August 15, 2020 | Trading Desk Notes August 15 ,2020

Question: How many times have we seen markets get “silly” during the “dog days” of August...only to get hit with “reality” immediately after the Labor Day weekend? Answer: More than enough times to make us wonder what qualifies for “silly” these days…knowing full well that “silly” is usually hiding in plain sight…and the clues (at least in hindsight) were everywhere.

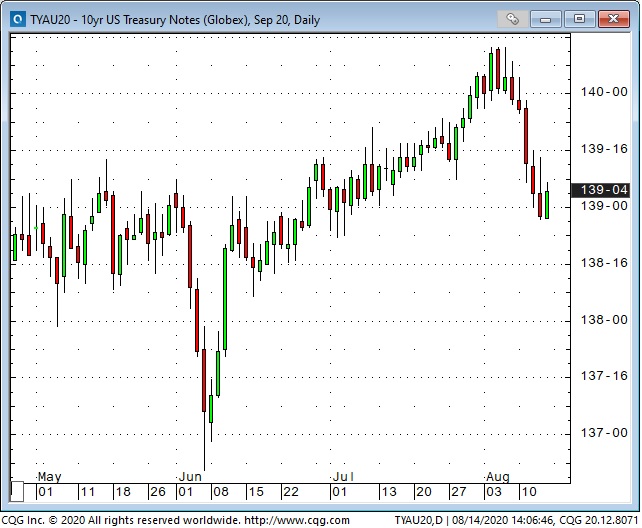

The drama in gold & silver and the relentless bid in the stock market captured the media’s attention this week but…credit market yields lurched ominously higher. Maybe it’s nothing…but since a lot of folks have turned their back on the bond market…expecting the Fed to keep yields pinned to the floor…the fact that both corporate and Treasury yields took a sudden tumble may be a clue that some popular assumptions need rethinking.

Real rates have been falling steadily for the past 2 months (well, 2 years if you take a longer view) and they lurched higher this week with significant knock on effects for the precious metals.

Now the folks expecting nominal Treasury yields to eventually go negative will likely say that this week’s bond market action was just a wee correction after a huge rally…and they may be right…but with global PMIs jumping you have to wonder if the bond market isn’t starting to choke on the massive Treasury (and corporate) issuance. And from a different angle, if the Fed really wants to see inflation north of 2% maybe they’d be OK with a steeper curve and a 2%+ yield on the long bond.

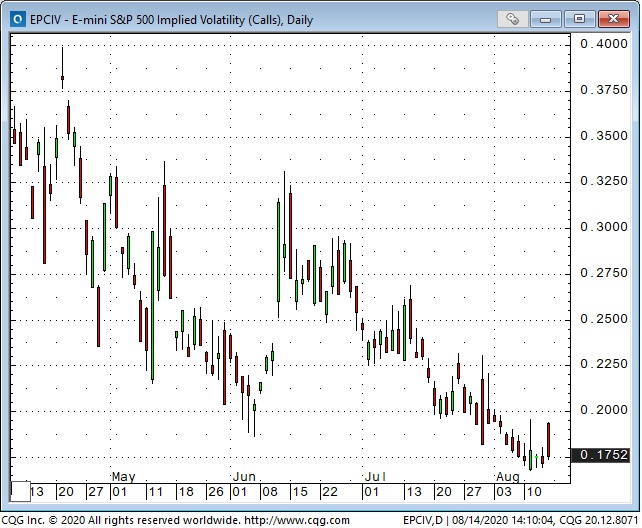

So if rising interest rates are one of the (presently) overlooked “clues” what’s the “silly?” Well, take your pick from anywhere along the “risk on” spectrum…but if there is a blanket caution perhaps it would be, “Don’t be short Vol” going into September.

Another candidate for “silly” that may be about to turn “deadly serious” after the Labor Day weekend is politics and geo-politics. The Presidential election will be less than 2 months away come September and the debates and actions by key participants will likely re-define “acrimonious.” Would it really be a stretch, for instance, to imagine the President hitting China with tariffs? What’s happening with Greece and Turkey? Who could get drawn into that…and what does that do to EURUSD?

And then there’s the virus. Which keeps spreading. We don’t even want to think about that turning deadly serious.

Our short term trading:

Gold: we continue to hold the net short put spreads established 2 weeks ago around $1955 basis Dec. We sold futures August 7 and covered them Aug 13 for a profit of ~$100 oz.

WTI: we are bearish…this is a lack-of-demand story. We established contango spreads a month ago (and added 2 weeks ago) looking for nearby WTI to weaken relative to the deferred months. So far that’s working.

EURUSD: We were skeptical of the EUR rally that began in mid-May against the USD, YEN and SWISS but waited to fade the rally until August when it began to show signs of topping. We are small short and may be early…but if EURUSD falls through August lows we will try to add.

CADUSD: We’ve thought that CAD would struggle above 75 cents…but it didn’t and we got stopped for a small loss early this week. CAD seems to be lifted by EUR strength, rising commodity indices and rising S+P. Our negative bias on CAD probably helped us turn a blind eye to the chart which shows CAD plodding relentlessly higher since the March lows.

S+P: We’ve held a long-dated net bearish put spread on the S+P since June. It’s obviously under water but the losses are small and we’ve hung onto the position “just in case” the market suddenly takes a swan dive…like gold did. We think of it as our Nassim Taleb trade.

Lumber: just in case you missed it (we did!)…look at lumber. This is a classic shortage-of-supply story. In early June the Sept contract traded ~$10 discount to January…a typical carrying charge or contango market. Now Sept is ~$130 premium Jan (a shortage of spot supply creates a backwardation market with deferred contracts at discounts to the nearby.)

If you’d like to know more about using the futures and options market to trade currencies, metals, interest rates, stock indices, energy and other commodities please contact Drew Zimmerman at PI Financial Corp in Vancouver.

PI Financial Corp. is a Member of the Canadian Investor Protection Fund. The risk of loss in trading commodity interests can be substantial. You should therefore carefully consider whether such trading is suitable for you in light of your financial condition. In considering whether to trade or the authorize someone else to trade for you, you should be aware of the following. If you purchase a commodity option you may sustain a total loss of the premium and of all transaction costs. If you purchase or sell a commodity futures contract or sell a commodity option or engage in off-exchange foreign currency trading you may sustain a total loss of the initial margin funds or security deposit and any additional fund that you deposit with your broker to establish or maintain your position. You may be called upon by your broker to deposit a substantial amount of additional margin funds, on short notice, in order to maintain your position. If you do not provide the requested funds within the prescribe time, your position may be liquidated at a loss, and you will be liable for any resulting deficit in your account. Under certain market conditions, you may find it difficult to impossible to liquidate a position. This is intended for distribution in those jurisdictions where PI Financial Corp. is registered as an advisor or a dealer in securities and/or futures and options. Any distribution or dissemination of this in any other jurisdiction is strictly prohibited. Past performance is not necessarily indicative of future results

STAY INFORMED! Receive our Weekly Recap of thought provoking articles, podcasts, and radio delivered to your inbox for FREE! Sign up here for the HoweStreet.com Weekly Recap.

Victor Adair August 15th, 2020

Posted In: Victor Adair Blog

Next: This Week in Money »