November 11, 2023 | Trading Desk Notes For November 11, 2023

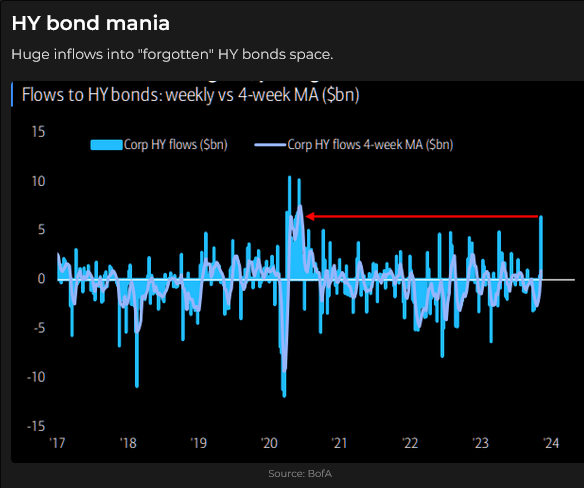

Surging Megacap Tech shares power the Nasdaq 100 to the highest weekly close since July

Three weeks ago, the NAZ closed at a 6-month low as long-term interest rates hit 16-year highs, but a reversal lower in interest rates last week ignited a buying frenzy across the stock market, with the NAZ closing this week ~10% above recent lows.

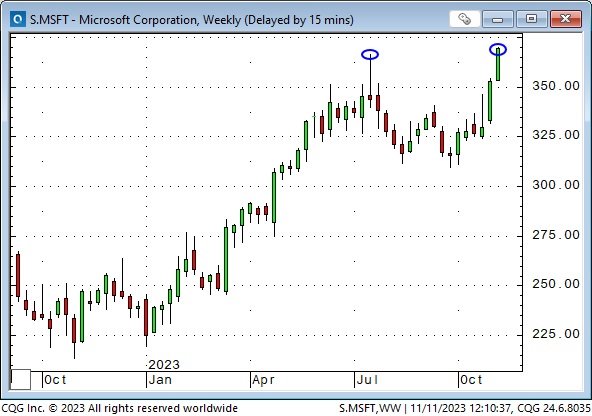

In my July 22 TD Notes, I wrote that MSFT’s reversal from all-time highs on July 18 likely signalled a turning point in sizzling tech stocks. July 18 was an 18-month high in the NAZ, which fell ~12% to October’s lows.

But MSFT hit a new All-Time High this week as Megacap Tech stocks pulled all stock indices higher.

Stock indices traded to new highs early Thursday (but failed to rally above October’s highs) after being “dead in the water” Monday to Wednesday (perhaps “catching their breath” after last week’s scorching rally.) But around mid-day, the indices fell sharply on a poorly received 30-year bond auction and then took another leg lower when Powell said he was “not confident that rates are high enough.” The S&P closed at a new low for the week on Thursday, and it looked like a correction to last week’s rally could develop.

However, the S&P rallied overnight and had its highest daily close on Friday since September 20, registering a classic daily key reversal up (the market traded below Thursday’s low and above Thursday’s high and closed above Thursday’s high). This key reversal followed a key reversal down on Thursday.

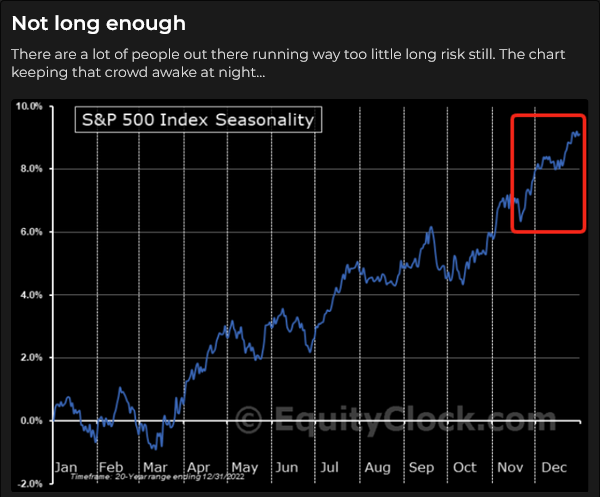

The seasonal trend for the S&P is higher into the American Thanksgiving (October 23) and even higher into the end of the year.

S&P futures hit a 6-month low on Friday, October 27; implied VOL hit a 6-month high.

