March 5, 2024 | Sheltering in Place

Happy Monday Morning!

As expected, the Bank of Canada held rates firm last week, pushing back on a growing chorus of market pundits calling for rate cuts. “The assessment of the governing council is that we need to give higher interest rates more time to do their work.”

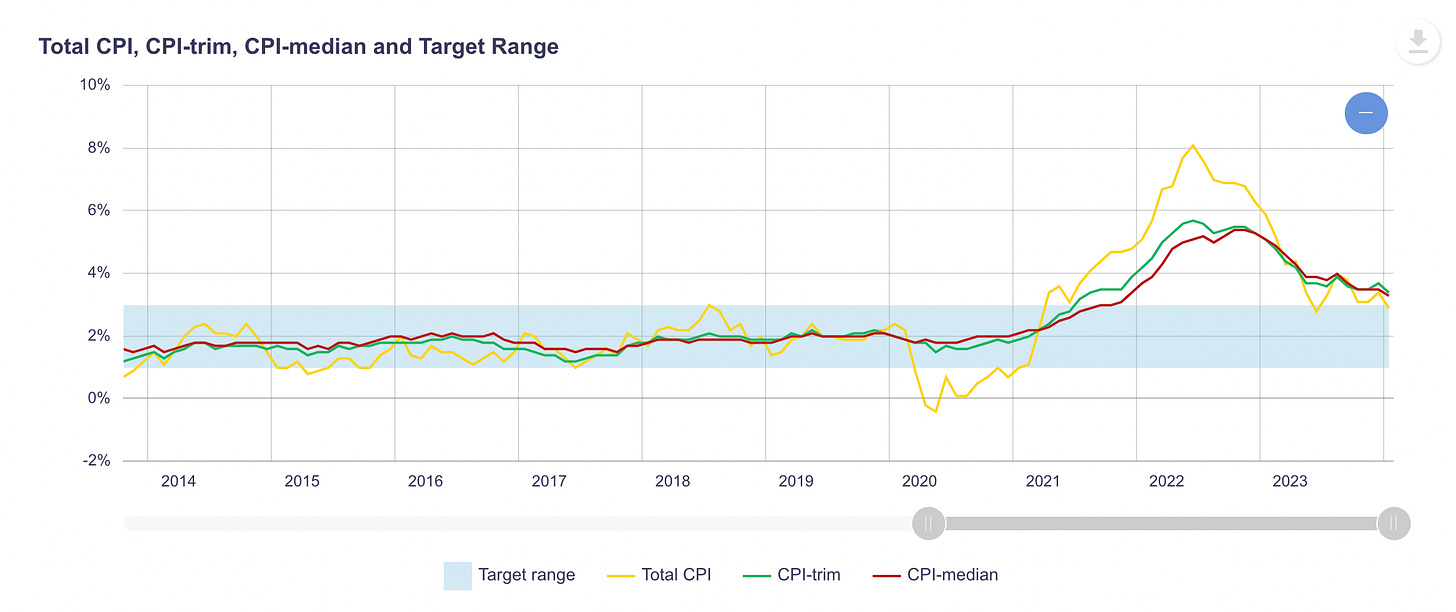

The persistence of core inflation north of 3% remains a concern for Macklem and co.

“The council is still concerned about risks to the outlook for inflation, particularly the persistence in underlying inflation.”

“Recent inflation data suggest monetary policy is working largely as expected. But future progress on inflation is expected to be gradual and uneven, and upside risks to inflation remain. Governing Council needs to see further and sustained easing in core inflation.”

So here we are, in what feels like a repeat of 2023. Lots of chatter around rate cuts coming into the year, an early spike in housing activity, only for the sugar rush to fade, and the rate cuts to be pushed further out.

This is quite the conundrum.

