June 23, 2023 | Which Of These Currencies Will Collapse First?

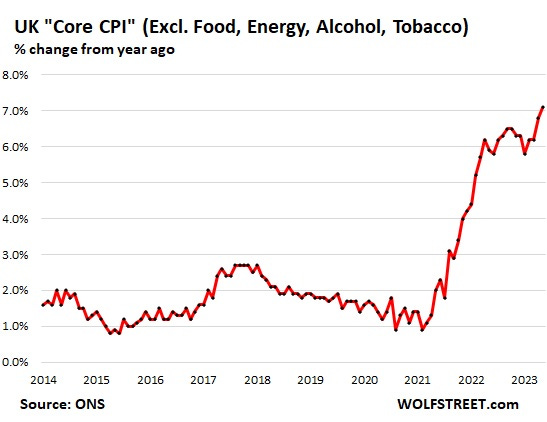

Inflation was supposed to moderate this year. But in the UK, EU, and Japan that’s not happening. Here’s the UK…

… the EU…

Euro rallies after ECB raises rates and inflation forecasts

European policymakers now expect core inflation to average past the 5% mark, while in March projection this forecast was only at around 4.6%. The strength of the jobs market, and the stickiness of services and housing prices keep ECB officials alert and prepared for a further rate hike in July… and maybe another one in September.

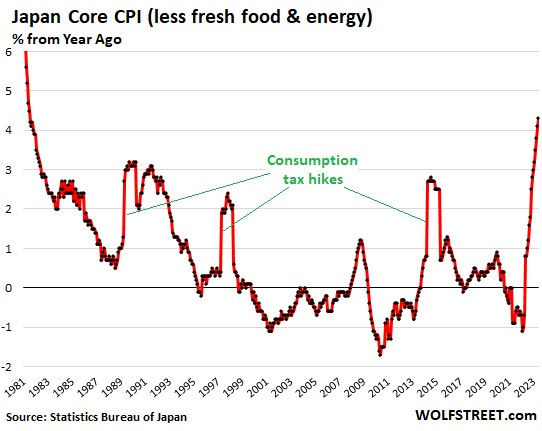

… and Japan:

