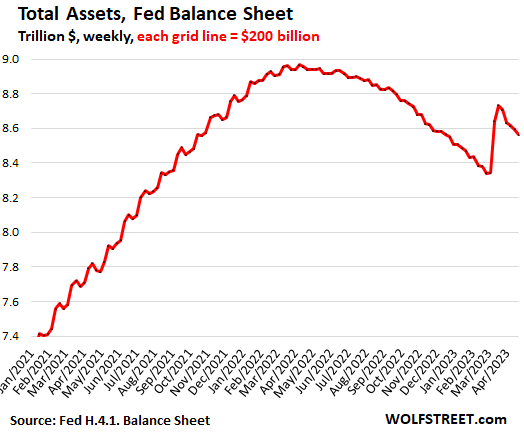

April 27, 2023 | Fed’s Balance Sheet Plunges $171 Billion in Five Weeks since Peak Bank Bailout as QT Continues and Liquidity Support Cools

The Federal Reserve’s balance sheet, released today, dropped another $30 billion for the week, to $8.56 trillion, bringing the plunge in the five weeks since peak bank bailout to $171 billion, as quantitative tightening (QT) continued at the normal pace and liquidity support shifts and unwinds, though First Republic seems to be sucking hard on the Fed’s teat.

The new principle of separating QT from bank liquidity support was laid out by Powell during the last post-meeting press conference, where the Fed can let QT run on track in the background, while briefly stepping in as lender of last resort to a bank. Looking at it with a magnifying glass to see the details of the banking crisis:

QT continued:

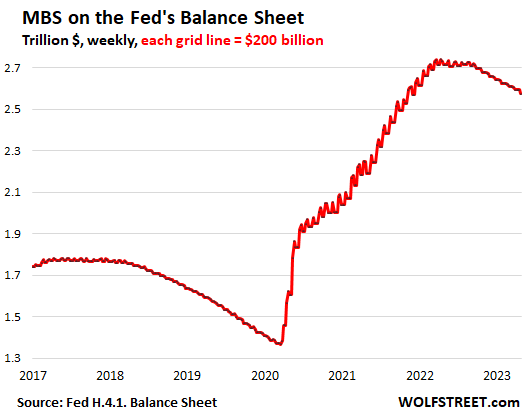

MBS -$17 billion for the week, -$164 billion from peak, to $2.58 trillion. The Fed only holds government-backed “Agency MBS” where the taxpayer carries the credit risk, not the Fed.

Mortgage-backed securities roll off the balance sheet primarily through the pass-through principal payments that holders receive when mortgages are paid off, such as when mortgaged homes are sold or mortgages are refinanced, and when regular mortgage payments are made.

The roll-off has been below the cap of $35 billion per month because home sales have plunged and refis have collapsed, and therefor fewer mortgages are getting paid off.

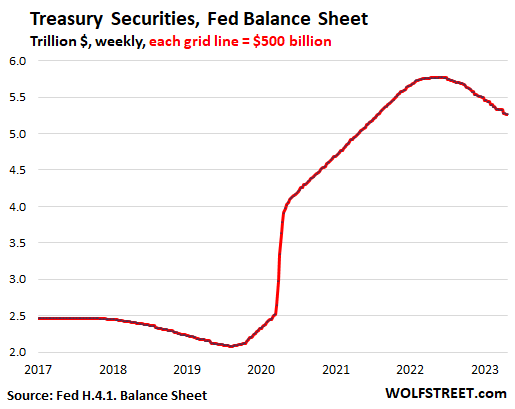

Treasury notes and bonds “roll off” the balance sheet when they mature and the Fed gets paid face value for them. Maturity dates fall either on the middle of the month or at the end of the month. Today’s balance sheet was in between. Next week, over $40 billion in Treasuries will roll off the balance sheet.

Liquidity support.

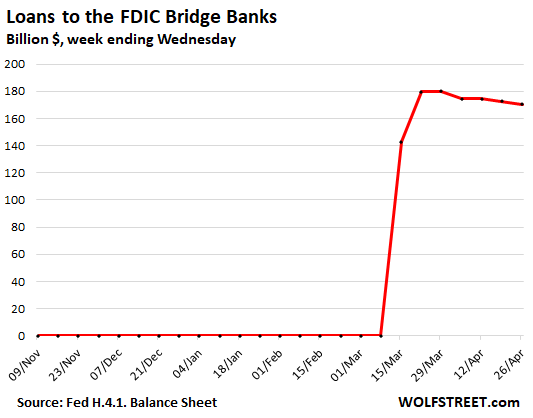

Loans to FDIC bridge banks: -$2 billion in the week, to $170 billion. The FDIC bridge banks have been and still are the largest of the bank liquidity support programs. They took over the collapsed Silicon Valley Bank and Signature Bank. The FDIC has made deals to sell a large part of the assets and transfer the deposits to other banks. It’s now auctioning off in bits and pieces the MBS and Treasury securities that the bridge banks still hold. When these deals close, the funds will go back to the Fed. When everything is said and done, this balance goes to zero:

