October 28, 2023 | Trading Desk Notes For October 28, 2023

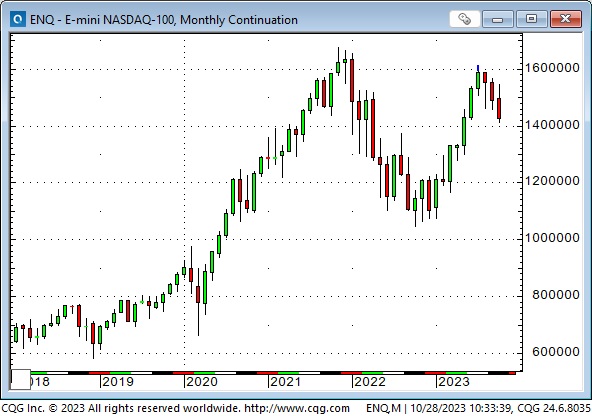

The Nasdaq had its best-ever first-half gain this year (~45%) but peaked in July and fell ~12% to this week’s lows

The Nasdaq’s “defining moment” was made on July 18 when MSFT’s market cap soared ~$100 billion in an hour on an AI announcement, taking the share price to All-Time Highs of ~$367. Within three days, those gains had evaporated. The lead for my July 22 Notes was “A turning point in sizzling tech stocks?”

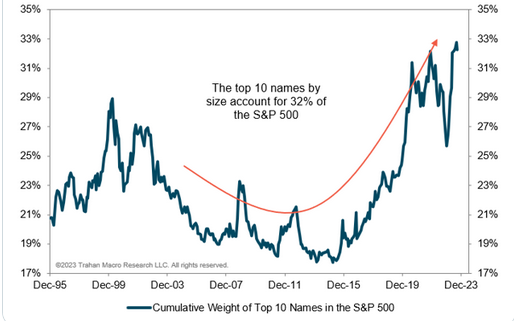

In the July 22 Notes, I went on to say, “I’ve been skeptical of the “Magnificient Seven” rally for a few months, thinking that sentiment bordered on “irrational exuberance.” However, I respected the power of the rally and patiently waited for an opportunity to fade it. I thought the “$100 Billion in an hour” surge in the MSFT market cap may have signalled a top, and when the Nasdaq dropped below Tuesday’s highs on Wednesday, I got short and remained short into the weekend. One of my favourite chart patterns (regardless of time frame) is a “lower high.” If the Nasdaq falls from this week’s high of ~1600000, it could be a great short.”

It has been a great short. Too bad I covered far too early!

AAPL is down ~16% from All-Time Highs made on July’s Key Turn Date.

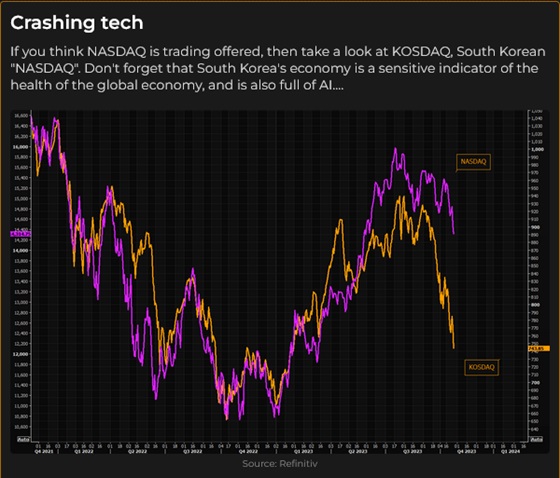

The Magnificent Seven are starting to crack, but other sectors have been hit harder. The Russell 2000 closed at a 3-year low this week, down ~19% since July.

The Dow Jones Transports are down ~19% since July.

Bank stocks have been weak. The Royal Bank of Canada (traded in USD in NY) is down ~23% since July (down ~35% from January 2022 ATH), at a three-year low.

Airlines are struggling. The JETS ETF is down ~35% since July.

