we can do to prevent Canadians from going insolvent.”

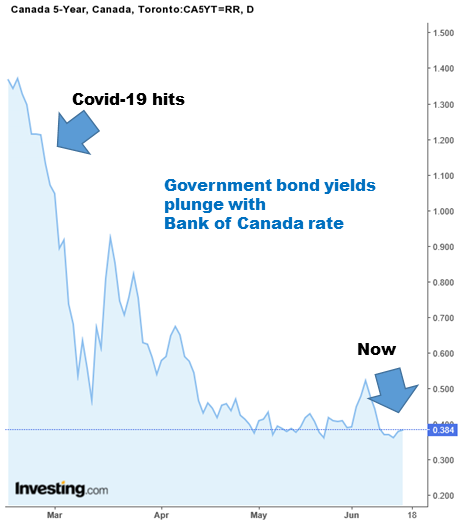

Okay, that’s why the yield on the benchmark Government of Canada bond currently looks like this. See what’s happened since the virus came to town in March?

Also note the language used by Macklem. Canadians are not ‘struggling’ or confronting ‘financial stress.’ Instead they risk “going insolvent”, thanks to excessive debt-snorfling, over-leveraging, house-horniness and the kind of financial acumen usually associated with small, burrowing rodents. In other words, interest costs must be plunged or else many will drown in their own payments.

But, is it too late?

Robert Hogue, a biggie economist at RBC, is suggesting this may be the case. Look at real estate listings, he says. Getting scary.

Realtors across the country reported a jump of almost 70% in properties hitting the market in May after a barren April. Says Hogue: “There are early signs demand and supply are decoupling. We expect further decoupling in the period ahead. Economic hardship is no doubt taking a toll on a number of current homeowners — including investors. Some of them could be running out of options once government support programs and mortgage payment deferrals end, and may be compelled to sell their property.”

Yes, as a certain pathetic blog has been yammering about for weeks now, the decision by almost a million homeowners to stop making mortgage payments is consequential. If these people lost employment and income and became unable to service their loans after a month or two, it shows deep financial failure. If some decided to cease servicing their debts out of economic uncertainty, well, nothing has changed. The jobless rate will stay elevated and society seriously abnormal for months to come. When payments on $180 billion in abandoned mortgages restart, the stress will return. And more may realize the burden and risk posed by housing debt in a post-pandemic world.

Says RBC: prices will fall in most markets in the coming months. “Strong starting points in Ottawa, Montreal, Toronto and Halifax will provide these markets with a temporary buffer. Prices are already declining in Alberta, and Newfoundland and Labrador. Nationwide, we expect benchmark prices to fall 7% by the middle of 2021 though believe a widespread collapse in property values is unlikely.” Recall that CMHC is forecasting a decline of up to 18%. CIBC says 10%. Moody’s says 30%. Remax says phooey.

Meanwhile, have you noticed what crashed interest rates have done to financial assets?

From the virus-infused low on March 23rd, US stocks have gained 42%. Bay Street is ahead 38%. The S&P 500 has given investors who ignored the pandemic an 11% year/year return. Amazing, and many people wonder how stocks can be so disconnected from the real economy.

One reason is this: where else is money going to go? Bonds pay diddly. Cash and GICs have zero returns. Commercial real estate is suddenly looking dodgy. Houses are the inflated tools of the indebted, chattering class. Landlording’s a death wish. So even with a pesky virus nibbling the planet, diversified and balanced portfolios of financial assets seem more secure – and have performed admirably.

And now here’s Tiff. Expect low rates, he says, until things start looking the way they were way back in February. The best guess? Two years. The next Bank of Canada move up will take place in 2022, the odds suggest. That means low bond yields, cheapo corporate financing, buckets of monetary stimulus, central bank bond-buying and more dough migrating into growth assets.

As for real estate, the soma of the masses, it all comes down to jobs. If they come back fast, then the market holds (after the current boomlet). If millions are still collecting CERB in October, expect rampant poochedness. The non-recovery.

STAY INFORMED! Receive our Weekly Recap of thought provoking articles, podcasts, and radio delivered to your inbox for FREE! Sign up here for the HoweStreet.com Weekly Recap.

Garth Turner June 17th, 2020

Posted In: The Greater Fool