Canadians are drowning in debt — of all three types. The total amount owed in government, household and corporate debt has soared since 2010. Of particular concern today is the rapid increase in federal government debt since 2020.

Can Canada escape this debt trap?

We know that Canada has had a growing household debt problem for at least two decades, as the real estate sector soared, consumer spending was financed by debt and households borrowed more to reach for unaffordable homes in some cities.

But the federal government had modest debt ratios for much of that time. Government debt held at one of the lowest debt ratios in the G-20, if you did not include provincial government debt. But that changed quickly.

In 2020, when COVID-19 hit, the federal government of Canada chose to pump one-half of a trillion extra dollars into the economy, out of fear that a new depression would be triggered by the pandemic. No other country in the world matched Canada’s largesse when it came to adding new liquidity into the economy by creating money.

But Canadian corporations and households were already leaders in debt owed compared to the rest of the world before 2020. So with the jump in debt at the government level Canada’s situation deteriorated markedly.

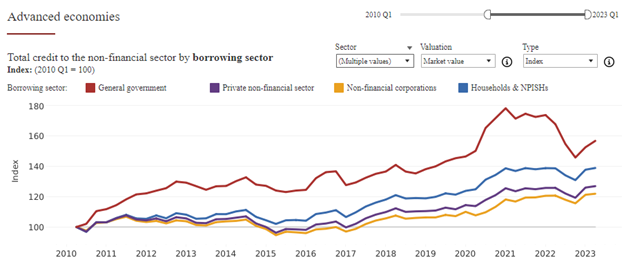

Here are the numbers for advanced economies and Canada from bis.org:

Source: BIS

At first glance we can see that debt growth for advanced economies is much slower than in Canada, starting in 2010. The fastest growth in advanced economies was for the “general government” sector at about 60% gain over the period.

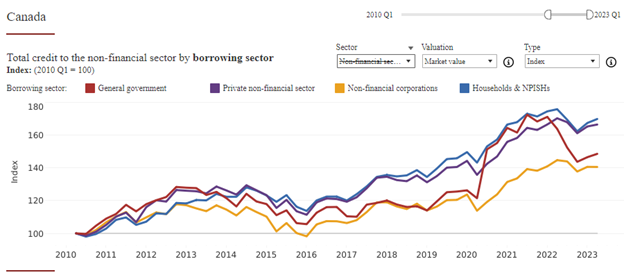

Source: BIS

In Canada we can see that both “household” and “private non-financial sector” grew much faster than in the advanced economies, at about 70-80 percent. And even the “non-financial corporations” grew 40 percent in Canada and only 20 percent in Advanced economies.

For government — red line — Canada had only 20 percent growth until 2020. But note the vertical move from 2020 to 2021.

Given that Canada was leading the pack in the household and corporate sectors in total borrowing as a percent of GDP and in the rate of change since 2010 it is worrying to see the government borrowing increase so rapidly in just a few years.

Usually when government spending increases rapidly the private sector will enjoy a surplus and can reduce its borrowing by the same proportion. All of the money that the government borrows is transferred to someone in the private sector, so that government spending (an expense) is turned into income for some individual or some corporation.

So we are watching to see if the private sector can take these funds created by spending at the federal government level and use them to reduce their borrowing for mortgages, car loans and credit cards. This will not change the overall leverage in the economy, but will move the excess borrowings from a shaky borrower such as consumer to a steady borrower with a AAA credit rating, the federal government.

Hilliard MacBeth

The opinions expressed in this report are the opinions of the author and readers should not assume they reflect the opinions or recommendations of Richardson Wealth or its affiliates. Assumptions, opinions and estimates constitute the author’s judgment as of the date of this material and are subject to change without notice. We do not warrant the completeness or accuracy of this material, and it should not be relied upon as such. Before acting on any recommendation, you should consider whether it is suitable for your particular circumstances and, if necessary, seek professional advice. Past performance is not indicative of future results. The comments contained herein are general in nature and are not intended to be, nor should be construed to be, legal or tax advice to any particular individual. Accordingly, individuals should consult their own legal or tax advisors for advice with respect to the tax consequences to them, having regard to their own particular circumstances.. Richardson Wealth is a member of Canadian Investor Protection Fund. Richardson Wealth is a trademark by its respective owners used under license by Richardson Wealth.