October 15, 2023 | Trading Desk Notes For October 15, 2023

“This may be the most dangerous time the world has seen in decades.” Jamie Dimon, CEO of JPMorgan Chase, in a statement accompanying the bank’s quarterly earnings news release.

This edition of the TD Notes will be brief. After three days in Calgary attending Josef Schachter’s “Catch the Energy” conference, I returned to my desk Sunday afternoon. I want to highlight where the “stress” was in various markets last week.

Gold

Gold gapped higher on Monday and soared ~$125 (~6%) from last week’s lows to Friday’s close. Leading into last week’s lows, gold had traded lower for 12 of the previous 13 days, leaving gold “ripe” for a sharp reversal. Gold rallied ~$60 on Friday ahead of the weekend.

Gold call option volatility soared. (Would you want to be naked short of gold calls here?)

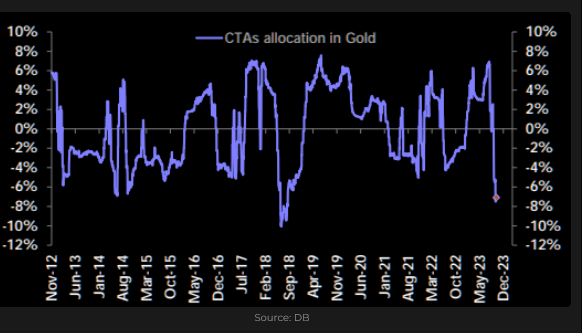

This chart from Deutsche Bank shows that Commodity Trading Advisors (CTAs) were collectively net short gold futures before last week.

Currencies

The US Dollar Index hit an 11-month high on October 3, then trended lower for six consecutive days. Despite the geopolitical stress in Israel, it was lower early last week but traded sharply higher on Friday. The USDX has closed higher for 12 of the previous 13 weeks, up ~7% from 18-month lows in mid-July. Capital comes to America for safety and opportunity.

When gold and the USD surge higher together, it is usually a symptom of acute stress in financial markets.

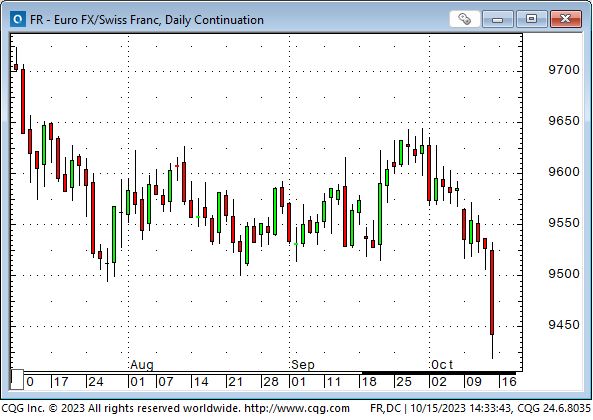

The Swiss Franc soared to an All-Time High against the Euro this week, another sign of stress in financial markets.

The Canadian Dollar was among the few currencies to close higher on the week against the USD. I think the CAD (and the Mexican Peso) was seen as “safe havens” along with the USD (fortress North America.)

Crude oil

WTI futures closed Friday ~$8 higher than the previous week’s lows. American crude oil production is ~13.2 mbd.

Option vol on WTI futures closed the week at the highest level since March. (Would you want to be naked short WTI calls?)

Equities

The S&P dropped to 4-month lows the first week of October but began to rally as markets believed that the “Fed was done” raising rates. (I have repeatedly opined that investors would see the end of Fed tightening as a “Green Light Special” to buy equities.) The rally continued early this week, but the S&P slumped ahead of the weekend.

The Magnificent Seven continue to draw capital relative to other sectors.

The ZEB ETF of Canadian bank shares fell to a 32-month low in early October.

Bonds

US Treasury Bond prices tumbled from the mid-July Key Turn Date, with yields hitting 16-year highs in early October. The yield surge was mainly driven by sharply rising real rates (yields soared while inflation expectations remained relatively steady.)

Rising term premiums reflect the market’s worry that an issuance tsunami caused by continuing government deficits may overwhelm buyers. (There will “always” be buyers of US Treasury bonds, but true “price discovery” – now that “price insensitive” Central Bank buying has been replaced by net selling – may mean buyers will demand much “better prices” than were previously on offer!)

The bond rally Monday through Wednesday may have been due, in part, to a combination of safe-haven buying and a “bounce” in a deeply oversold market. However, the nascent rally off 16-year lows was hit with a body blow on Thursday when the 30-year bond auction was a disaster. The bond market may need to believe that the economy is “truly” headed into recession before prices rally. (Another possible “support” for bond prices is the idea that the Treasury, sensing the market’s reluctance to buy bonds, may shorten the duration of future issuance – sell more short-dated paper and fewer long bonds.)