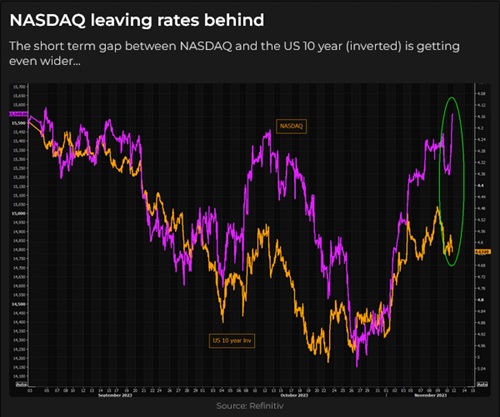

Bonds

The sharp about-face in equity indices from Thursday to Friday was all the more remarkable given that the interest rate markets continued lower on Friday. (Remember, the reversal from 16-year high yields sparked last week’s equity market rally.)

There have been many “explanations” for the steep fall in bond prices, particularly in September and October, but the key unanswered questions remain, “Who will buy all the bonds the Treasury will be issuing as the government continues to run larger and larger deficits, and at what price will they buy?”

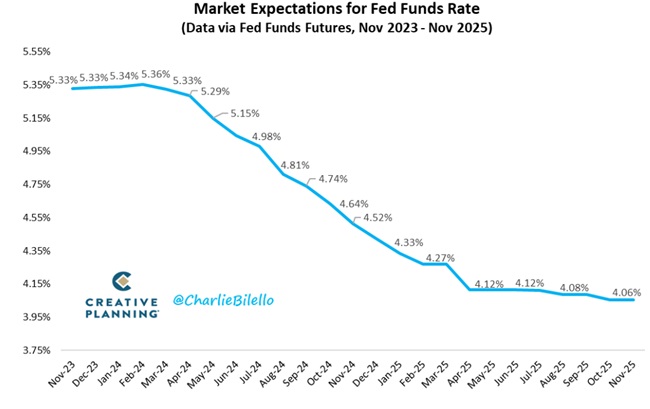

This is the market’s current pricing for short rates between now and November 2025.

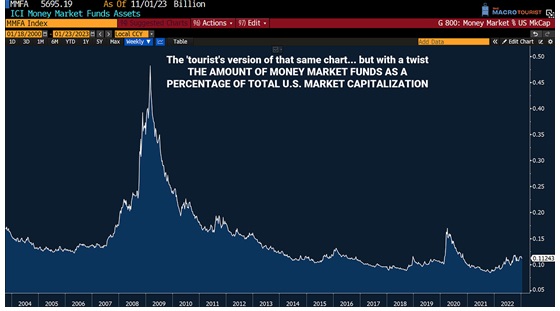

Money Market Funds

Everybody knows that capital has been flowing “in size” to money market funds, and the charts can “make it look like” a tsunami, but this chart from my friend Kevin Muir shows MMF as a % of total US stock market capitalization – nowhere near GFC levels.

Currencies

The US Dollar Index bounced back this week after falling sharply last week.

Price action in the Canadian Dollar has been the inverse of the USD for most of this year.

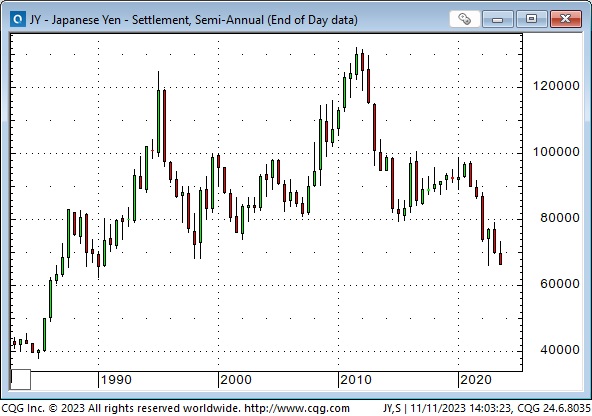

The Japanese yen fell to a 33-year low this week, down 50% from its all-time high in October 2011.

Gold

Front-month Comex gold futures nearly touched a new low for the year on Friday, October 6, having dropped ~$280 from the May 4 highs but reversed higher late in the day. The market gapped higher Sunday afternoon following the Hamas attacks and rallied ~$200 from the early October lows to the late October highs. Gold closed Friday ~$80 below the late October highs.

