December 16, 2023 | Trading Desk Notes For December 16, 2023

Powell kicked the Everything Rally into Overdrive!

Markets were expecting “some” pushback from Jay, “We’re a long way from neutral” Powell after a sizzling 6-week stock market rally, but he waved the white flag instead, and the Everything Rally ripped higher!

The bullish rip took Dec 2024 SOFR futures to ~9630 at Thursday’s high, effectively pricing in 3-month rates at ~3.7% twelve months from now (which would require 6 x 25bps cuts from current levels.)

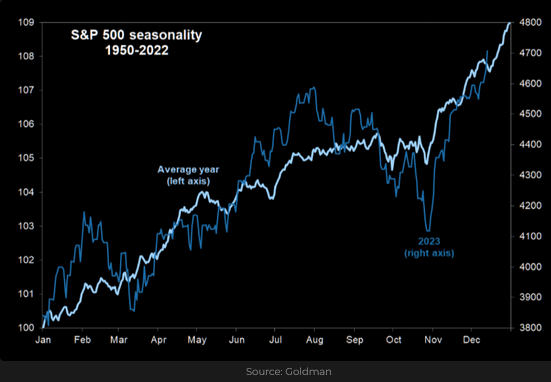

The stock market loved the idea of the Fed cutting rates – The DJIA soared to new All-Time Highs, up ~5,000 points (15.5%) in seven consecutive weeks (the longest string of consecutive higher weekly closes in six years.)

The Russell 2000 (small caps) Index had lagged behind other indices in the rally off the October lows, but it caught up with a vengeance this week, up ~24% in seven weeks compared to a gain of “only” 15% by the S&P.

The banking and home-building ETFs have surged higher on the prospect of lower interest rates. KBE is up ~38% from the October lows; XHB is up ~36% at All-Time Highs.

The 10-year Treasury futures were trading at 16-year lows in October with a cash market yield of ~5%, but they have had their best 8-week rally in years, with yields down to ~3.9% on Thursday.

The US Dollar Index fell to a 5-month low on Thursday (but bounced back a bit Friday) as the FOMC looked “dovish” compared to other Central Banks (ECB, BoE, BoC, BoM, SNB) who delivered “too early to think about cuts” messages while Norges Bank raised rates.)

Gold surged ~$50 Wednesday/Thursday after Powell surprised the markets but fell back on Friday. Gold had rallied along with stocks, bonds and currencies off the October lows but got “slammed” when it gapped higher to ATHs on a Sunday afternoon two weeks ago. Note the blue line below that charts an 18% rise in open interest throughout October and November as prices rose to ATHs (and net spec long positions rose to the highest level since April 2022 following the Russian invasion of Ukraine) and the subsequent 8% decline in open interest as buyers turned sellers as prices fell away from ATHs.

WTI crude oil futures have NOT been part of the Everything Rally. Prices hit a 13-month high of ~$95 in late September and fell to a 6-month low of ~$68 this week. Net spec long positions were the highest in September since the Russian invasion of Ukraine but have fallen ~60% as prices declined and buyers turned sellers.

The 6-month forward WTI price relative to the front month has gone from ~$10 backwardation at the September highs to a current contango of ~$1. (A decline in the front-month price relative to deferred prices is often a sign of reduced demand urgency and/or ample supply in commodity markets.)

The sharp decline in natural gas prices over the last six weeks has likely weighed upon WTI crude oil prices, given the global fungibility and arbitrage between different energy markets.

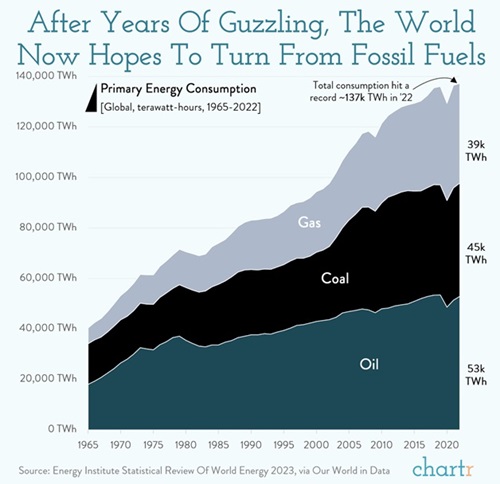

Despite all the “pledges” at COP28, I’ll bet the “over” on this chart.