The venerable DJIA is down nearly 10% from its July highs, down ~2% YTD, and closed this week at 7-month lows.

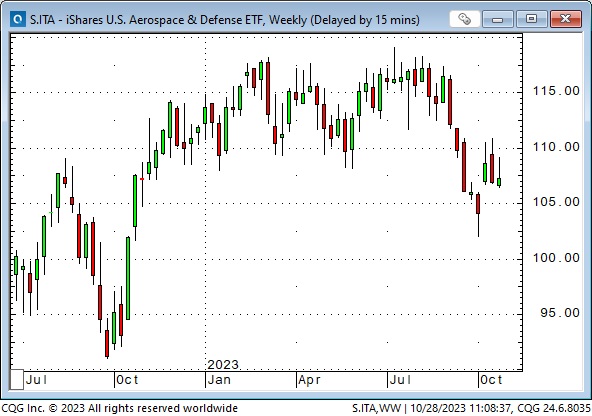

Even defence stocks are down >10% from their July highs.

Harley-Davidson, which I see as a uniquely vulnerable “consumer discretionary” play, given the monstrous shadow inventory of “slightly used” hogs sitting in suburban garages, is down ~50% from its January highs (down ~35% since mid-July) to a 3-year low.

Shares of ChargePoint Holdings, which “operates the largest online network of independently owned EV charging stations operating in 14 countries,” closed at new All-Time lows this week, down ~95% from the highs reached in December 2020.

The Bank of America contrarian Buy Signal got stronger this week as share prices fell. This is NOT a short-term signal.

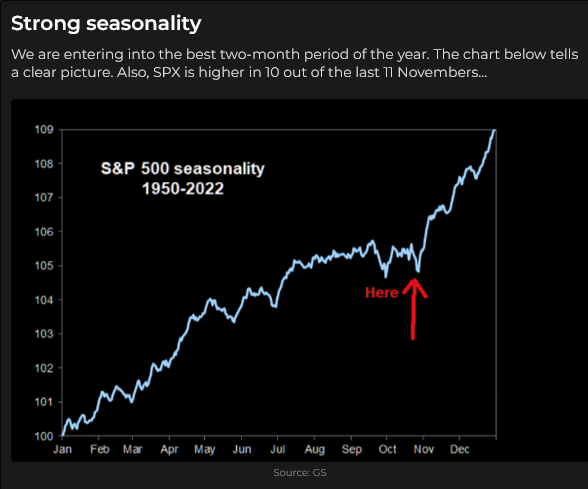

The BoA contrarian buy signal might be a bell-ringer if historical seasonality patterns kick in. (This is NOT investment advice!) Remember, bear market rallies can be nasty, and most stocks are in a bear market.

Bonds

The long bond futures made a new 16-year low on Monday but closed green on the week.

The recent surge in US Treasury yields for three consecutive years is unprecedented in American history. However, the rise looks modest compared to the 39-year tumble from ~16% in September 1981 to ~0.50% in August 2020. The 30-year fixed mortgage rate reached 18.4% in October 1981 but dropped to less than 10% by late 1989. It was ~8% this week.

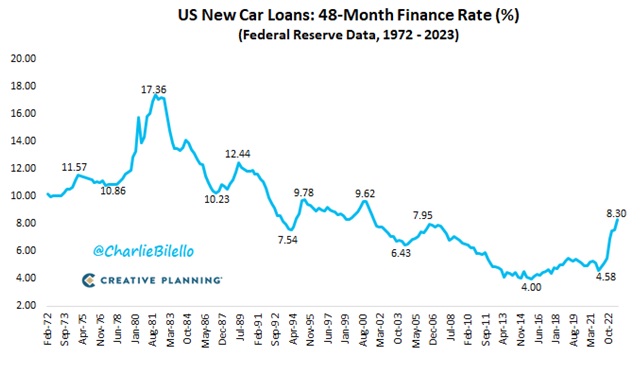

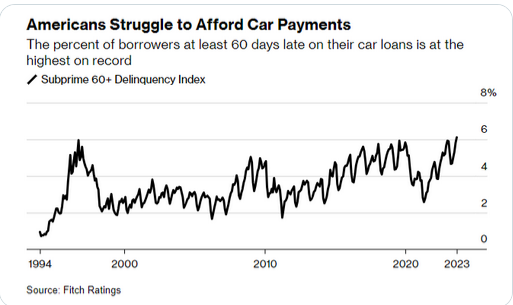

The interest rates on new car loans have nearly doubled in the last few years but are less than half the 1981 levels.

