April 17, 2023 | Suckers Rally?

Happy Monday Morning!

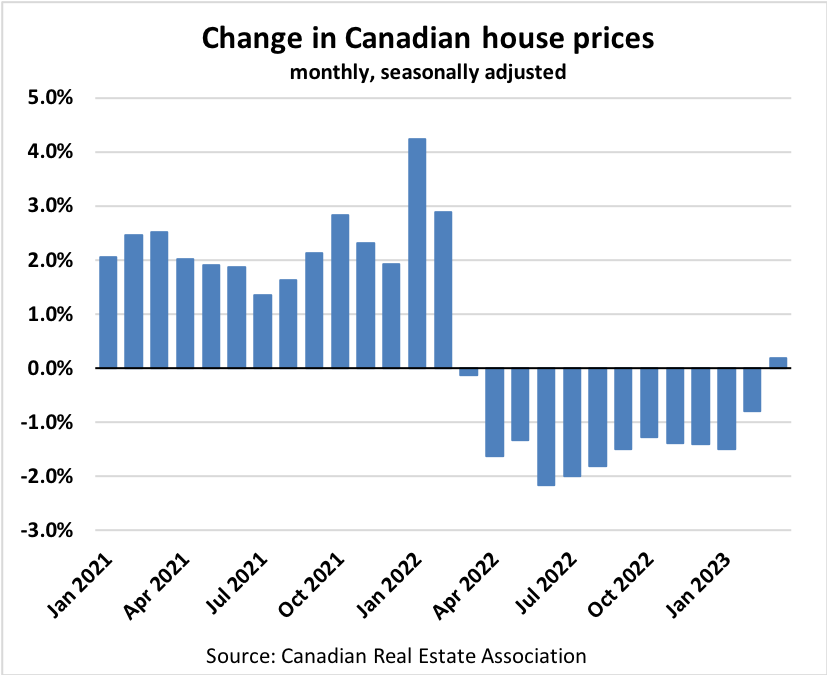

For the first time in a year Canadian home prices ticked higher. Monthly data published by CREA noted a very modest 0.2% month over month increase in national home prices.

However, regular readers here know this has been ongoing for several months now. Prices in most major markets, across most product type, have been pushing higher since January. Yes, it’s certainly surprising given mortgage rates, while they have stabilized, remain elevated. The macro doesn’t look great, lots of chatter about a looming recession, stubbornly elevated inflation, and potential job losses ahead. There are a lot of risks out there yet home buyers seem willing to compete in bidding wars.

Here’s the problem. The majority of home buyers aren’t thinking about the macro. Most people just want a house to live in. And so the micro trumps the macro, at least in the short run. And the micro data overwhelmingly shows that demand is outpacing supply. The number of new listings hitting the MLS hit another 20 year low in the month of March. Yes, you had to go all the way back to the year 2003 when new listings were this low. There was 3.9 months of inventory on a national basis at the end of March 2023, down from 4.1 months at the end of February and now more than a full month below its long-term average.

In Toronto, home of the speculative frenzy that is Canadian housing, we have the same number of homes for sale as we did back in March 2017 when prices were ripping higher prompting policy makers to introduce a series of measures to cool the market, including a foreign buyers tax and a mortgage stress test shortly thereafter.

Home prices are poised to push higher in the months ahead, and that will continue until supply improves. When that will happen I do not know, but I do know that 20 year lows in new listings is not sustainable. Eventually sellers will come back into the fray.

Was that truly the bottom, or is this a suckers rally? If it was the bottom the correction only lasted 12 months. Short, but sharp. Benchmark prices fell $131,300 peak to trough, at one point falling 16% on an annual basis, the sharpest drawdown since the home price index was created back in 2005.

No doubt peak fear was back in the dog days of summer when Tiff Macklem froze the market with a jumbo 100bps rate hike. Try selling a home then, crickets. Sentiment has taken a massive turn since the calendar flipped into 2023. The Bank of Canada moving to the sidelines undoubtedly helped.

I must say, the sudden shift in sentiment has surprised me considering home prices are still egregiously high, affordability still incredibly horrendous. However, if there’s one thing thats proven surprising over the years it’s the animal spirits of Canadian home buyers and their lust for Real Estate.

STAY INFORMED! Receive our Weekly Recap of thought provoking articles, podcasts, and radio delivered to your inbox for FREE! Sign up here for the HoweStreet.com Weekly Recap.

Steve Saretsky April 17th, 2023

Posted In: Steve Saretsky Blog