May 24, 2024 | De-Dollarization: The Trend Continues

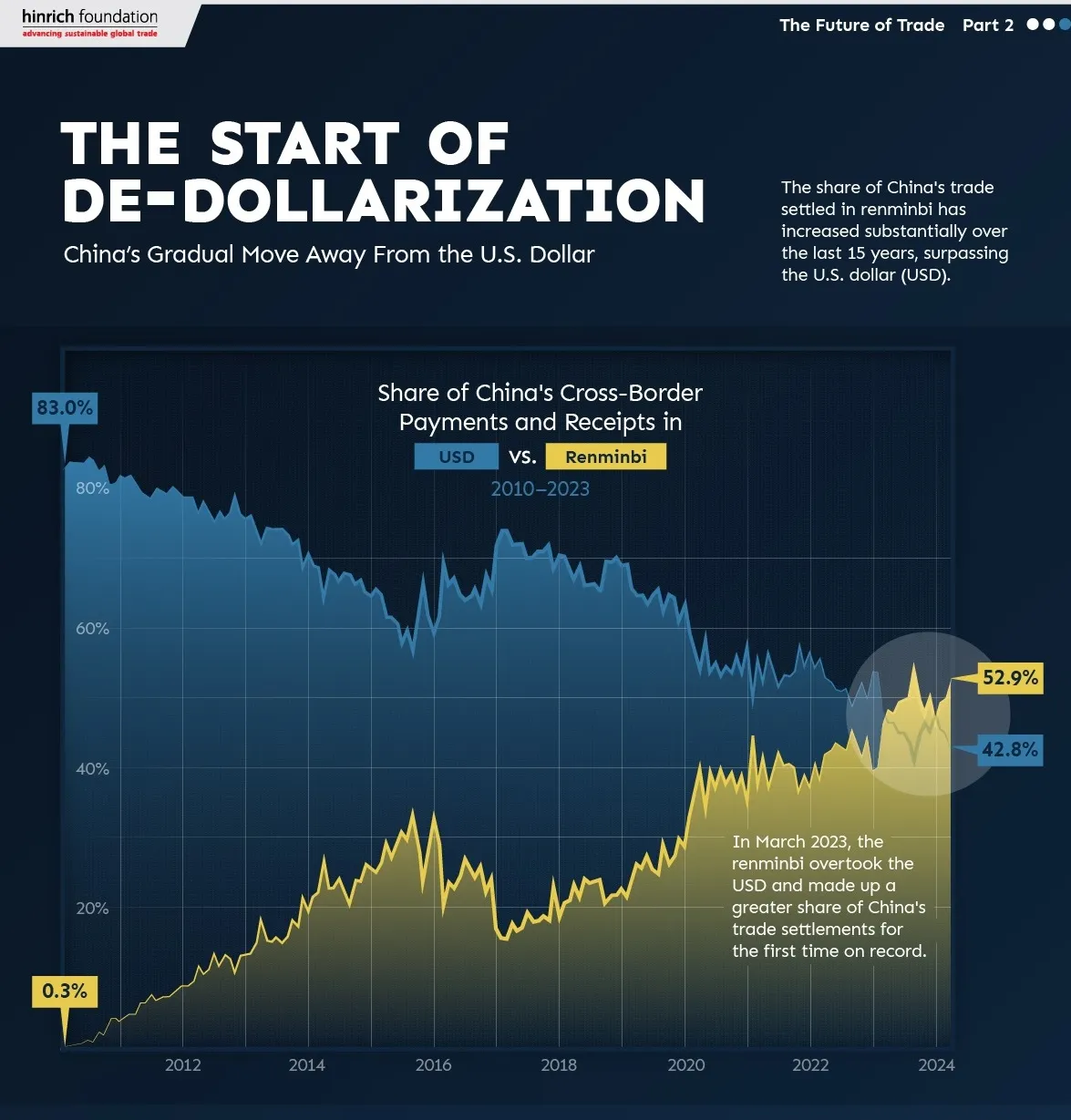

Big parts of the world continue to migrate away from the US dollar. And lately the process has met some important milestones.

