The cash S&P 500 index closed green for 10 of the last 11 weeks, registering an All-Time High weekly close

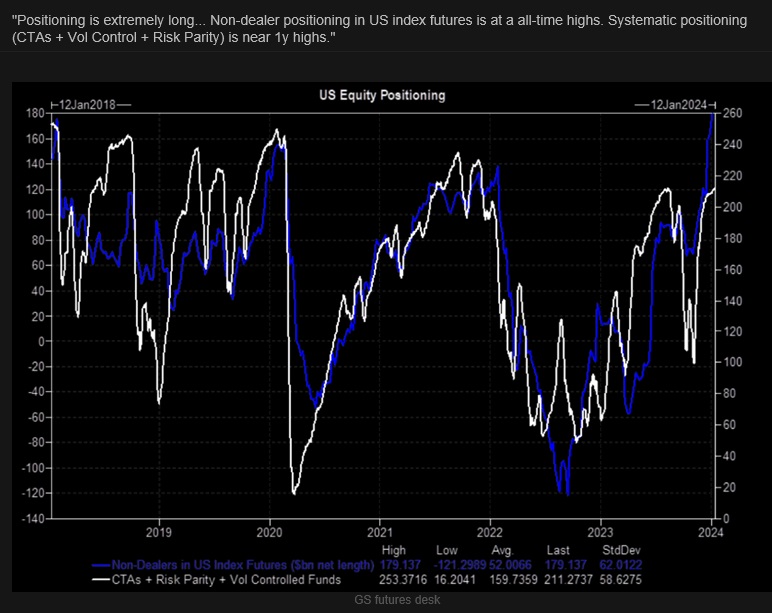

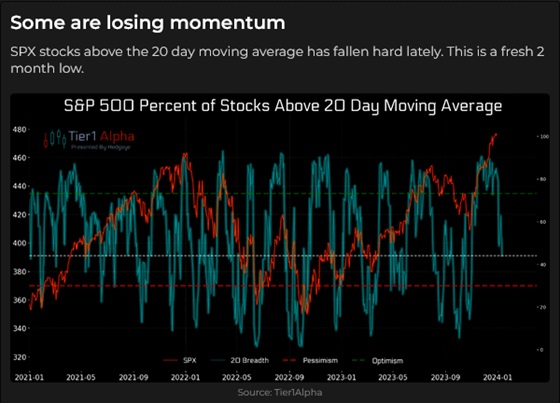

Stock market sentiment and positioning are very bullish.

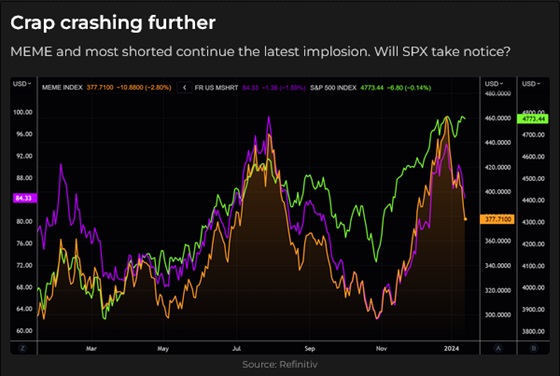

Capital has flowed to “quality” stocks and away from unprofitable or “meme” stocks YTD.

MSFT closed this week at an All-Time High with a market cap of ~$2.89 Trillion – eclipsing AAPL as the global market cap leader.

Meanwhile, the Shanghai Stock Index closed at a 4-year low in China.

Interest rates

Stock markets seem unperturbed by rising geopolitical tensions, focusing instead on lower inflation expectations and (thus) lower interest rates. Interest rate futures are currently pricing an 80% chance of a 25bps cut by the FOMC in March, with 3-month rates falling to ~3.6% by December 2024. The FOMC meets on January 30/31 and may provide clues on their outlook.

Red Sea geopolitical stress ramps up

American and British attacks on Houthi targets in Yemen in response to their attacks on shipping in the Red Sea prompted price spikes in gold (~$40) and crude oil futures (~$3)) but the gains were not sustained.

The net speculative long positioning in Comex gold futures as of January 2 was the largest since April 2022 (following the Russian invasion of Ukraine) and is only slightly lower this week. Gold’s failure to sustain a rally on bullish news (The US and UK attacks on the Houthis) may be a bearish signal for gold prices.

Peter Ziehan explains why the US and UK attacks on Yemen may not be a trigger for a much wider mid-east conflict in this 7-minute video.

Currencies

In mid-November, net short speculative positioning in the Canadian Dollar (large and small speculators combined) was the largest it had been in ~7 years. (Circle on the chart.)

This large speculative position was built up as the CAD fell ~4 cents from July to November – and as the US Dollar Index rallied for 13 of 15 weeks with markets believing that the Fed would be “higher for longer.”)

Over the next eight weeks, as the CAD rallied, that positioning was unwound, and as of January 9, speculators were slightly net long (with small speculators accounting for ~110% of that position.)

The CAD rallied from the end of October to the end of December as the US Dollar fell against most currencies and as stocks and bonds rallied hard on expectations that the Fed was done raising interest rates and would soon start cutting rates.

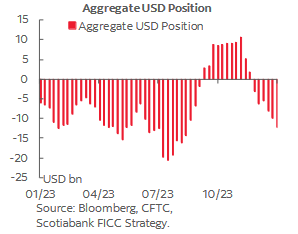

Not surprisingly, the aggregate USD position, as measured against the major currencies traded in the CME futures market, became increasingly short as the USD fell from late October to late December.