Gold’s weakness before the Hamas attacks resulted in aggressive short-covering as well as “geopolitical stress” buying, but the decline from the late October highs may indicate that the market is not worried about a widening conflict and may be starting to price in a “winding-down” of tensions around Israel. Are the conflicts in Israel and Ukraine possibly nearing a “negotiation” phase?

I have frequently mentioned that central banks have dramatically increased their gold buying since the Russian invasion of Ukraine. While the gold ETF market saw an initial flurry of buying after the attack, it has since seen net selling. My point has been that without the significant increase in CB buying, the gold price would likely be a few hundred dollars lower, given the stronger USD and much higher real and nominal interest rates.

Ironically, gold bulls have been relatively quiet about being “saved” by communist central banks in Russia and China buying gold. I suspect that most of the Russian and Chinese “buying” has been from domestic producers – who may (or may not!) be getting a fair price. China and Russia are the number 1 and number 2 (respectfully) largest global gold producers, accounting for ~20% of newly mined gold.

Energy

Front-month Nymex WTI crude oil hit a 13-month high of $95 in late September but dropped to a 4-month low of $75 this week.

The steep drop in the forward curve backwardation accompanying the decline in the spot price added to the bearish tone. The June 2024 contract was trading at ~$10 discount to December 2023 in late September; by this week, the discount had fallen to ~$1.

Nearby contracts for Nymex natural gas have declined sharply in the past two weeks.

The bullish trend in uranium issues continued this week.

Commodities

This week, a 4-month Head and Shoulders top in the Goldman Sachs commodity index broke through the neckline.

My short-term trading

At the end of last week, I had a nasty cold that seemed to give me severe brain fog, so I was flat over the weekend.

I shorted the S&P on Monday as it looked to have “run out of gas” after last week’s relentless rally.

I also bought OTM gold puts on Monday. I didn’t want the risk of being short, but I thought the gold market was rolling over.

The brain fog kicked in on Tuesday when I intended to cover my short S&P position but covered the gold puts by mistake. When I realized my error, I covered the S&P position and stayed flat gold. The minor loss on the S&P trade was more than offset by the gain on the gold puts.

Feeling a little better on Wednesday, I ventured back into trading, shorting the S&P. I was stopped for a slight loss.

I shorted the S&P on Thursday and was ~40 points ahead by the close, thanks to the poor 30-year auction and Powell’s “hawkish” comments.

I covered the S&P for a 10-point gain before the “floor session” opened Friday morning. The S&P had an excellent opportunity to fall but didn’t take it. I bought the S&P around the same level I had shorted it on Thursday and stayed long into the weekend with an unrealized gain of ~25 points.

I did a 180-degree turn in my thinking about the S&P from Thursday to Friday. I had been probing the S&P from the short side this week and felt very confident in my short position at Thursday’s close, but the market’s failure to break, especially with bond prices down hard on Thursday, gave me pause, so I covered before the Friday opening.

I was flat after covering my short S&P trade (I had no position to “justify”) and realized that the market (and the Mag7 in particular) wanted to go higher, so I got long. As my friend Peter Brandt might say, “I have strong opinions, weakly held!”

On my radar

I regret having covered my gold puts by mistake, and I will look for a setup to reestablish the trade. I think the market senses that the conflicts are nearing a negotiation phase, and geopolitical stress will be reduced. I could be wrong!

Equity market buyers have been WAY more aggressive than sellers since the 3-month decline ended on October 27. I think many people got short or underweight stocks during the August to October decline, and they will have to cover/rebalance if this rally continues. Corporate share buy-backs, short-covering, and buying by under-weight PMs will provide upside pressure.

The down trendline from the end-of-July highs is broken; the market closed on the 20-week MA. If it keeps going higher, people will chase it.