Russia Confiscates €800 Million From Deutsche Bank, Unicredit And Commerzbank

(Zero Hedge) – After two years of being on the receiving end of a weaponized global reserve currency, getting booted from SWIFT, countless (toothless) sanctions and watching some $350 billion of its assets be frozen and soon confiscated, Moscow has had enough, and over the weekend the FT reported that a St Petersburg court seized around €800 million worth of assets belonging to three western banks – Deutsche Bank, Commerzbank and UniCredit.

The seizure marks one of the largest moves against Western lenders since Moscow’s invasion of Ukraine prompted most international lenders to withdraw or wind down their businesses in Russia. It comes after the ECB told Eurozone lenders with operations in the country to speed up their exit plans.

Russia, China team up against the US dollar with planned blockchain payment system

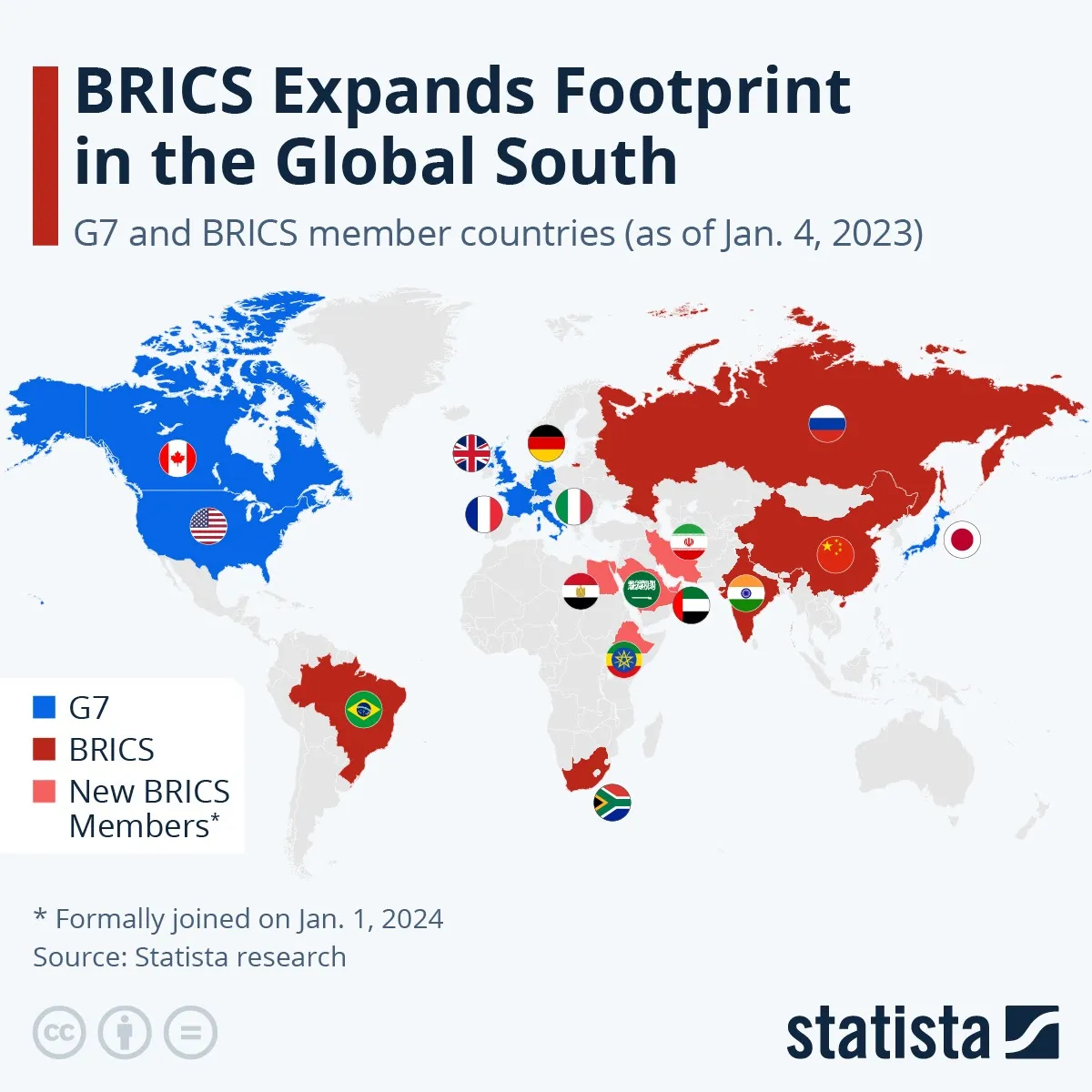

(Fox Business) – The BRICS bloc of countries led by China and Russia are moving ahead with their efforts to move away from the U.S. dollar with an announcement that they plan to create a payment system based on blockchain.

The five-nation BRICS group, which also consists of Brazil, India and South Africa, will work on creating a payment system based on blockchain and digital technologies, Kremlin aide Yury Ushakov said in an interview with Russian agency TASS late Monday.

