October 2, 2023 | The Naughty List

Happy Monday Morning!

The housing crisis in this country gets a lot of attention, as it should. Fixing it, however, is proving to be rather difficult. Over the past several years we have attempted to beat demand over the head with a blunt instrument. The list of policy measures include, a foreign buyers tax, empty homes tax, a speculation tax, an increased property transfer tax on luxury homes, increased property tax on luxury homes, a foreign buyer ban, and a mortgage stress test just to name a few. You’ll notice there’s a recurring theme here and it has to do with taxes. We’ll circle back on that shortly.

It turns out killing demand has proven rather challening. Especially when the feds are hellbent on maintaining current levels of immigration. Canada’s population grew by 1,050,000 in the second quarter, the highest rate of growth in a single year since 1957. So now we are going to try the supply side. According to CMHC, Canada needs about 3.5 million additional housing units by 2030 to restore affordability. But what the hell does that even mean?

It means over the next six years we need to average 583,000 housing completions per year. Over the past five years we have averaged just over 200,000 completions per year. In other words, it’s never going to happen, but we’re going to try anyways because we have to.

Governments at all levels are now ambitiously rolling out new measures to ramp up housing construction, including the removal of GST on new rental construction, provincially mandated housing supply targets, and blanket rezoning at the municpal levels. There’s just one thing standing in the way, economics.

New housing supply costs money, lots of it, and money is not only getting harder to find, but a lot more expensive. That’s largely by design as the Bank of Canada tries to kill spending to regain price stability. Monetary policy is working in direct opposition of fiscal policy.

The feds are trying to counter-act this cyclical downturn by removing GST on purpose built rental construction and handing money to municipalities who approve redevelopment. Even then, its proving not enough.

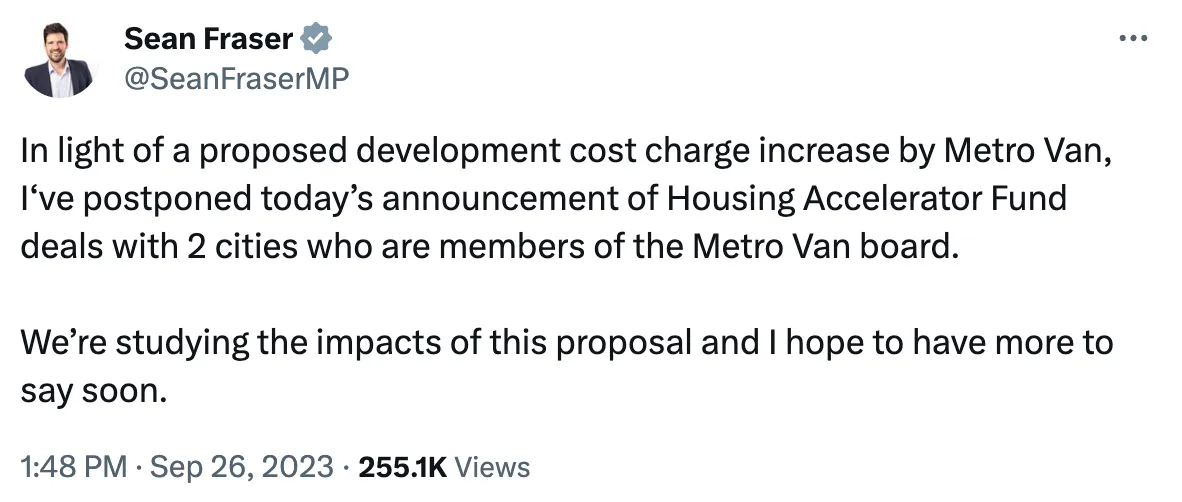

The two municipalities set to receive federal funding — Surrey and Burnaby, the second and third largest cities in B.C. by population — had applied to the federal government’s Housing Accelerator Fund, a $4-billion program “meant to remove barriers and support the development of affordable, inclusive, equitable and climate-resilient communities.”

Both cities had received letters from the housing minister saying they had received the funding, but that’s now in question due to Metro Vancouver Regional District’s proposed fee increases to help pay for upgraded infrastructure.