For an excellent (free) weekly summary of energy markets, I highly recommend the Eye on Energy report written by my good friend Josef Schachter. His paid subscription service provides in-depth coverage of publicly traded energy shares. Josef and I will speak at the World Outlook Financial Conference at the Bayshore Hotel in Vancouver on February 2 & 3, 2024.

My short-term trading

I had cataract eye surgery last week and again this week, so I’ve been trading much less than I otherwise might have been. The mild discomfort from the surgeries was worthwhile, considering that my vision is now substantially better than before.

Taking time away from trading is an excellent opportunity to become more contemplative about trading. Knowing that I missed some great trading opportunities because of the surgeries reminds me that I’m always missing great trading opportunities – that my job is not to foresee and catch every move in the market but to properly manage the trades I choose to take.

I started this week with a long CAD position established last week. Given the substantial spec short position in the futures market, I thought the CAD would participate in the Everything Rally and might get an extra “kick” from short-covering. I was disappointed with its performance when it didn’t rally with the stock market on Monday, so I sold it for a small gain. I was concerned that thin trading conditions on the CPI report early Tuesday morning would leave markets vulnerable to “algos” running stops, and my tight stop would be hit, leaving me with a slight loss. I was also having surgery Tuesday morning, with a post-op exam Wednesday morning, so going flat seemed like a good idea.

The CPI report was a relative non-event Tuesday morning, but my stop would have been hit. The CAD “caught fire” Wednesday following Powell’s remarks and raced to 4-month highs by Friday.

I was in the doctor’s office on Wednesday for the post-op exam when Powell surprised the markets. When I returned to my desk, it was too late to chase the rally.

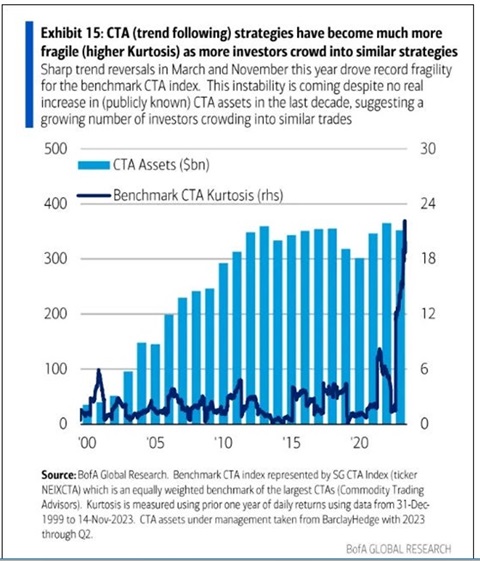

I shorted S&P futures Thursday morning when SOFR futures were pricing ~150bps of cuts over the next twelve months. The S&P had surged nearly 200 points following Powell’s remarks, making 23-month highs, but had fallen back. I thought it was overdone (being long was a very crowded trade), so I got short with a stop above the highs (a rally to new highs would negate the “overdone” idea.) I’ve stayed short into the weekend.

I shorted CAD Friday morning just below 75 cents. It had rallied nearly 150 bps since Powell’s remarks on Wednesday and was sustaining its gains as other currencies (notably the Euro) were giving back some of their Thursday gains. CAD traders were waiting for scheduled remarks from the BoC Governor (he said it was “too early” to talk about cutting rates.) I thought that was “about as good as it gets” for the CAD, so I got short with a stop above the day’s highs and stayed short into the weekend, thinking that the CAD might follow the Euro lower.

On my radar

My bias is that the markets hit peak irrational exuberance on Thursday morning when they were trading off expectations of 150 bps of Fed cuts by Dec 2024. I waited for some price action confirmation of my bias before establishing my trades. If my stops get hit, I’m wrong and I’ll take some slight losses.

There was a flurry of commentary following Powell’s remarks as to “why” he didn’t push back. It’s entertaining to speculate, but given the WIDE range of theories about why he did what he did, many people will be wrong. (There is a lot of speculation that he was motivated by political considerations, in essence, “What do you have to do to keep Trump from getting elected?”)

From a trader’s perspective, an unexpected bit of news caused another leg higher in a bull market, setting up an opportunity to fade an “exhaustion” top. (Ross Clark, my friend and an excellent technical analyst for over forty years, flagged an Exhaustion Alert in the S&P in yesterday’s report.)