“We believe that creating an independent BRICS payment system is an important goal for the future, which would be based on state-of-the-art tools such as digital technologies and blockchain,” Ushakov said.

He said the payment system’s major aim is to decrease the BRICS nations’ dependence on the U.S. dollar and to develop the Contingent Reserve Arrangement (CRA), an agreement among the BRICS’ central banks for mutual support during a sudden currency crisis. The CRA is generally seen as a competitor to the International Monetary Fund (IMF).

China offloads record amount of dollar assets

(RT) – China sold a record number of US bonds in the first quarter of this year, highlighting the country’s shift away from dollar assets, the latest data from the US Treasury Department reveals.

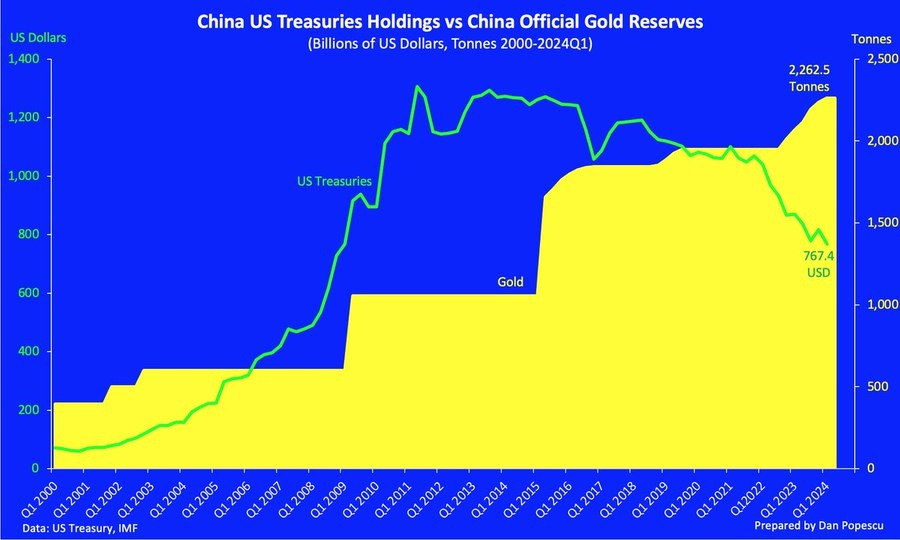

Beijing has divested a total of $53.3 billion in Treasuries and agency bonds combined in the first three months of the year, while at the same time increasing its purchases of gold and other commodities, data showed.

“The handling of Russian reserves by the US and other G7 countries, including threats of expropriations and sanctions, likely prompted China to reduce its exposure to US Treasury assets to avoid being similarly targeted,” Craig Shapiro, a macroeconomic adviser at LaDuc Trading, told Newsweek on Saturday, referring to the seizure of Russian assets.