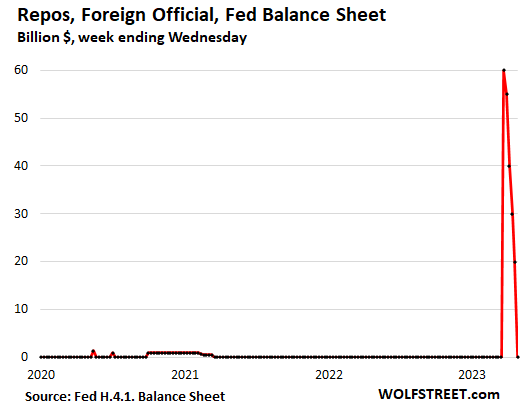

Repos with “foreign official” counterparties: -$20 billion in the week, to $0. They’re now paid off. This was likely the program that the Swiss National Bank used to provide dollar-liquidity support for the take-under of Credit Suisse by UBS. The Fed has for years offered these repos to foreign central banks so that they can access short-term dollar liquidity against collateral of eligible US securities that they’re holding.

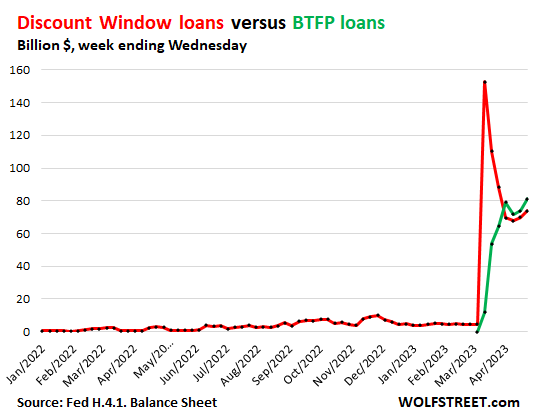

The Discount Window (“Primary Credit”): +$4 billion for the week, to $74 billion, less than half of its bank-bailout peak of $153 billion. The Fed charges banks 5.0%. Banks also have to post collateral, valued at “fair market value.” These are punitive terms for banks who can normally borrow from depositors for a lot less without having to post collateral. It’s only when banks need liquidity badly during a run on the deposits, but cannot sell their assets quickly enough without losing a ton of money, that they will avail themselves of the Fed as lender of last resort.

Bank Term Funding Program (BTFP): +$7 billion to $81 billion. Under this new program, rolled out on March 13, banks can borrow for up to one year, at a fixed rate, pegged to the one-year overnight index swap rate plus 10 basis points. Banks have to post collateral, but valued “at par.” For banks, the terms of BTFP are still punitive, though less punitive than the Discount Window.

Renewed turmoil is bogging down First Republic – First Republic Discloses it’s a Zombie – and it said that it was heavily relying on the Fed’s liquidity programs to cover the massive flight of uninsured deposits. First Republic is a substantial part of what we’re looking at here at the Discount Window and at the BTFP.

This chart shows both, the loans at the Discount Window (red) and the loans at the BTFP (green):

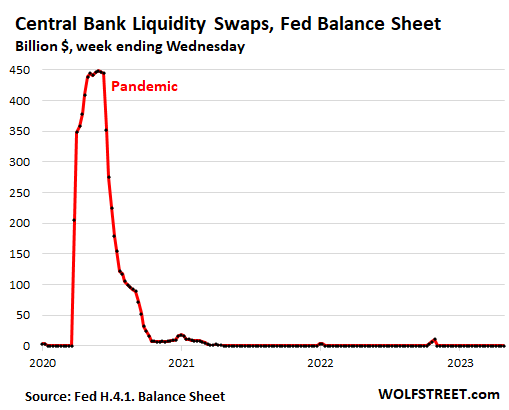

Central Bank Liquidity Swaps: No activity.

STAY INFORMED! Receive our Weekly Recap of thought provoking articles, podcasts, and radio delivered to your inbox for FREE! Sign up here for the HoweStreet.com Weekly Recap.

Wolf Richter April 27th, 2023

Posted In: Wolf Street