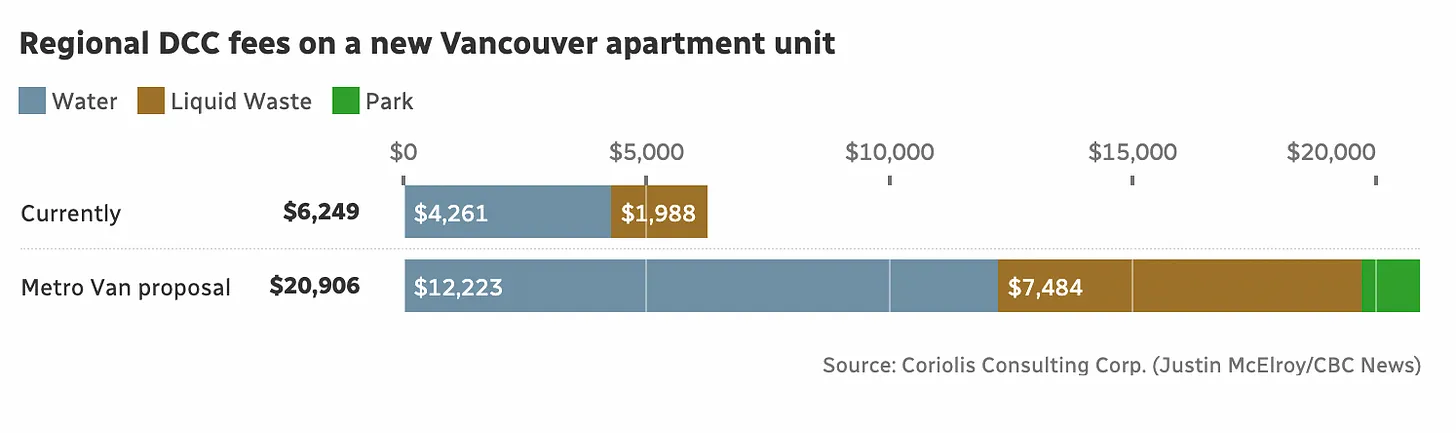

Metro Vancouver collects fees known as development cost charges (DCCs) for new residential and non-residential developments in the region.

The regional district is moving ahead on the proposed increases to DCCs, due to a desire by local politicians to reduce the rate of property tax increases projected in the years ahead.

“We have four sewage treatment plants that need to be rebuilt at the same time,” said Metro Vancouver vice-chair John McEwen.

“The taxpayer is already put to the limit. So we’ve come to the decision and realization that growth needs to start paying for growth, and that’s the only way we can move forward.”

The overall costs, once fully implemented in 2027 as planned, would be significant: an analysis by Coriolis Consulting estimated that the increased fees would cost developers an additional $11,360 to $14,657 for every new apartment unit.

In other words, municipal taxes are going to negate the benefit of the Federal Governments GST cost savings.

As we noted earlier, all levels of government are starved for tax dollars. Despite a record boom in population growth (more tax dollars), a multi-decade housing boom, and a decade of ultra low interest rates, the trough has run dry. And this is before we see the real impacts of rising interest rates pushing debt servicing costs higher and tax receipts lower.

In Canada’s two largest major metros the squeeze is on. A recent city of Vancovuer Staff report says the municipal budget is facing ‘extraordinary fiscal pressures’ and will have to raise property taxes by 9% per year over the next five years.

The city of Toronto is effectively insolvent and is proposing a municipal sales tax as part of a slew of new measures aimed at easing a projected $46.5 billion in budget pressures over the next decade, an “unprecedented financial crisis” that if left unaddressed threatens the fiscal foundations of the city.

Again this is despite a feeding frenzy of new taxes during an epic housing boom. According to research from Altus Group, the average government charges for each new single‐detached home in the GTA is roughly $186,300, or roughly 21.7% of the average price for a new home. For a new condo, the average government charges per apartment are approximately $122,800, or roughly 23.9% of the average price for a new condominium apartment.

So Governments need more taxes but are being told they must shift the tax bill away from new housing.

Perhaps they can make it up in volume?

