May 3, 2020 | Bankrupt Cities And States Get The National Disaster They’ve Been Hoping For

The people running states like New Jersey and cities like Chicago know they’re broke. Ridiculously generous public employee pensions – concocted by elected officials and union leaders who had to have understood that they were writing checks their taxpayers couldn’t cover – are bleeding them dry, with no political solution in sight.

They also know that they have only two possible outs: bankruptcy, or some form of federal bailout. Since the former means a disgraceful end to local political careers while the latter requires some kind of massive crisis to push Washington into a place where a multi-trillion dollar state/city bailout is the least bad option, it’s safe to assume that mayors and governors – along with public sector union leaders – have been hoping for such a crisis to save their bacon.

And this year they got their wish. The country is on lockdown, unemployment is skyrocketing and mayors and governors now have a plausible way to rebrand their criminal mismanagement as a “natural disaster” deserving of outside help.

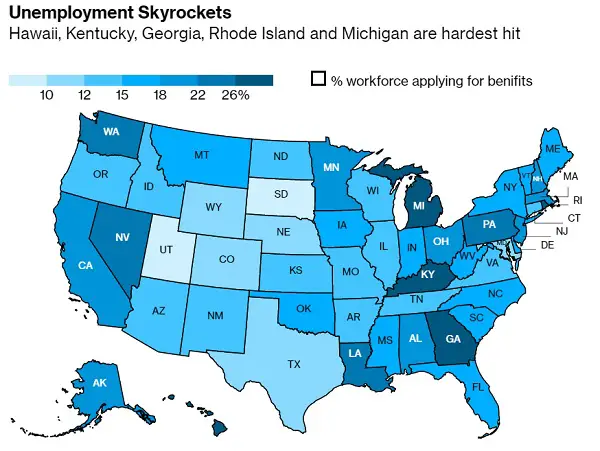

Here, for instance, is an estimate of how high unemployment will spike for various states. Note that overall it’s brutal, but the distribution isn’t what you might expect:

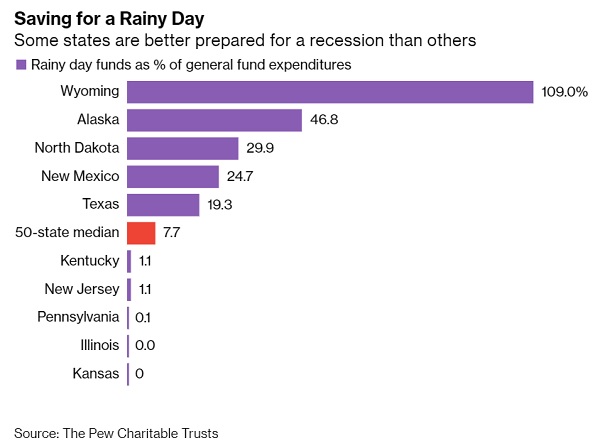

And here’s a table of state rainy day funds (i.e., cash on hand). To their credit, oil-producing states had the discipline to save against that commodity’s inevitable price fluctuations. Other states apparently didn’t see the need:

Illinois, which has the most underfunded pensions but, interestingly, a relatively healthy labor market, apparently had its natural disaster bailout plan prepped and printed before COVID-19 was invented and released. Because governor Gov. J.B. Pritzker almost instantly had his hand out for – get this – $41 billion, a sum equal to three times the state’s estimated pandemic-related revenue loss in the coming year. Overall, governors have asked for about $500 billion in aid.

And wait till California starts begging. See California Governor: Expect Budget Gap in ‘Tens of Billions’.

For President Trump, bailing out “badly run Democrat states” seems politically pointless, since those states will never, ever vote Republican. Senate majority leader Mitch McConnell, meanwhile, trolled his Dem counterparts by suggesting that states just declare bankruptcy (thus freeing them to cut pension benefits).

But of course this is just partisan fantasy. Letting Illinois go bankrupt would send the muni bond market into a “who’s next?” seizure, which would quickly spread to corporate bonds, equities, and real estate, cratering the US and then the global economy. At least that’s the worst-case scenario economists will present to policymakers.

With no stomach for presiding over the end of the world during an election year, Washington will cave, agreeing to whatever governors demand. And so the grossest mismanagement in the history of US state and city government will be swept under the rug – or more accurately will be swept onto taxpayer balance sheets along with that of all the other sectors that are – surprise! – too big to fail.

This is a shame since one of the few things worth looking forward to in the deep recession the world was stumbling towards before the pandemic hit was the collapse of unconscionable public sector pensions, and the disgrace of the people who conned teachers, firefighters, and cops into thinking that those generous benefits were guaranteed. On the list of financial/political crimes of the modern era, theirs ranks near the top. And now they’ll go both unpublicized and unpunished.

Meanwhile, the resulting multi-trillion-dollar addition to the national debt will hasten the fiery end of the fiat currency/fractional reserve banking/unlimited-government-debt world. One can only hope that future historians will get the story right while the perps are still alive to answer for their sins.

STAY INFORMED! Receive our Weekly Recap of thought provoking articles, podcasts, and radio delivered to your inbox for FREE! Sign up here for the HoweStreet.com Weekly Recap.

John Rubino May 3rd, 2020

Posted In: John Rubino Substack