June 29, 2023 | Until Something Breaks…

There’s a sense among some investors — or at least among some commenters on finance-oriented podcasts — that the current equities bull market will never end because [fill in your preferred variation on “the Powers That Be won’t let it end”].

This kind of frustration is understandable. A thing that shouldn’t happen has been happening for such a long time that it’s easy to envision a powerful “they” at work and in control.

So it might help to know that the previous two cycles behaved just like this one, with interest rates rising but stocks rising even faster, in an improbable but seemingly inexorable dance. A dance that ended catastrophically for stocks.

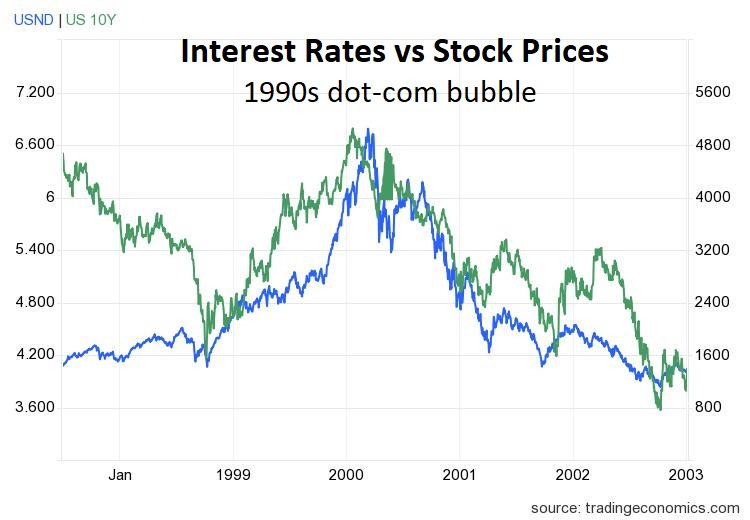

The dot-com bubble

Let’s start with the dot-com bubble of the 1990s. In the following chart, the blue line is the NASDAQ index of tech stocks and the green line is the US 10-year Treasury note yield. In late 1998, interest rates (the green line) plunged, and stocks took off. Then stocks and rates rose in tandem for a while — during which time a big part of the investing community concluded that the Powers That Be would keep the bull market going forever, thus justifying literally any price for the hottest dot-coms.

But in 2000, rising interest rates choked off the liquidity that fueled the bubble, and stocks tanked. The NASDAQ fell from 5000 to 1200 between early 2000 and mid-2002, with many dot-coms plunging to zero.

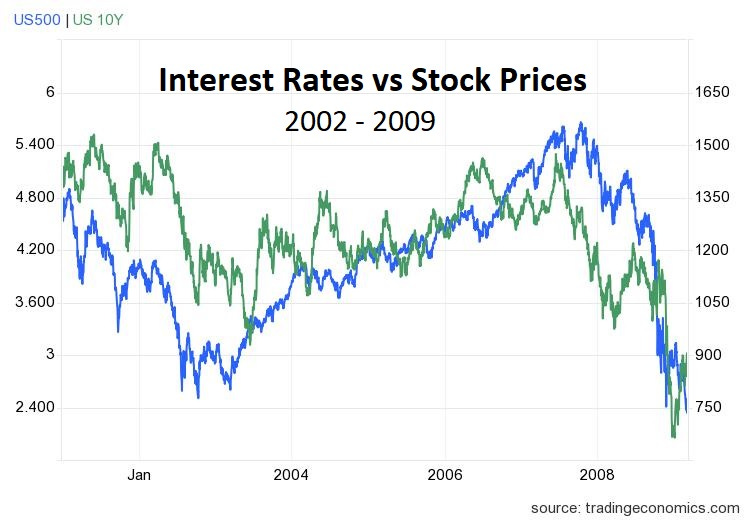

The housing bubble

In the 2000s housing bubble, interest rates (green line) plunged in late 2003 and stocks (blue line) took off, leading many to conclude that the Establishment wanted house prices to rise forever, so the bank and homebuilder stocks were infinitely valuable. Stock prices and interest rates then proceeded to rise in tandem until late 2007, when money became tight enough to burst the subprime housing bubble. The S&P 500 was cut in half by late 2009.

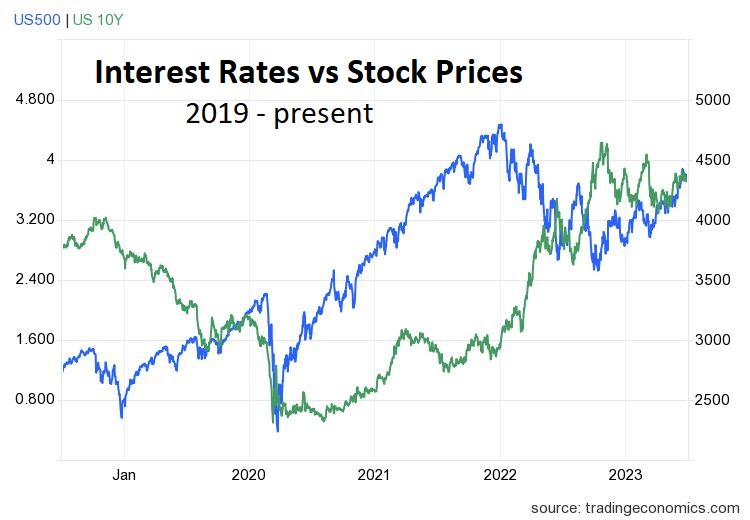

The everything bubble

Now fast-forward to the current bubble, and note how the first part of the pattern has repeated almost perfectly. Interest rates (green) plunged in 2020 and stocks (blue) took off, leading many to conclude that Big Tech is a bargain at any price. Interest rates also rose, slowly at first and then dramatically.

Today, in short, looks like the terminal phase of the dot-com and housing bubbles, with a disorderly end approaching rapidly. It’s not clear what sector will play the dot-com/subprime housing role in the coming bust, but there are so many potential candidates (housing, commercial real estate, Big Tech, local/regional banks, pension funds) that it almost doesn’t matter. This is the everything bubble.

With the Fed announcing yesterday that rates will have to rise further and for longer than the markets seem to expect, the story of the coming year will probably read like those of 2000 and 2008 — disastrously for the “buy the dip” thesis.

STAY INFORMED! Receive our Weekly Recap of thought provoking articles, podcasts, and radio delivered to your inbox for FREE! Sign up here for the HoweStreet.com Weekly Recap.

John Rubino June 29th, 2023

Posted In: John Rubino Substack