Cash

Nearly $1 Trillion has flowed into American Money Market Funds YTD. Total assets are at All-Time Highs, almost $6 Trillion.

My short-term trading

I started last week long gold and Mexican Pesos – positions I had initiated on Friday of the previous week. When markets opened on Sunday afternoon, I covered the Peso position for a modest gain. Given the crisis in Israel, I did not want to be short the USD against any other currency. I remained long gold throughout the week and into the weekend, raising my stop as prices increased.

Given geopolitical developments, I was amazed that the broad stock market continued to rally Monday through Wednesday. I shorted the S&P when it fell back from Tuesday’s highs and added to the position on Wednesday but was stopped for a slight loss when the market turned higher late Wednesday afternoon.

My unwillingness to maintain a short S&P position was compounded by the knowledge that I would be travelling to Calgary on Thursday and trying to follow markets from a hotel room on Friday. Reducing risk exposure seemed like the prudent thing to do, so I missed the Thursday/Friday breakdown. (I took some solace from the soaring gold price.)

On my radar

I agree with Jamie Dimon’s statement that this may be the most dangerous time the world has seen in decades. The old adage is that where there’s a risk, there’s an opportunity, but my trader’s intuition warns me that market risks right now may be several degrees of magnitude greater than I can imagine.

My number one trading goal is to protect my capital – this is no time to swing for the fences. I will be actively looking for trading opportunities, but I will probably use limited-risk trading strategies (like buying options) to execute trading ideas rather than counting on stops getting filled at my price to limit losses.

Be careful out there.

The 2023 “Catch The Energy” Conference

I’ve known my friend Josef Schachter for nearly twenty years, and I greatly respect his skills as an energy market analyst. I’ve attended all of his annual conferences in Calgary and am amazed at the quality of the companies presenting there. If you are looking for someone with an excellent track record of picking winners in the oil patch, check out his website.

The Barney report

My wife went to a vast National park on the rugged west coast of Vancouver Island while I was in Calgary. She dropped Barney off with some dog sitters we had not used before. This family has a few goldens, and Barney loved the company!

Listen to Victor talk about markets

I talked with Mike Campbell for about 8 minutes on Saturday, October 14, on his top-ranked Moneytalks podcast. We discussed where the “stress” from events in Israel showed up in the financial markets – particularly in gold and currencies. My segment with Mike starts around the 1 hour and 10 minute mark. You can listen here.

The Archive

Readers can access weekly Trading Desk Notes going back six years by clicking the Good Old Stuff-Archive button on the right side of this page.

Headsupguys

There’s a reason I put a link to Headsupguys in my Notes every week. I’ve had friends who took their own lives, and Headsupguys helps men struggling with depression.

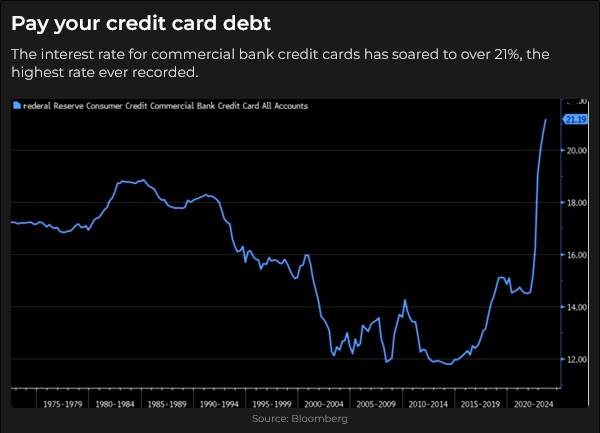

This week, I read a five-minute essay written by Sean McLaughlin in 2017 when he was deeply depressed. He had been a trader for 20 years, and it wasn’t going well. He felt inadequate, lost, scared, anxious, depressed, unloved, and unhealthy. He had run out of money and was in debt. He was afraid of losing his family.

The good news is that Sean turned his life around and is a happy, successful man today.

Some men aren’t so lucky.

If you or someone you know is struggling with depression, talk to them and contact headsupguys. They can help.

Subscribe: You have free access to everything on this site. Subscribers receive an email alert when I post something new – usually 4 to 6 times a month.

Victor Adair retired from the Canadian brokerage business in 2020 after 44 years and is no longer licensed to provide investment advice. Nothing on this website is investment advice for anyone about anything.

STAY INFORMED! Receive our Weekly Recap of thought provoking articles, podcasts, and radio delivered to your inbox for FREE! Sign up here for the HoweStreet.com Weekly Recap.

Victor Adair October 15th, 2023

Posted In: Victor Adair Blog

Next: Be Among the First to Panic »