October 15, 2023 | The Big Cycle 2

When your system, whatever it may be, is working extremely well, we used to say it’s “firing on all 8 cylinders.” What does that mean?

A gasoline motor contains metal cylinders inside which the gasoline burns (hence “internal combustion engine”) and causes belts and gears to turn. A V-8 engine has eight cylinders arranged in (surprise!) a “V” shape. The motor produces maximum power when all 8 cylinders are producing at their maximum capacity. This “firing on all 8 cylinders” is the ideal state.

Now, does it actually happen? In reality, the cylinders and all the machinery around them have imperfections. One or more might stop working, in which case you aren’t getting full power anymore.

Something similar happens with entire countries and economies. In theory, all the important components can be in their optimal state—in which case this country is probably the dominant world power (or at least dominant in their local sphere).

Ray Dalio’s Big Cycle theory, which I introduced last week, measures those components into something kind of like a stock valuation model. A score of 1.0 means the country is “firing on all cylinders.” That is historically quite rare. But in geopolitical and economic power terms, you don’t need perfection. Relative power is what matters. You just have to be better than the others.

Ray updates his model every year. Today I’m going to review his 2023 scores and see what they may tell us about the world’s future. After that, we will look at two of his very recent videos/reports. Taken together, it is most sobering.

As you’ll see, countries that were once firing on all (or at least most) cylinders are losing momentum. Others are boosting their motors and gaining horsepower. At some point, the lines cross. Could it happen soon?

Power Scores

Before we get started, please note the rest of this letter will be hard to follow if you missed last week’s The Big Cycle. If you did, please go read it right now. Then come back here to finish.

Dalio says great powers rise and fall in what he calls The Big Cycle. He identifies 18 factors that govern the cycle, all of which can be quantified with hard data. Obviously, data from centuries ago is scarce, but Ray and his team have done a lot of work to find the best sources and use them as consistently as possible.

Today, data reliability is still limited but we usually know the limitations. Ray has continued refining his methodology since the 2020 data shown in his book. Below, I’ll be quoting from an update he published in January 2023.

Here’s how Ray describes his latest scores.

“The overall country power score is created by weighing the outputs of the 18 gauges, each of which is derived as a composite of several stats we aggregate based on relevance, quality, and consistency across countries and time. Because both the size of a country and the strength of the powers matter, I show measures of the total power and the per capita power of each country. For more detail on how I thought about different types of measures (in per capita and absolute terms), please see the table at the end of this report, following the computer-generated country summaries.

“To be clear, while these indices aren’t perfect because the data through time isn’t perfect and not everything can be captured in the data, they do an excellent job of painting the big picture. Additionally, it is worth noting that we have updated and improved the analysis since the book was published, which is why you may notice some figures differ slightly in this report compared to the publication. This system is a never-ending work in progress so you should expect it to evolve and continuously get better.”

As mentioned last week, I’m quite fascinated to see a trader compare countries using the same kind of quantitative techniques used to compare investments. These may seem like different universes, but they really aren’t.

Let’s look at the scoreboard.

Skate Where the Puck Is Going

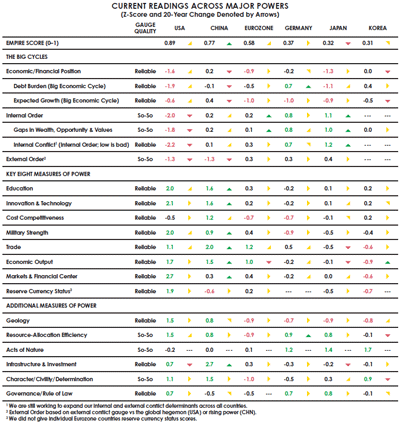

Ray Dalio’s 2023 book update is chock-full of tables like the one below. I realize it may be too tiny to read. If so, you can request your own copy of the report here.

Source: Ray Dalio (Click to enlarge)

Let me walk through what you’re seeing here. The left column lists the Big Cycle determinants that go into calculating the overall “Empire Score” between 0 and 1. A score of 1 would be “firing on all cylinders.”

Then he shows both overall and by-determinant scores for 6 powers: USA, China, the Eurozone, Germany, Japan, and Korea. These are the “top 6” powers as of January 2023, according to Dalio’s criteria. (He also grades others, not shown here.)