The recent sharp rise in car loan interest rates coincides with increased delinquent payments.

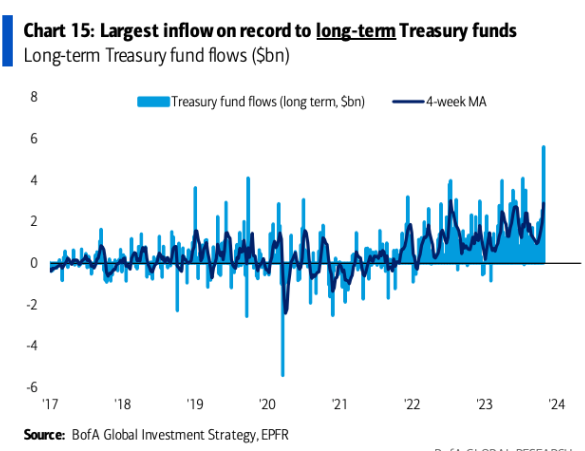

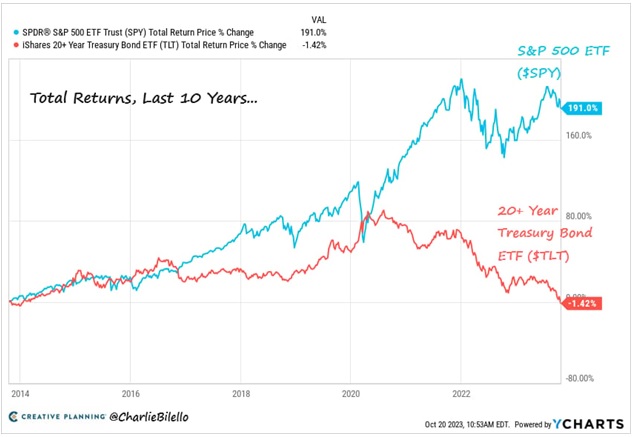

The TLT bond ETF has fallen >50% from 2020 highs, but people are buying it in size. (Note the volume bars at the bottom of the chart, and there are still two days left in October, which may see strong month-end buying.)

With a weak stock market and worrying geopolitical stress, some investors see Treasuries with ~5% yields as a safe haven ( and maybe a “bargain” relative to risky stocks.) Even Bill Ackman covered his shorts.

Gold

Comex gold futures spiked ~$30 late Friday on news that the Israeli military moved into Gaza in force. The December contract closed the week above $2,000 for the first time since July.