Speculators have remained resolutely net long the Euro (the Anti-dollar) since the big turning point in September 2022 when the EUR hit a 20-year low against the USD.

On a 4-year lookback, the combined large and small Euro spec positioning switched from net short to net long at the onset of the COVID crisis in March 2020 (small circle on the chart) and has stayed net long ever since – except for the period between mid-July and mid-September 2022 (big circle on the chart) when combined large and short specs went net short the Euro (they sold the lows.)

On a 10-year lookback, the largest net long Euro spec positioning was held in August 2020 – when the US 10-year Treasury yield hit a historic low of 0.50%.

The Commitment Of Traders Report (COT)

I started looking at COT data 30 years ago when I got to know Steve Briese, who wrote a weekly letter, The Bullish Review, about trading markets based on the positioning of the various participants in the futures market. (Steve later wrote a book, The Commitments of Traders Bible, that I highly recommend.)

The way I understood the COT data years ago was that the commercial accounts were usually better informed about the markets they traded than the speculators were. The commercials also had “deeper pockets” and could afford to “accumulate” positions from speculators who sold into falling markets or bought into rising markets.

The general advice (as I understood it) was to “go with the commercials.” I had difficulty using the COT data years ago because my trading time frame was “too short” relative to the commercial time frame. I was also aware (and Peter Brandt has made this point several times) that the commercials were sometimes wrong, and if/when they capitulated, the speculators won big time.

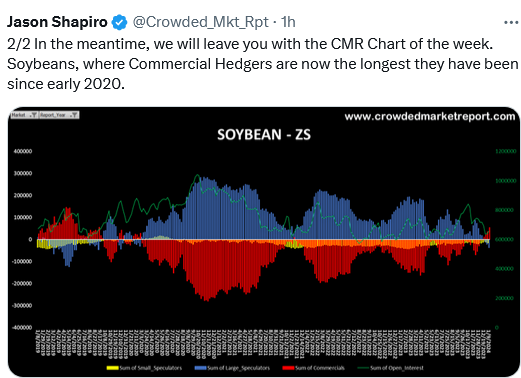

For the past several years, I’ve looked for good and timely COT data and last year, I found the Crowded Markets Report by Jason Shapiro. I read about Jason in Unknown Market Wizards by Jack Schwager in 2020 and liked his contrarian approach to markets, so I subscribed to his service. Jason has several YouTube videos where you can learn about his approach to markets. He has a Substack site, and his Twitter/X address is: https://twitter.com/Crowded_Mkt_Rpt

A word of advice on using COT data: It is not for day traders. Here’s a Twitter/X post from Jason yesterday – he’s looking at Soybeans with a 4-year time horizon.

Energy markets

Spot uranium hit $100/pound this week, a 16-year high. Cameco shares are 10X from their 2020 low and have doubled in the last 12 months. Supply is short, and leading mining companies are having production problems. Capex cratered following Fukushima, and even though some shutdown mines are being rejuvenated, uranium looks like a classic supply/demand problem. Here’s a link to a uranium article by Goehring & Rozencwajg (I subscribe to their service and recommend them.) Here’s a link to a uranium report by Canaccord Genuity, a leading Canadian securities firm.

NYMEX Natural Gas prices have jumped ~50% in the last month on weather-related concerns and have nearly recovered the losses they suffered in November when supply overran demand.

NYMEX WTI can’t seem to get up “off the mat” since the steep sell-off from September through December.

For an excellent (free) weekly summary of oil and gas markets, I highly recommend the Eye on Energy report written by my good friend Josef Schachter. His paid subscription service provides in-depth coverage of publicly traded energy shares. Josef and I will speak at the World Outlook Financial Conference at the Bayshore Hotel in Vancouver on February 2 & 3, 2024.

I subscribe to and highly recommend Doomberg and Robert Bryce for a global macro perspective on energy markets.

My short-term trading

For the past few weeks, I’ve been thinking that the rallies in stocks, bonds and currencies on the belief that the “Fed is done and will slash interest rates in 2024” had gone too far too fast. I shorted CAD and gold near the end of 2023 and covered those trades for decent gains last week. I was flat at the end of last week, and this week, I waited for the bounce back in bullish enthusiasm to run out of steam.

I shorted the S&P on Thursday and was ahead by ~35 points on the trade, but it rallied back, and I covered for a tiny loss.

I re-shorted the S&P on Friday, shorted the CAD, and held those positions into the long (Martin Luther King) weekend.

The COT data and other sentiment and positioning information I look at lead me to believe that speculators are chasing this rally, so I’m trying to catch a turn. That may mean a few small losses before I catch a turn, and there may never be a turn, which also may mean a few small losses. (For instance, NVDA and MSFT look like a classic upside breakout.)

On my radar

The “stay independent” party won the Taiwan election, and Biden is sending some high-level folks to meet to congratulate them, so tensions with China may be in the news.

Italy promised some aid for Ukraine but tied that to “diplomatic efforts” to end the war. I suspect there will be more pressure on Ukraine to “negotiate,” and I wonder what happens if the war stops. Russia has a lot of resources that the world could use, and Russia may be keen to sell. There has been talk about “The West” turning over billions of Russian assets to Ukraine. That might be “on the negotiating table.”

To some degree, markets have been pricing in a possible contagion in the Middle East. What happens if Israel de-esclates?

The Iowa GOP primary is on Monday, and here we go with the run-up to the November elections.

Corporate quarterly reports started this week and will come thick and fast for the next three weeks.

The Barney report

The Lord of the Manor strikes a contemplative pose.