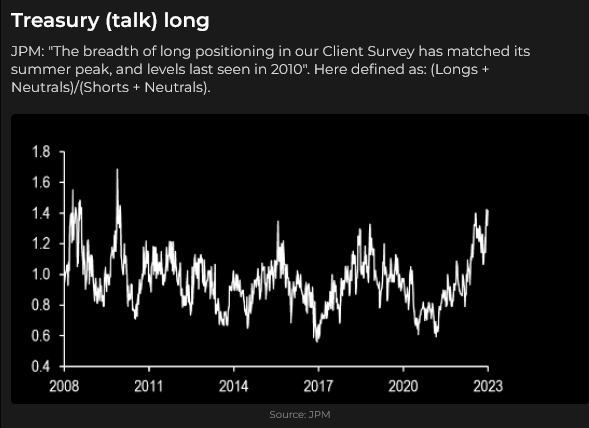

The markets are now (heavily) positioned on the idea that Central Banks are DONE raising rates; the only question is, “What’s the Delta on cutting rates?” I’m willing to place limited-risk bets that markets are hoping for too much / too fast.

My bias is that the Euro will weaken against the USD. The Eurozone economy is weaker than the US economy, and I don’t see the ECB sitting tight while the Fed cuts. (And then there’s Ukraine.) The knee-jerk reaction to sell the USD this week caused a s/t Euro rally that will fade.

Sentiment has become very “risk-on,” with people chasing and buying “lottery tickets.” I’ll be looking for opportunities to fade “animal spirits.”

I’m more interested in positioning (what’s already priced in) than forecasts of what will happen.

China has been on a roll for over twenty years. Still, I wonder if the boom times are over, given deleveraging, deflation, declining FDI, dictatorship, and wrong-way demographic trends (not enough babies.) The authorities will try to stimulate domestic consumption, but the people may be wary and decide to save their money after the lockdowns and the “disappearing” of prominent people. One-man autocratic rule stifles innovation, and innovative people will try to get their money (and themselves) out of the country before they are trapped inside.

There will be elections worldwide in 2024, starting with Taiwan in January and leading to the American Presidential elections in November. I can imagine dramatic changes in the markets I trade, and I hope to keep an open mind and be prepared to deal with what is happening rather than what I wish was happening.

Thoughts on trading

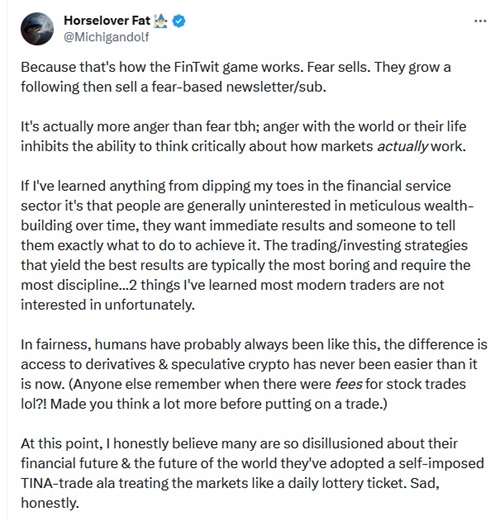

Here’s a screenshot of a tweet from Horselove Fat. I agree with a lot of what he says.

The Barney report

We didn’t have a Christmas tree in our house last year because we thought we’d have to put a fence around it to keep Barney the puppy from tearing it apart. We took a chance this year, hoping Barney would leave the tree alone. So far, so good, but he is fascinated with it.

Listen to Victor talk markets with Mike Campbell

On today’s Moneytalks show, Mike and I talked about the dramatic market reactions to Fed Chairman Powell’s remarks on Wednesday. You can listen to the show here. My segment with Mike starts around the 1 hour and 6 minute mark.

The World Outlook Financial Conference

Tickets are now on sale for the 2024 WOFC, which will be held at the Westin Bayshore Hotel in Vancouver on February 2 & 3, 2024. Click here for more information and to purchase tickets.

The Archive

Readers can access weekly Trading Desk Notes going back six years by clicking the Good Old Stuff-Archive button on the right side of this page.

Headsupguys

There’s a reason I put a link to Headsupguys in my Notes every week. I’ve had friends who took their own lives, and Headsupguys helps men struggling with depression.

Subscribe: You have free access to everything on this site. S subscribers receive an email alert when I post something new – usually 4 to 6 times a month.

Victor Adair retired from the Canadian brokerage business in 2020 after 44 years and is no longer licensed to provide investment advice. Nothing on this website is investment advice for anyone about anything.

STAY INFORMED! Receive our Weekly Recap of thought provoking articles, podcasts, and radio delivered to your inbox for FREE! Sign up here for the HoweStreet.com Weekly Recap.

Victor Adair December 16th, 2023

Posted In: Victor Adair Blog