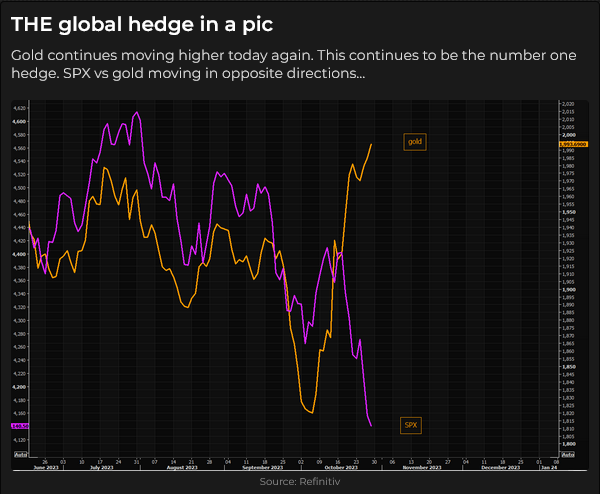

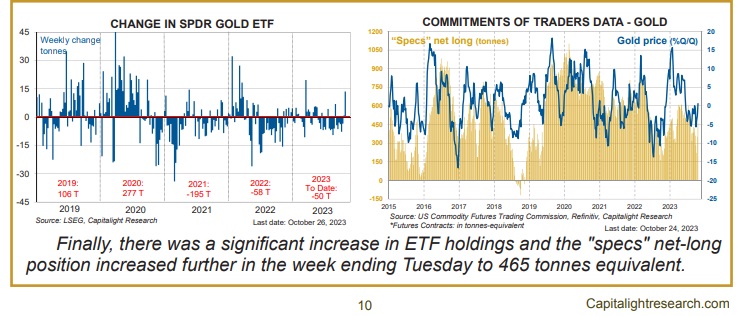

Gold is rallying as a geopolitical hedge after being “unloved” in the ETF space for most of the last three years. (These Gold Monitor charts are courtesy of Martin Murenbeeld.) Note the spike of buying this week in the gold ETF.

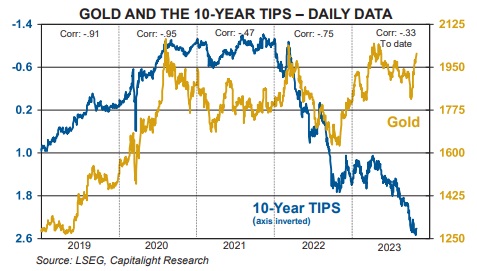

When gold and the USD rally simultaneously, markets are usually under “stress.” That has been the case over the last three weeks, but the spread between gold and real interest rates has widened. If Middle-East tensions lessen, rising real interest rates could pull gold down.

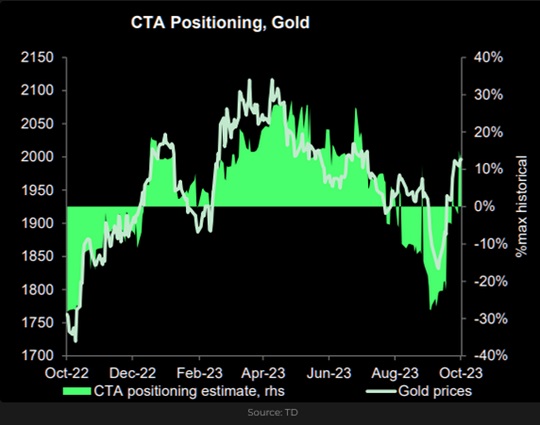

Part of the gold rally over the past three weeks has been due to speculative short-covering. That doesn’t mean gold can’t go higher; the CTAs who were recently short gold were heavily long in April and could become aggressive buyers if gold continues to rally.

Energy

WTI crude oil is not getting much of a “geopolitical stress” bid, or if it has, then those bids are being hit with “lack of demand” offers. However, if markets begin to think that the production and transport of crude from the Mid-East is at risk, then prices will spike.

Currencies

The Swiss Franc did not rally with gold this week; it closed lower against the USD and the Euro. (It had hit record highs against the Euro the past two weeks.)

The Japanese Yen is close to the 32-year low it hit in October 2022. (The Japanese authorities intervened to support the Yen last October.) The BoJ meets this week and may “tweet” monetary policy again.

The Canadian Dollar dropped to a 1-year low this week following a “dovish” Bank of Canada meeting on Wednesday. The CAD is close to 3-year lows, down ~6% from the highs made during the mid-July Key Turn Date. In last week’s notes, I wrote that Canada may be a candidate for “what breaks” due to the sharp rise in interest rates. Highly indebted consumers, faced with short-term mortgage renewals at much higher interest rates, may stress the real estate sector, a big part of the Canadian economy. Canadian bank shares are already at 3-year lows.

My short-term trading

I shorted the S&P on Thursday of last week and took profits of ~90 points on Monday when the market began to rally off intra-day lows.

I bought 1-month slightly OTM calls on the 10-Year TNotes on Thursday of this week and held the position, with a small unrealized gain, into the weekend.