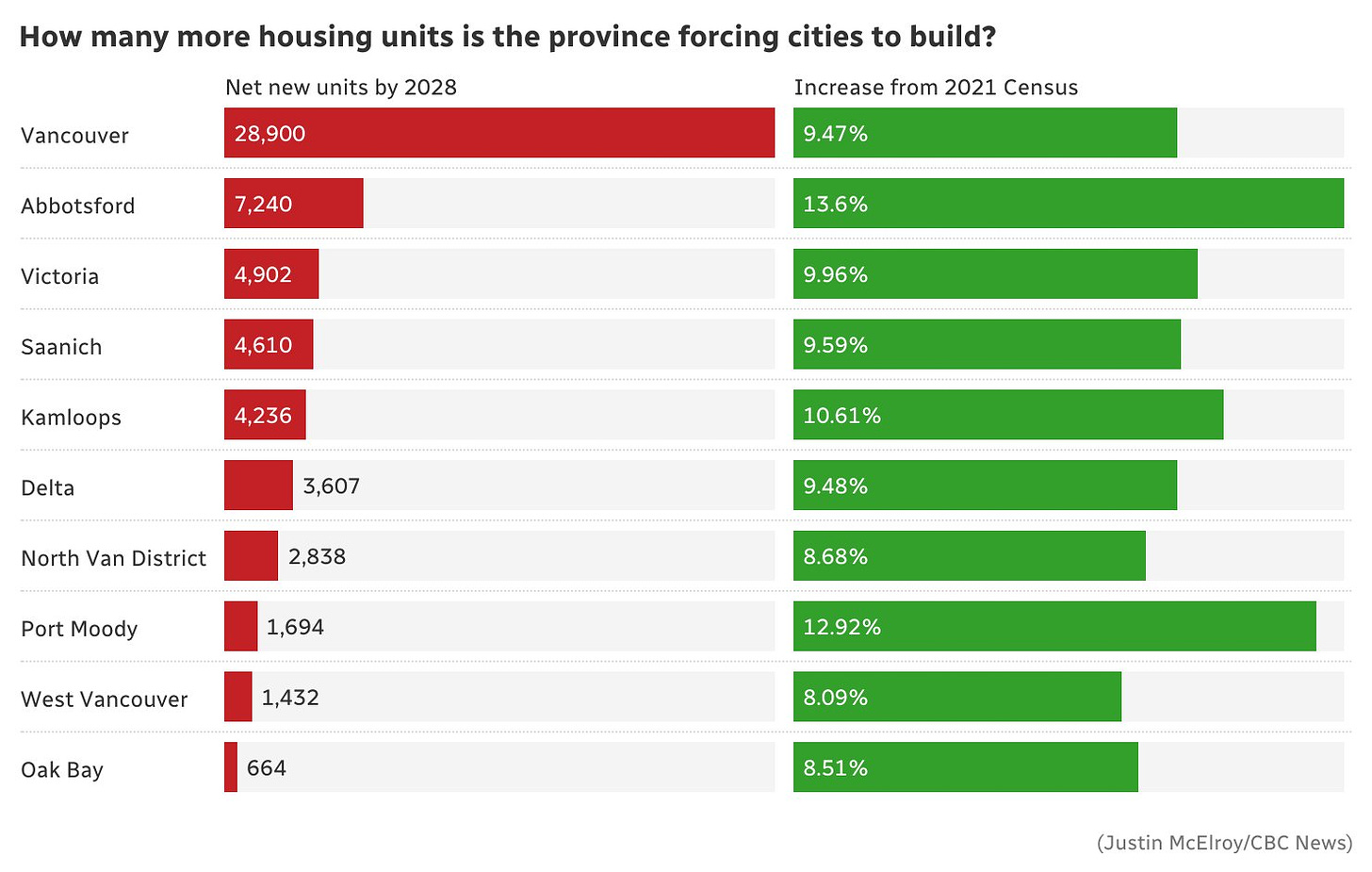

The BC Government just announced mandatory housing targets for the first 10 municipalities on its “naughty” list. These municipalities must meet provincial housing targets or risk having the province force through higher density.

While this is a great theory in concept, we must not forget about the economics. You can rezone entire cities but you still have to convince the private sector to build, which requires projects to be both financially feasible and credit worthy. You can lead a horse to water but you can’t force it to drink.

The private sector and the public sector are seemingly competing for tax dollars, ensuring a prolonged housing crisis as a recession looms.

STAY INFORMED! Receive our Weekly Recap of thought provoking articles, podcasts, and radio delivered to your inbox for FREE! Sign up here for the HoweStreet.com Weekly Recap.

Steve Saretsky October 2nd, 2023

Posted In: Steve Saretsky Blog