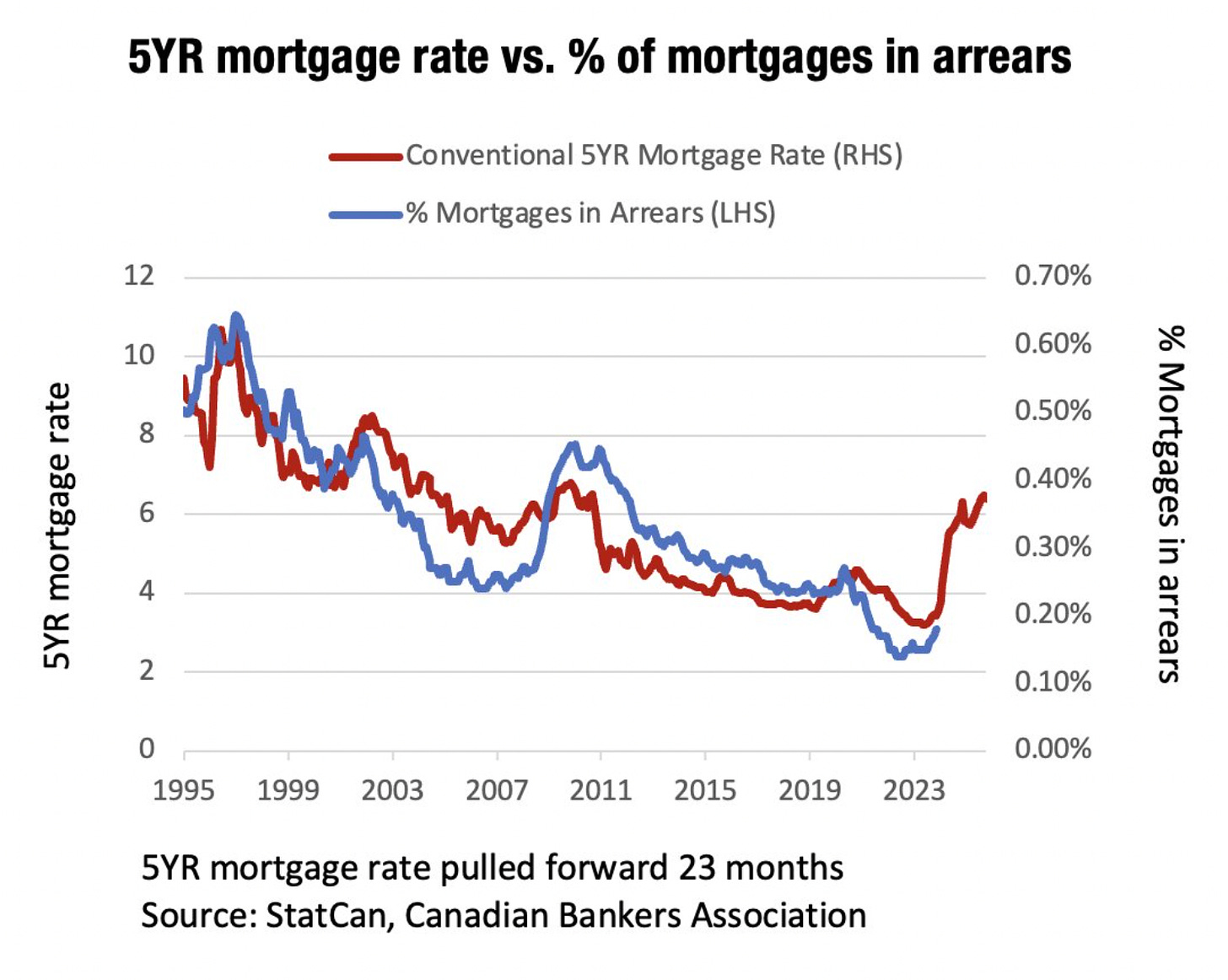

It’s been exactly two years since this rate hiking cycle began, and it appears the poison is finally sinking in.