I had a “busy” week, with several events/appointments unrelated to trading, causing me to “back away” from trading more actively. Sometimes life gets in the way!

On my radar

Markets are obviously “stressed” with option VOLs at multi-month highs in most asset classes, except FX.

I have no idea what will happen in the Mid-East, but it feels as though the market has priced in rising intensity, so any sign of negotiations could result in a swift re-pricing of risk assets. Any sign of a broader conflict will spike risk assets.

My first objective with my trading account is to preserve my capital, so I’m not making any bold moves.

The Fed is expected to leave rates unchanged when they announce on Wednesday, but I wonder if they might “back off” a bit on their QT program given the significant rise in bond yields and the “stress” in markets.

The Treasury refunding announcement is due Wednesday – I wonder if they will pull in the duration of their issues – sell fewer long bonds and more short-term paper.

I’m cautiously long the 10-year via call options, so I’m looking for a rally – maybe the Fed or the Treasury sparks a rally, perhaps the market starts to believe that the 4.9% Q3 GDP is a high-watermark and a recession looks more likely.

The monthly NFP report (Friday, Nov 3) is always a big deal, but if there is any sign that the labour market is weakening, bonds could catch a bid.

What I’m really looking for is enough of a bond rally to ignite some short-covering.

Shorting gold here, with existential developments in the Middle East, is like playing with fire.

A great line from Harnett at BoA this week: “Investors are impatient for a recession to inspire some de-leveraging.” My interpretation: Investors have been/will continue to punish fiscal excess.

Quote of the week: Bonds are contracts – stocks are stories. Charles Kantor. I found this quote in Kevin Muir’s latest letter, “WHEN THE MATH CHANGES,” wherein he explains why, after being a HUGE bond bear, he is now long bonds against a short Magnificent Seven position. Kevin was my lead guest when I hosted the Moneytalks show this week. You can listen here.

The greatest-ever FX trade? I’ve been considering buying the Yen against selling the Swiss Franc. Essentially, I think the Swiss authorities don’t want to see the Franc get any stronger (article in the FT this week), and the Japanese authorities don’t want to see the Yen any weaker. Here’s what the spread looks like over the last 24 years. It looks like catching a falling piano, but there’s never been a better time/price to put on the trade!

Managing risk on this trade would be tricky – I can’t help but think about traders calling the short Japanese bond trade a “Widow-maker.” It seemed like a good idea, but years passed, and it never worked! This idea could also earn that title.

The Barney report

My wife has been away most of this week, visiting friends and family, so Barney and I have been home alone together. We’ve had some great forest walks, as usual, but when you live on an island, the ocean is never far away. Here’s Barney the Sea Dog.

Listen to Victor talk about markets

I hosted the Moneytalks show this week while Mike Campbell took a much-deserved vacation. I had three great guests: 1) Kevin Muir, the Macrotourist; 2) my son Drew Zimmerman, the CEO of a TSX-listed company exploring for uranium in the Athabaska Basin; and 3) Greg Weldon, a long-time friend and fantastic macro analyst. You can listen here.

The Archive

Readers can access weekly Trading Desk Notes going back six years by clicking the Good Old Stuff-Archive button on the right side of this page.

Headsupguys

There’s a reason I put a link to Headsupguys in my Notes every week. I’ve had friends who took their own lives, and Headsupguys helps men struggling with depression.

If you or someone you know is struggling with depression, talk to them and contact headsupguys. They can help.

Subscribe: You have free access to everything on this site. Subscribers receive an email alert when I post something new – usually 4 to 6 times a month.

Victor Adair retired from the Canadian brokerage business in 2020 after 44 years and is no longer licensed to provide investment advice. Nothing on this website is investment advice for anyone about anything.

STAY INFORMED! Receive our Weekly Recap of thought provoking articles, podcasts, and radio delivered to your inbox for FREE! Sign up here for the HoweStreet.com Weekly Recap.

Victor Adair October 28th, 2023

Posted In: Victor Adair Blog