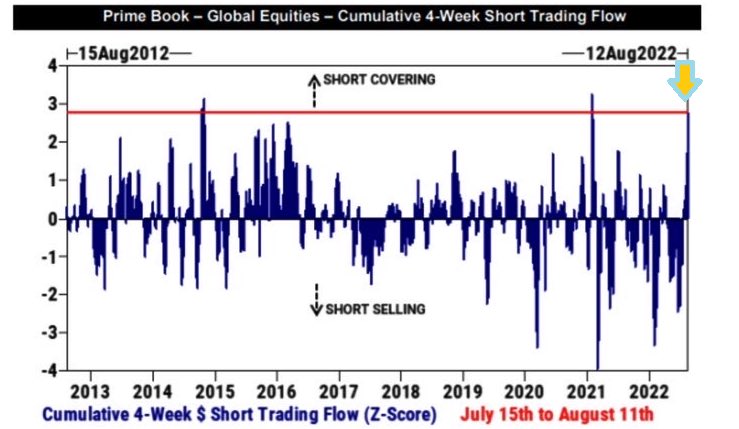

As risk markets have rebounded over the past month, FOMO has resumed with retail flows moving back to the sketchiest and over-valued securities and shorts being forced to buy back positions. The basket of most-shorted stocks tracked by Goldman Sachs is up almost 39% this quarter. As shown below (from Goldman Sachs Prime), the past month has seen the 3rd biggest hedge fund short-covering event of the last decade.

See Every Wall Street Trend Goes Haywire as Stock Bears Are Crushed:

See Every Wall Street Trend Goes Haywire as Stock Bears Are Crushed:

Retail investors, who watched their post-pandemic profits wiped out this year and dashed out of stocks in June, are rushing back. Share purchases from small-fry traders jumped 62% during the week through Tuesday, industry data compiled by JPMorgan Chase & Co. show.

Like Monty Python’s Black Knight, animal spirits have been injured year to date, but they’re “not dead yet.”

So long as wild abandon and gambling permeate, we can be sure that the cycle bottom is nowhere nigh. As in 2003 and 2009, when cycle lows finally present, very few will have the cash or will to buy.

The first down leg was triggered by concern about central banks hiking interest rates and the reality that higher rates reduce free cash flow and profits. With some $130 trillion of private debt globally, up 250% since 2000, the next down leg will come amid spreading solvency problems. Those capital injuries are always more grave. See more in Volatility Investor Warns of False Dawn for US equities market:

“We are getting close to the end of phase 1, a repricing of growth. Phase 2 is more interesting to me. It is more of a credit cycle. People are upset that they’ve lost money, but there is no fear. The headlines in Q4 and Q1 are going to be of people having trouble refinancing, and nervous investors will start selling. By Q4 or Q1 it will switch to fear.”