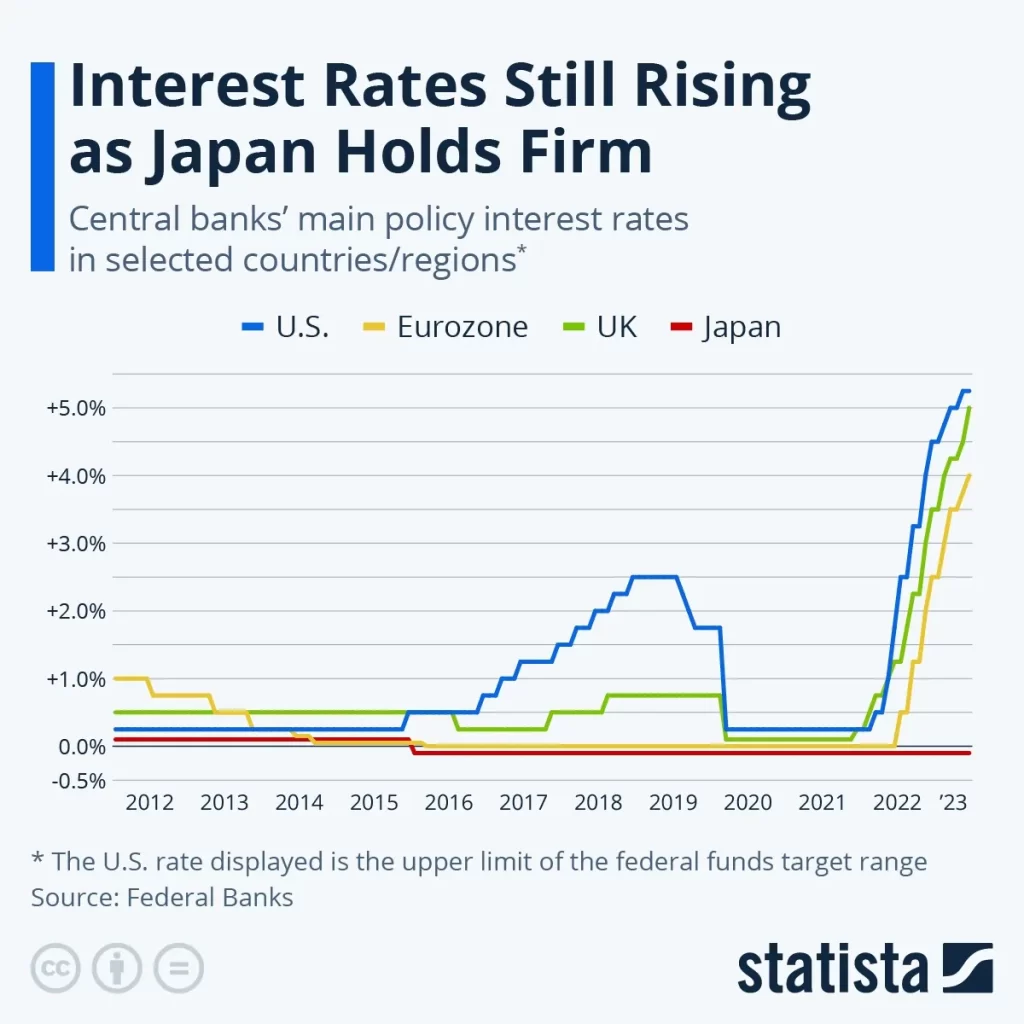

In response to their misbehaving price indexes, the Bank of England and European Central Bank have both raised interest rates aggressively, bringing them into line with the US at 4 or 5 percentage points higher than a year ago.

But Japan, despite existing in the same world as those other overindebted economies, is running a very different kind of monetary policy. As the following chart illustrates, the US, UK, and EU are attacking inflation while Japan is acting like rising prices don’t matter and deflation is the more serious threat.

Fascinating real-world experiment

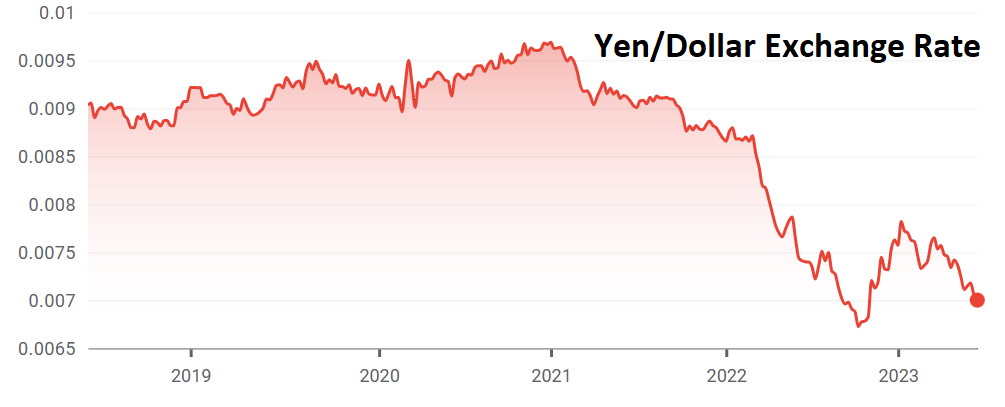

In general terms, the countries with soaring interest rates are pursuing price stability at the risk of destroying their banks, insurance companies, and pension funds. Japan, meanwhile, is using low interest rates to fight the deflationary impact of a rapidly aging population and insanely high government debt — at the risk of a currency crisis as capital pours out of the yen and into higher-yielding dollar and euro-denominated paper.

The result is a fascinating real-world monetary policy experiment comparing two diametrically-opposed responses to resurgent inflation. The tighteners are pulling money out of the system, while Japan is pumping money into it.

Who’s right? The short answer is that in a world this over-leveraged, there are no “right” answers, only different kinds of monetary disasters. The countries with soaring interest rates and rapidly tightening money will see their financial sectors blow up as debts are refinanced at ever-higher rates and interest costs bankrupt entire sectors — followed by massive government bailouts of everyone in sight and a return to easy money and soaring inflation.

Japan will see the yen’s decline continue until it becomes disorderly, at which point the BoJ either tightens and blows up its economy or just gives up on the whole national currency thing.

The yen goes first

As for the question in the title of this post, the yen will face increasing pressure as the gap between national interest rates widens. Which makes it the more timely short candidate. But in the end, it may not matter. Both monetary policies will fail and all four of these currencies will plunge, just at different rates.

STAY INFORMED! Receive our Weekly Recap of thought provoking articles, podcasts, and radio delivered to your inbox for FREE! Sign up here for the HoweStreet.com Weekly Recap.

John Rubino June 23rd, 2023

Posted In: John Rubino Substack