It’s important to keep these two indicators distinct. The current score tells us something about the present, but the direction may be a better clue to the future. If your goal is, as Wayne Gretsky put it, to “skate where the puck is going” then you want to know who is rising the fastest.

In the overall score, only three countries get green arrows, meaning they are in 20-year uptrends: China, India, and Indonesia. A few countries show milder uptrends: South Korea, Singapore, Australia, Turkey, and Brazil. All others are either sideways or declining. Two—Japan and Switzerland—are declining significantly faster than the others. Note that there are no green arrows in the US column and multiple green arrows in the Chinese column. Although the rankings show the US with still lots of green.)

(If I were at my dream dinner with Ray, I would be willing to make a gentleman’s bet that his data will show China beginning to slip by 2028 based on demographics and productivity. But it would be a small bet!)

You might be tempted to consider those countries as places to invest or avoid investing. That’s not what this means. The scores aren’t intended to show economic or investment prospects. They are the weighted average of the indicators Ray Dalio believes define a country’s place in the world order. Economic indicators are part of that but so are education, internal stability, governance, etc.

Over long periods, investment prospects may be better in the strong and/or ascending powers, simply because there the wind is at your back, so to speak. That’s even more true in the leading power—of which there can only be one. That’s currently the US but our score is headed the wrong way. So, let’s look deeper at the US and its challengers.

Gradually, Then Suddenly

Ray’s rankings include a computer-generated narrative reviewing each country’s scores. I’ll quote at length from the US section. (Note: The bold is Dalio’s, not mine.)

“For the United States, the big cycles look mostly unfavorable.

“The United States is in an unfavorable position in its economic and financial cycles, with a high debt burden and relatively low expected real growth over the next 10 years (1.4% per year). The United States has significantly more foreign debts than foreign assets (net IIP is -68% of GDP). Non-financial debt levels are high (267% of GDP), and government debt levels are high (122% of GDP). The bulk (99%) of these debts are in its own currency, which mitigates its debt risks. The ability to use interest rate cuts to stimulate the economy is modest. That said, being the world’s leading reserve currency is a large benefit to the US. If this were to change, it would significantly weaken the US position.

“Internal disorder is a high risk. Wealth, income and values gaps are large (relative to countries of similar per capita income levels). Regarding inequality—the top 1% and top 10% in the United States capture 19% and 45% of income (respectively the 8th and 11th highest share across major countries). Our internal conflict gauge is very high. This gauge measures actual conflict events (i.e., protests), political conflict (i.e., partisanship), and general discontent (based on surveys).

“External disorder is a risk. Most importantly, the United States and China, which is fast-rising and the #2 power (all things considered), are having significant conflict as measured by our external conflict gauge. One example of this is that 79% of Americans today have an unfavorable view of China (up from 45% in 2018).

“Looking in more detail at the eight key measures of power—the United States has the largest capital markets and the strongest financial center among major countries. Its equity markets are a majority of the world total (58% of total market cap and 71% of volume), and a majority of global transactions happen in USD (57%). In addition, the United States has the strongest reading on our measures of technology and innovation among major countries. A moderately large share (13%) of global patent applications, a large share (27%) of global R&D spending and a large share (27%) of global researchers are in the United States.

“The United States also has the strongest position in education among major countries. The United States has a large share of the world’s bachelor’s degrees (18%). On years of education, the United States is good—students have on average 14.1 years of education vs 11.7 in the average major country. PISA scores, which measure the proficiency of 15-year-old students across countries, are around average—495 vs 483 in the average major country.”

This is a mixed bag. The US has strengths in innovation, education, and financial markets. But offsetting those are our serious debt problem along with what Ray calls “internal disorder.” We have very high wealth and income gaps along with deep political/social divisions. Ray characterizes the US as “a strong power in gradual decline.”

Assuming for a moment this is right, much depends on how gradually the US declines. Large powers decline much more slowly than people imagine. Right now, we are still clearly on top. That could change if the current trend continues. But will it change next year? 2030? 2050? Hard to say.

But remember, we’re talking about relative power. So the US rate of descent is only half the equation. The rate at which challengers gain power is equally important.