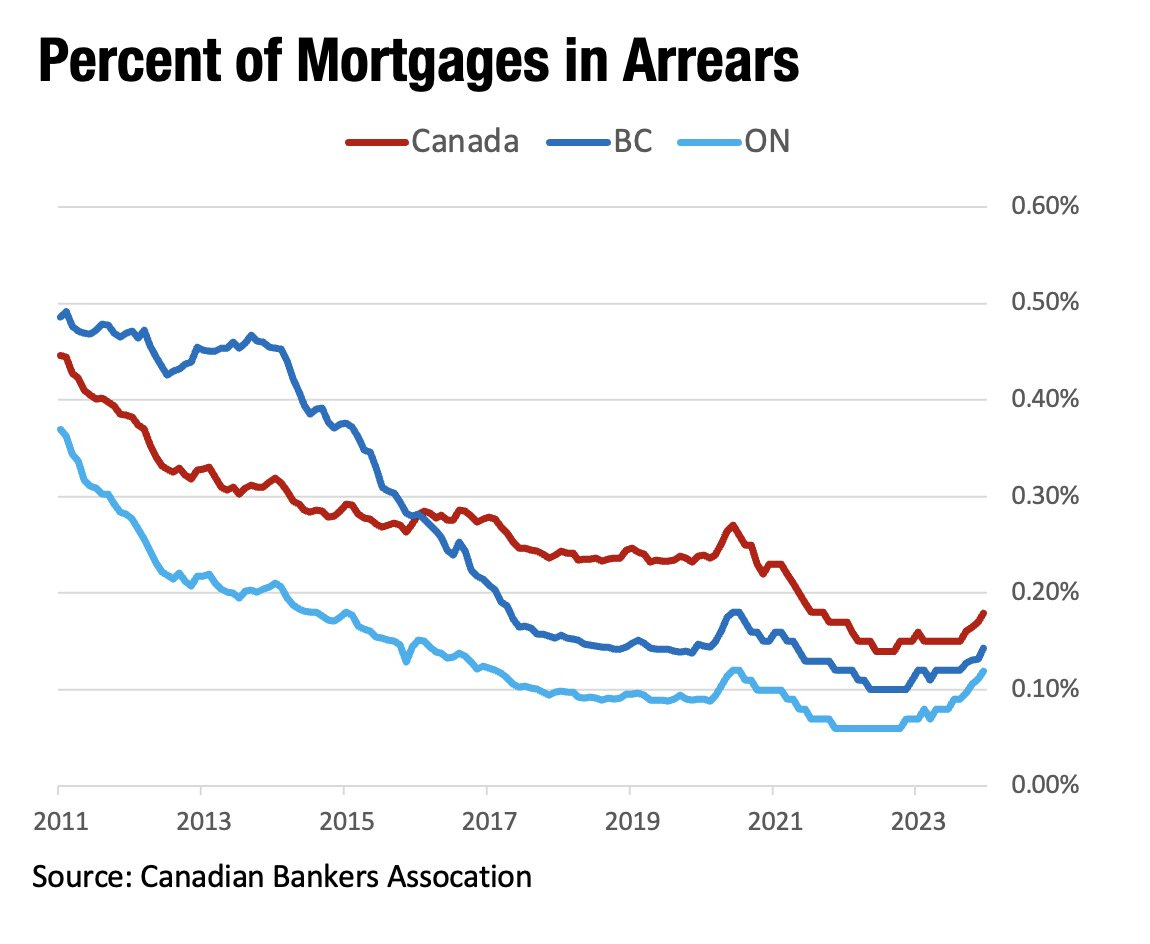

Mortgage delinquencies are surging. They’re up 135% in Ontario and 62% in BC. Yes it’s true they are coming off all time record lows. This is not a catastrophe by any stretch. There are 5 million residential mortgages in Canada, 10,000 of which are delinquent. The national arrears rate sits at 0.18%.

However, that doesn’t mean we should be ignoring the rate of change here. We know Canadians are struggling with rising mortgage payments, you can see this in bank earnings where amortizations are growing and at some banks upwards of 15% of their book is negative amortizing (ie the balance is growing!).