Four Charts

China continues to swap its US Treasuries for gold:

The BRICS coalition continues to expand, as new members (like Saudi Arabia!) join:

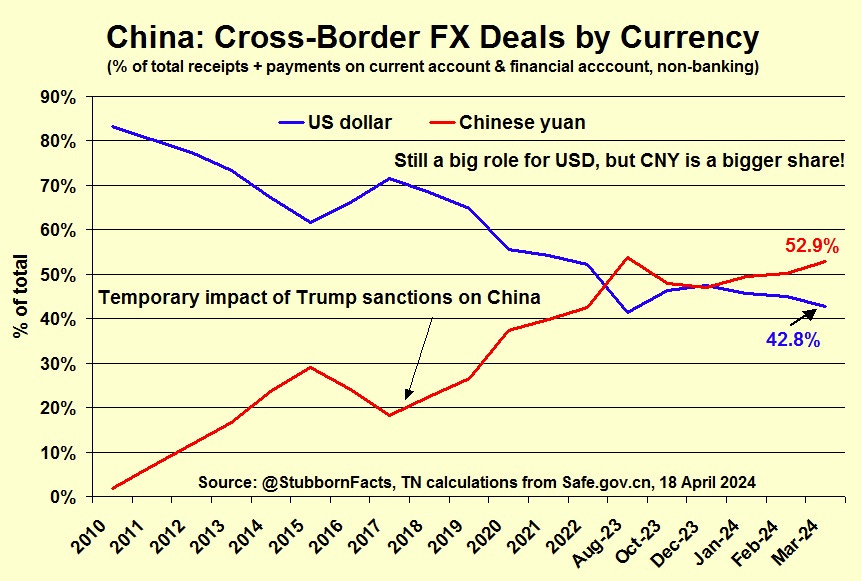

Last year, for the first time, more of China’s cross-border transactions were in renminbi (aka yuan) than dollars:

Here’s the same trend, visualized another way:

Two More Articles

UAE Completes First Cross-Border Digital Dirham CDBC Payment Worth $13.6M to China

The United Arab Emirates (UAE) has successfully completed the first cross-border payment using the Digital Dirham.

This historic transaction of AED50 million ($13.6 million) was sent by Sheikh Mansour bin Zayed Al Nahyan, chairman of the board of the Central Bank of the UAE, to China.

The cross-border payment was facilitated through the “mBridge” platform, a collaborative effort of the BIS Innovation Hub, four founding central banks including the Hong Kong Monetary Authority, Central Bank of the United Arab Emirates, Digital Currency Institute of the People’s Bank of China and Bank of Thailand, and over 25 observing members.

The program aims to transform wholesale cross-border payments using a multiple-central bank digital currency (multi-CBDC) common platform underpinned by distributed ledger technology (DLT).

Iraqi parliament calling to ditch US dollar for oil trade

(Cradle) – The Finance Committee in the Iraqi parliament made a statement on 31 January calling for the sale of oil in currencies other than the US dollar, aiming to counter US sanctions on the Iraqi banking system.

“The US Treasury still uses the pretext of money laundering to impose sanctions on Iraqi banks. This requires a national stance to put an end to these arbitrary decisions,” the statement said.

“Imposing sanctions on Iraqi banks undermines and obstructs Central Bank efforts to stabilize the dollar exchange rate and reduce the selling gap between official and parallel rates,” it added.

The Finance Committee affirmed its “rejection of these practices, due to their repercussions on the livelihoods of citizens,” and reiterated its “call on the government and the Central Bank of Iraq to take quick measures against the dominance of the dollar, by diversifying cash reserves from foreign currencies.”

Slowly, Then All At Once

De-dollarization is still in the “slowly” part of the process, but several pieces are falling into place”: A growing amount of trade is happening in non-dollar currencies, more countries are joining the BRICS coalition, and those countries are accumulating more gold.

There’s no telling when this becomes a real threat to the current dollar-centric global financial system, but the trend is clearly in that direction.

STAY INFORMED! Receive our Weekly Recap of thought provoking articles, podcasts, and radio delivered to your inbox for FREE! Sign up here for the HoweStreet.com Weekly Recap.

John Rubino May 24th, 2024

Posted In: John Rubino Substack