The closest challenger is China. Here is how the Dalio model currently evaluates China.

“Based on the latest readings of key indicators, China appears to be a strong power (#2 among major countries today) in rapid ascent. As shown in the table below, the key strengths of China that put it in this position are its infrastructure and investment, its importance to global trade, its high level of education, its innovation/technology, its high economic output, and its strong military. The eight major measures of power are somewhat strong today and are, in aggregate, rising rapidly. In particular, China’s importance to global trade, its innovation and technology, and its relative position in education are increasing.”

That seems pretty impressive. Looking more closely at the determinants, though, shows China losing ground in key metrics including debt burden, external threats (mainly the US), and cost competitiveness. Remember, too, Ray’s data is almost a year old now. A lot happened in 2023 and I suspect China’s position will be worse in Ray’s next update.

On the other hand, no other power appears remotely close to challenging the US and China. India and Indonesia are rising but both have a long way to go. World power seems to be a two-contestant race. (Or two sets of allies?)

The thing to remember is this race has no predefined end date. The present balance could persist for years. The US might arrest its decline or China might lose momentum. One or the other could have some kind of crisis that leads to a quick, Soviet-style collapse. Nothing is off the table, especially as we analyze the other cycles we have been studying!

My own view is that China has much deeper problems than are apparent in the data. I think Xi Jinping had a chance to forge a hybrid system balancing entrepreneurship with more government involvement than is normal in the west. “Capitalism with Chinese characteristics,” it was to be called—a powerful force Deng Xiaoping unleashed decades earlier. But when push came to shove, Xi is choosing state control over the country’s entrepreneurs.

That will leave the US and China in an uneasy relationship in which we’re simultaneously each other’s rivals, customers, and key suppliers. This should gradually change as both countries try to disentangle their web of connections. The “reshoring” and “friend-shoring” trends, in which previously outsourced production comes home or at least closer to home, will continue. (I talked more about that with Ed D’Agostino this week in a video we’ll send to you soon.)

But I also remember the Hemingway line about bankruptcy: It happens “gradually, then suddenly.” I have long thought—and Dalio’s data confirms—our debt situation would prove deeply problematic. I can imagine several scenarios where it goes critical very quickly. In the next few weeks, we will be looking at the US debt crisis, which Dalio is also recently focusing on to a greater extent.

That might or might not be a favorable situation for China. But I’ll bet we find out sometime in the next 5‒10 years.

Dalio’s Latest Thinking

Ray is prolific. He writes often and publishes everywhere, especially on LinkedIn. Here are some of his recent comments. First, he talks about his view of the current US internal disorder:

“When the causes that people are behind are more important to them than the system, the system is in jeopardy. So you have fighters on both sides who [do not want compromise because] it’s considered weak. And if you are in the middle, you’ll have to pick a side and fight. There’s the loss of the middle. What we need right now in my opinion is a strong middle. You need a strong middle, but you also have a political system where you have two parties. And because of those two parties, there’s a tendency to become more and more extreme.

“[After describing the benefits of a strong middle] …But in order to do that, you need a platform of the middle. You need a spokesman, I think, that draws people away from the extremes toward the middle.

“If you did have a third political party, and I’m not saying that’s practical, but I would say then you could have a platform and then you could have somebody that you could look at or candidates that say, ‘I am for the middle.’ And that would help to neutralize [the extremes]. Because otherwise history has shown you go to greater and greater extremism and then you have the battle. And I think that that’s what we should be afraid of most is that those extremists in a battle having a type of civil war, which I think there’s a reasonable chance of.”

And in his LinkedIn piece on external war, he writes (his bolding):

“When Hamas attacked Israel, like when Russia attacked Ukraine, there was a classic, irreversible transition from the pre-hot-war part of the cycle (when talking is possible) to the hot-war part of the cycle (when there is bloody fighting that goes on until one side achieves total victory over the other side). As I explain in my book, as a principle, ‘people dying in the fighting is the marker that almost certainly signifies the progression to the next and more violent civil war stage, which will continue until the winners and losers are clearly determined.’ It is unlikely that this Israel-Hamas war will be limited to Israel and the Gaza Strip and likely that it will continue until one side clearly wins over the other. It is also likely that the wars involving Israel, Hamas, Ukraine, and Russia will have big effects on the ongoing great power conflicts, and it is very likely that Hamas acted with support from more powerful countries.

