Eleven years of near-zero interest rates (2009-2022) drove record debt and consumption, with a manic over-allocation to expensive real estate. Then, online shopping and work-from-home collapsed demand for commercial and office space, and central banks embarked on the most aggressive rate-tightening cycle in more than 40 years.

As central banks hold tight, the highly leveraged economy is starting to reap what has been sown by years of deleterious financial behaviours and business models. As I wrote in Private Equity, “genius”: lever, gut, destroy:

It’s not just that consumers are encumbered by weak wage growth and crushing debt, nor is it just the rise of e-commerce taking sales away from bricks and mortar stores. It’s also that yield-starved investors plowed indiscriminately into this sector …while private equity raiders worked their usual ‘genius’, buying up majority stakes and levering up the balance sheet to suck out cash, leaving the emaciated businesses to implode on workers, landlords, taxpayers and the other investors.

A particularly heinous example of the destructive playbook is examined in The Plundering of America’s Hospitals. When hospitals sold off their land, investors got rich. Patients paid the price:

“…private-equity firms have profited while gutting a critical piece of America’s infrastructure, even on deals that turned out to be financial catastrophes for the hospitals and their communities.”

Also, see Private Equity Wants Your Credit Card Debt. And Car Loan. And Mortgage. The private credit craze is spreading to asset-based lending and the consumer. Awesome. Of course, we learned in the 2007-09 subprime meltdown that packaging risky debts and selling them as investment-grade to individuals and institutions is a recipe for disaster.

Along with individuals, pension funds have increasingly shifted capital from the safest, most liquid assets to riskier, illiquid holdings and funds concentrated around real estate and credit. See Canada’s largest pensions bet big on commercial real estate — now offices are emptying, and valuations are crashing:

“… hybrid work and online retail — are here to stay, says Peter Norman, chief economist at Altus Group, a real estate analytics consultancy.

“There’s going to be a lot of sorting out over the next decade or so,” said Norman. “There are millions of square feet of functionally obsolete office space in Toronto alone. That’s a structural issue, not a cyclical one.”

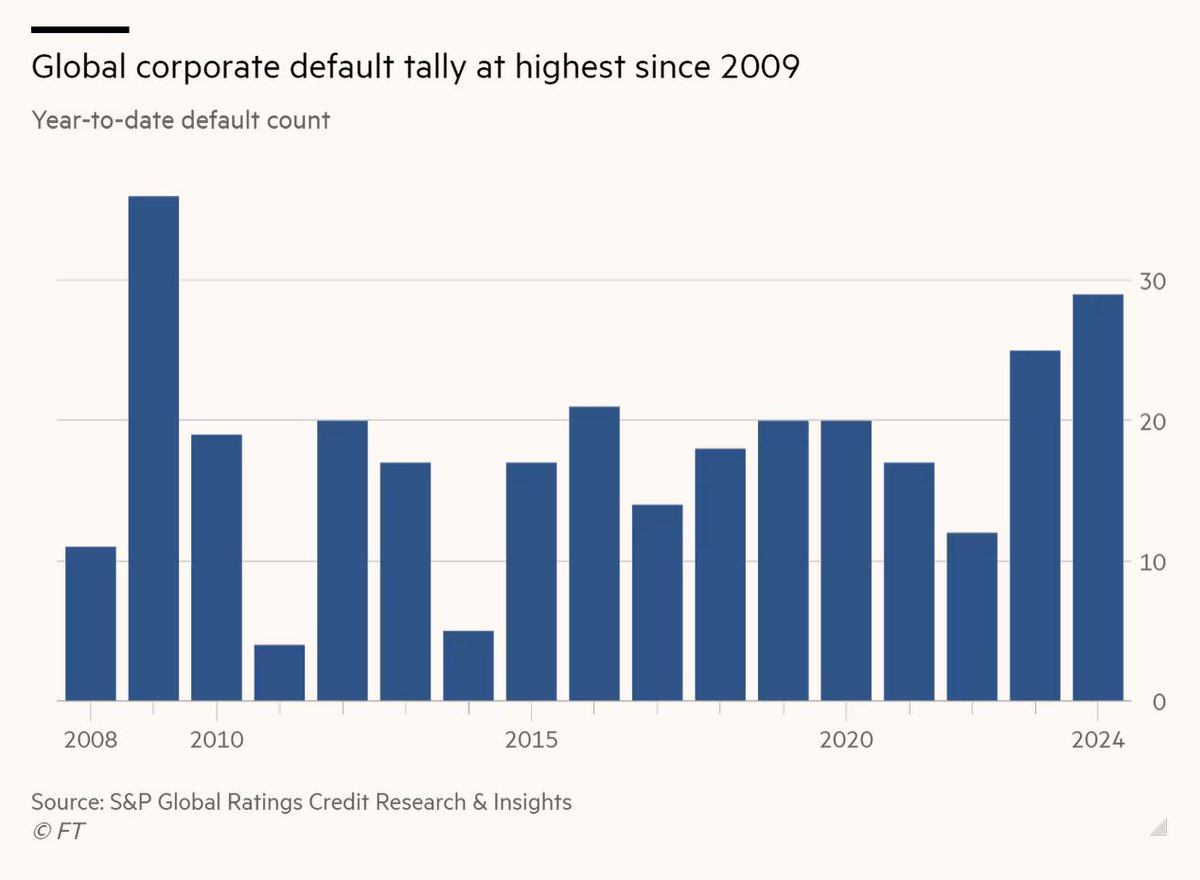

2024 has started with the highest corporate defaults globally, since 2009 (shown below, courtesy of The Financial Times).

Trillions in debt taken out when rates were unusually low are up for renewal this year and next.

We are at the point in the cycle when fewer hours worked, and rising layoffs accelerate the unemployment rate and the need for cash drives liquidation selling across most asset markets. Maybe this time will be different.