May 12, 2020 | Germ Warfare

If you haven’t changed your pants in two weeks, you’re probably working from home. Isolated. So, like, what’s the point? Maybe you don’t need pants at all.

Millions of people aren’t going to the office, the shop floor, the store or visiting clients any more. They haven’t for months. And more months to come. Working remotely hasn’t happened on this scale since before the Industrial Revolution when peasants were paid for the piece-work they turned out at home, in hovels shared with rats and kids. So not much has changed (fewer rats, though).

Yesterday we weighed in on elevators, office towers, cubicles and commuting. Last week we had a poll showing most people think their productivity at home is just peachy. There are a lot of folks who believe, in a post-pandemic world, that the old model of herding wage slaves into enclosed spaces overlorded by supervisors and vice presidents is, well, medieval. When everybody is online, on tap, on call connected all the time, why do we need to share an office? Especially when it takes hours and dollars to get there?

We’ll see if this is really a change. Or just a hiatus.

In any case, let’s discuss how you, the home worker in questionable underwear, can benefit from not going to the workplace. Assuming you’re still gainfully employed it’s possible to write off a number of residential expenses that would normally be paid in after-tax dollars. This is because a portion of your house is, in effect, being used by your employer as an extension of the office. So you get a break – on your 2020 income taxes. Fight back. Germ warfare.

But be careful. This will take a bit of work.

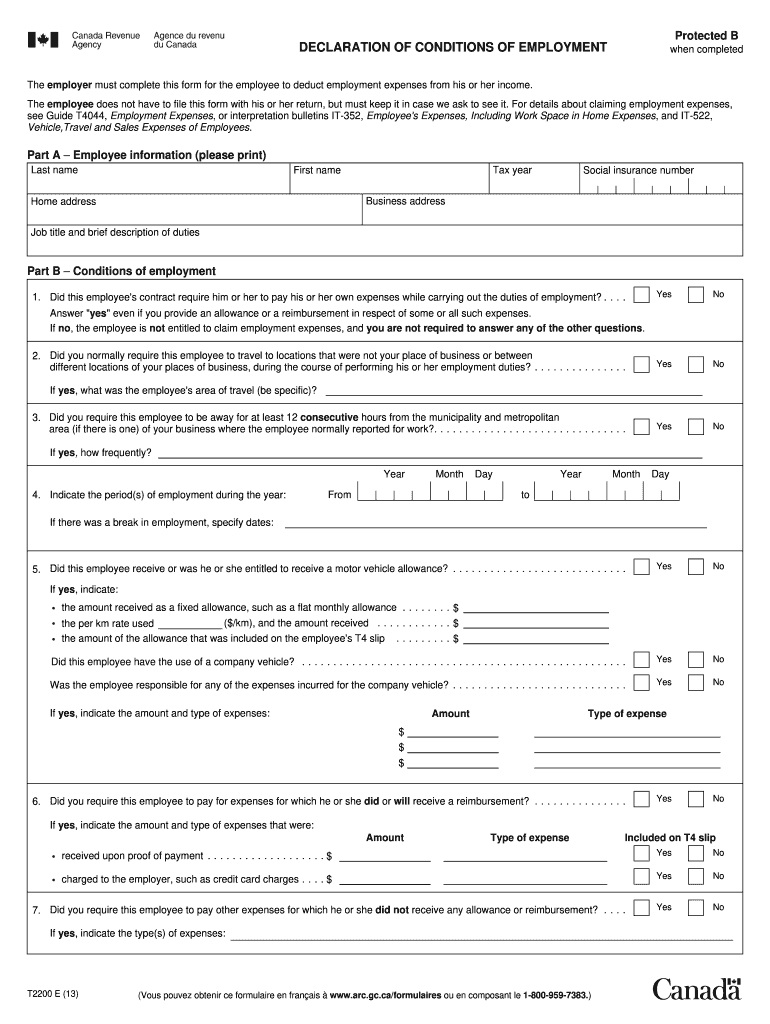

First, the boss has to promise you’ll get a signed copy of Form T2200, which is a Declaration of Conditions of Employment, with one little box at the bottom of page 1 checked off. That line reads, “Did you require the employee to pay other expenses for which he or she did not receive any allowance or reimbursement?” Yes. Check.

Here’s the form – you can download it from the CRA site to get signed by the company and included in your tax return for this year.

The CRA normally requires people deducting expenses for an office outside the workplace to use it for at least 50% of their total work time during the year. That may not be possible in 2020 if you’re called back in a couple of months, but let’s assume the meanies at RevCan relent and change the rules (which they will).

So what can you legitimately deduct?

The list includes paper, pens, staples, computer supplies, new equipment you have to purchase, repairs to your printer, yellow stickies, Tums and anything else necessary to do your job (except alcohol). Plus you can claim the cost of your Internet connection (but not Netflix), and a portion of the running costs of the house – heat, electricity, water. But not the mortgage, property taxes, condo fees, office furniture or capital improvements to the work space unless you are self-employed. In that case you can even deduct depreciation, but not on a spouse. Keep records. Every receipt and bill.

The amount of deductible home operating costs must relate to the actual square footage of your work area – for example, 20% of the area of the residence. Be realistic. Don’t cheat. Not worth it.

Then there’s the car. If used in the course of generating income – visiting clients, going to Staples for supplies, delivering work product – there are more deductible expenses. Gas, insurance, maintenance, license cost, usage can be claimed in part. Also the lease payment (a good argument to rent a car, instead of owning). Keep a detailed log of every trip, including date and distance. Record the odometer readings. Retain fuel slips. The CRA loves to disallow sloppy vehicle claims.

Be aware if you accept reimbursement from your employer for any of these costs they’re no longer deductible. And cheese doodles consumed while typing reports or loading Zoom are not a write-off. But buying a new laptop could result in a big deduction if you stay away from the cubicle for long enough.

A final word on taxes: that traditional April 30th deadline for filing the 2019 return was pushed out to June 1st. And you need not pay any outstanding balances until the first of September. Yay. But if you’re self-employed, everything has to be filed by the middle of June.

Now, regarding those pants. Sheesh. Get some dignity.

STAY INFORMED! Receive our Weekly Recap of thought provoking articles, podcasts, and radio delivered to your inbox for FREE! Sign up here for the HoweStreet.com Weekly Recap.

Garth Turner May 12th, 2020

Posted In: The Greater Fool