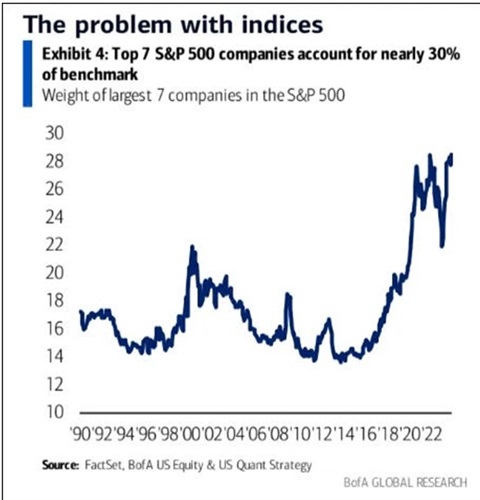

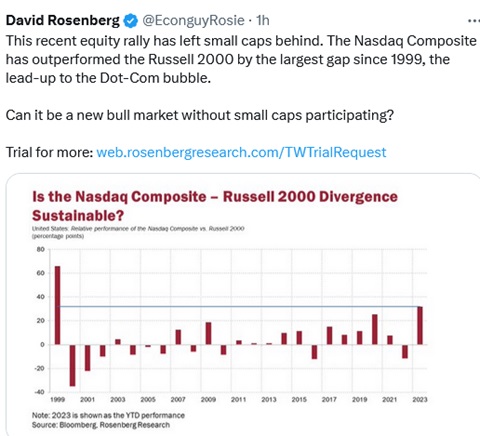

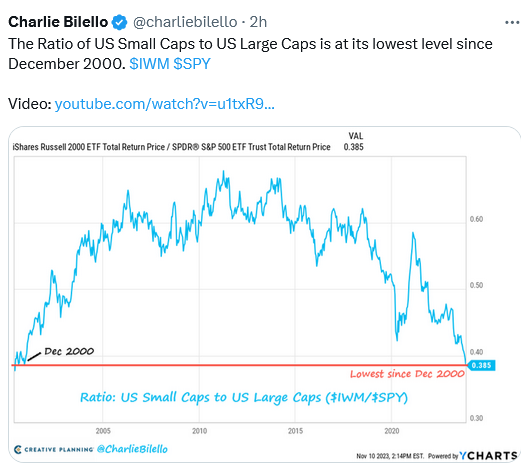

The out-performance by Megacap tech makes sense – many PMs running “other people’s money” in a long-only structure will see them as a “safe” career bet, whether they go up or down into year-end. I expect the Megacap/Russell spread to get wider.

Fed policy isn’t going to change between now and January.

I’m inclined to think we’re getting close to a recession, and if the market starts to think that way, then bonds may get a sustained bid, but they sure looked heavy this week after bouncing for two weeks off a 16-year low.

For people who don’t want to be in the stock market, money market funds or TBills near 5.5% seem safer bets than bonds, but if the “recession” story picks up, I could see people extending duration.

Weakening house prices may diminish the “wealth effect” and cause consumer spending to slow.

I see that delinquent CRE loans at US banks are at 10-year highs, but that is only 1.5% of total CRE loans (Financial Times), so that’s a bearish headline, not a bearish story.

The October CPI report is due on Tuesday morning, but it will have to be a shocker to get the FOMC to change policy at their December 12/13 meeting.

The Barney report

We’re down at the river again, but there is much more water than this summer when Barney went swimming. I’m hoping he doesn’t plunge in, but I’ll let him decide what he wants to do. He has a good look but decides against going out into the current. Good choice, Mister Barney!

Listen to Victor talk about markets

Mike and I discussed the sizzling stock market rally, the interest rate markets, and gold during our 8-minute interview on the Moneytalks podcast this morning. My segment starts around the 1 hour, 5-minute mark. You can listen to the whole show here.

The World Outlook Financial Conference

Tickets are now on sale for the 2024 WOFC, which will be held at the Westin Bayshore Hotel in Vancouver on February 2 & 3, 2024. Click here for more information and to purchase tickets.

The Archive

Readers can access weekly Trading Desk Notes going back six years by clicking the Good Old Stuff-Archive button on the right side of this page.

Headsupguys

There’s a reason I put a link to Headsupguys in my Notes every week. I’ve had friends who took their own lives, and Headsupguys helps men struggling with depression.

If you or someone you know is struggling with depression, talk to them and contact headsupguys. They can help.

Subscribe: You have free access to everything on this site. Subscribers receive an email alert when I post something new – usually 4 to 6 times a month.

Victor Adair retired from the Canadian brokerage business in 2020 after 44 years and is no longer licensed to provide investment advice. Nothing on this website is investment advice for anyone about anything.

STAY INFORMED! Receive our Weekly Recap of thought provoking articles, podcasts, and radio delivered to your inbox for FREE! Sign up here for the HoweStreet.com Weekly Recap.

Victor Adair November 11th, 2023

Posted In: Victor Adair Blog

Next: Canadians are Drowning in Debt »

“Who will buy all the bonds the Treasury will be issuing as the government continues to run larger and larger deficits, and at what price will they buy?”

The Federal Reserve will buy the bonds and it will pay any price since it can simply print the money out of thin air to buy them.