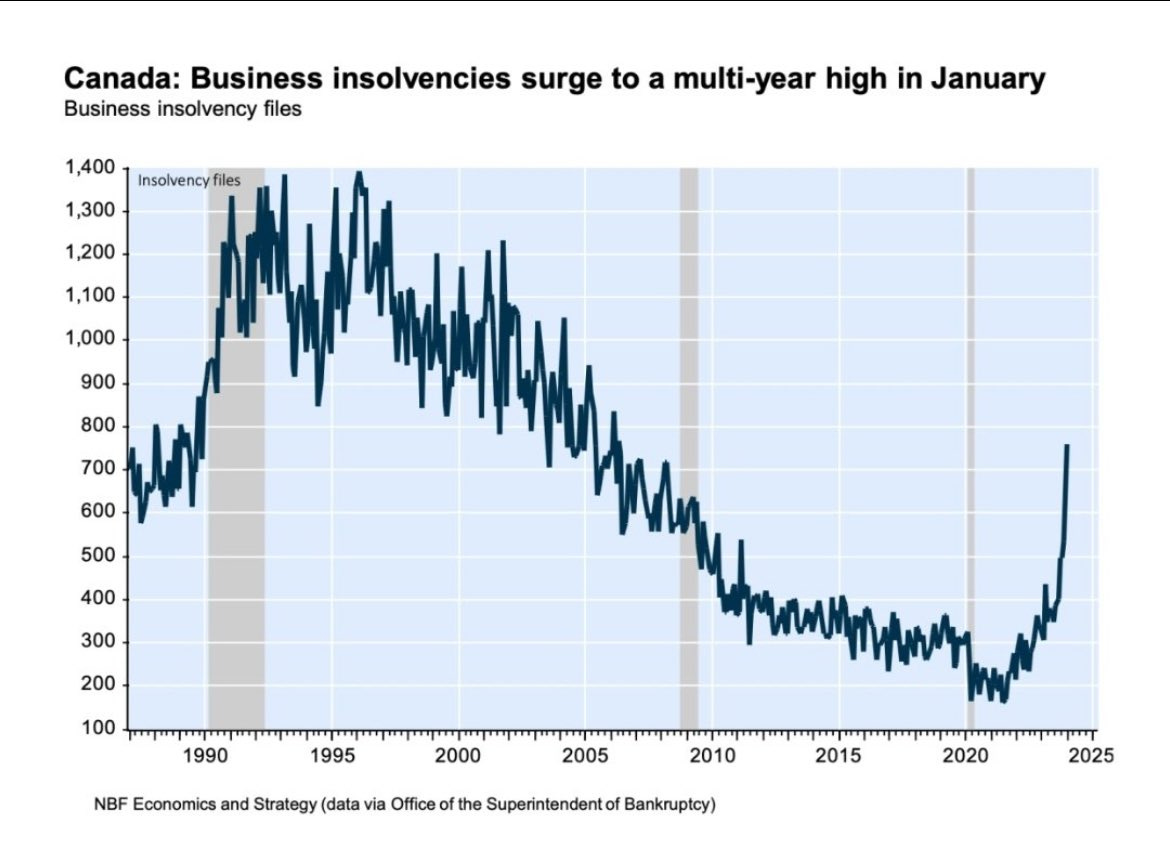

Canadians will do whatever they have to do in order to keep their house, including cost cutting everywhere else. I think this partly explains the surge in business insolvencies, which are now running at their highest levels since 2006!

Too early to cut rates? Are we sure about that?

Real GDP per capita has been falling for six consecutive quarters, household debt service ratios are at record highs, mortgage delinquencies are rising at an alarming pace, business insolvenices surging, and the labour market isn’t adding enough jobs to keep up with population growth.

The Canadian economy is choking on higher interest payments and its finally starting to show up in the data. The longer rates hold here, the more mortgage delinquencies shall rise.

Remember, nearly 50% of Canadian mortgage holders have not seen a payment increase yet!

How does this all translate for the housing market? Prices in nearly every market are higher today than they were a year ago! The cost of living is incredibly burdensome so people are just sheltering in place. Sales and new listings remain well below normal levels. This suppression of inventory has kept prices firm despite significantly higher mortgage rates. You can see the same thing in the rental market, tenants don’t move anymore because they can’t afford to give up their rent controlled home. Turnover rents were up more than 30% last year in Vancouver & Toronto (per CMHC).

Hunker down and live to fight another day appears to be the mantra.

Eventually something has to give, but not today.

STAY INFORMED! Receive our Weekly Recap of thought provoking articles, podcasts, and radio delivered to your inbox for FREE! Sign up here for the HoweStreet.com Weekly Recap.

Steve Saretsky March 5th, 2024

Posted In: Steve Saretsky Blog