“In other words, we should recognize that these two hot wars (the Israel-Hamas war and the Russia-Ukraine war) are not just between the parties directly involved in them—these wars are part of the bigger great power conflicts to shape the new world order—and they will have big effects on the countries who are allies and enemies of the four sides in these two seemingly irreconcilable wars. These two wars will cost the allies of these countries a lot. For example, the US is now fighting proxy wars in Europe and the Middle East while preparing for war in East Asia. As these wars spread, they will cost more.

“Fortunately, the progression toward a world war between the biggest powers (the US and China) has not yet crossed the irreversible line from being containable (which it is now) to becoming a brutal war between the biggest powers and their allies. If these major powers do have direct fighting with each other, in which one side kills a significant number of people on the other side, we will see the transition from contained pre-hot-war conflicts to a brutal World War III.”

Give Ray his due for being blunt. Neil Howe, George Friedman, and Peter Turchin all allude (some more than others) to their views of cycles ending in wars. It is NOT a pretty picture. After we look at the coming US debt crisis, we will then spend some time summarizing these views. Not fun, but critically important unless you want to keep your head in the sand.

Join Me for a Webinar!

The webinar we did last Thursday was very well received and attended. I will do another this next Thursday, October 19, at 6 pm ET. We will of course discuss energy, price movements, where we are in our drilling process, oil and gas production, and so much more, and answer your questions! You can register at the link following these disclosures.

Important disclosures: Note that John Mauldin’s association with King Operating is completely separate, legally and financially, from his involvement with Mauldin Economics. The opportunity presented above by John Mauldin in TFTF is not endorsed by Mauldin Economics, ME Research LLC, or any of its other partners nor do any of them have any financial or other interest in the described venture.

John Mauldin will be receiving significant financial benefits from investments made in this venture by investors. More specifically, as chief economist of King Operating, John is entitled to receive consulting fees as well as a significant interest in the fund’s general partner.

This opportunity is offered by King Operating and it is limited to accredited investors. Prospective investors should carefully review the offering memorandum and risks disclosure before proceeding.

Please register here to join in and watch the webinar. This will be fun and informative, and you want to be there!

New York, Dallas, and My New Book

Today I am flying to New York for a series of meetings and dinners. I will fly back home Wednesday. The next planned trip is to Dallas for Thanksgiving with my family, though others are in the talking stage.

My (and Tiffani’s) new book, Eavesdropping on Millionaires, will be physically in my hand in a week or so and in bookstores in early November. I am looking forward to that. It is a series of interviews with millionaires before the Great Recession, five years after, and then we follow up earlier this year with how they fared during the 2020 Covid crisis. Lots of data and really fun stories as we get to know them, how they made their money and how they kept it (or didn’t).

I am proud of the book. It is a quick read and will make a wonderful gift for friends and family (especially your kids beginning their journey). The pre-orders make a difference in the bestseller rankings, so thanks if you can!

Source: Eavesdropping on Millionaires

We hope you find it as fascinating as we did! Thanks for buying now if you can!

Starting in about a week, Dorado Beach (where I live in Puerto Rico) becomes really fun. It is party season when you get to meet a lot of friends and neighbors. We will do our own annual black-eyed peas and Texas chili party on New Year’s Day which draws a nice-sized crowd.

And with that it’s time to hit the send button. I’m looking forward to spending Sunday afternoon with my partners Olivier Garret and Ed D’Agostino where we have LOTS to talk about. I know that my writing on cycles will be a topic of dinners and conversations. I’m really looking forward to the feedback. I also enjoy your comments and really pay attention to them! Have a great week and don’t forget to follow me on X. (I’m getting more active there.)

Your starting to worry about the Great Reset analyst,

John Mauldin

STAY INFORMED! Receive our Weekly Recap of thought provoking articles, podcasts, and radio delivered to your inbox for FREE! Sign up here for the HoweStreet.com Weekly Recap.

John Mauldin October 15th, 2023

Posted In: Thoughts from the Front Line