Over the past year, bonds and mortgage-backed securities dropped in value as central banks hiked base rates in the banking system—that’s interest rate risk. The sound ones also rebound in value as central banks pause and then start cutting rates again.

But that doesn’t mean these instruments all have the same risk profile. Government bonds are transparent securities backed by the taxation ability of their issuers. They are liquid, priced to market daily and mature at face value on a set maturity date.

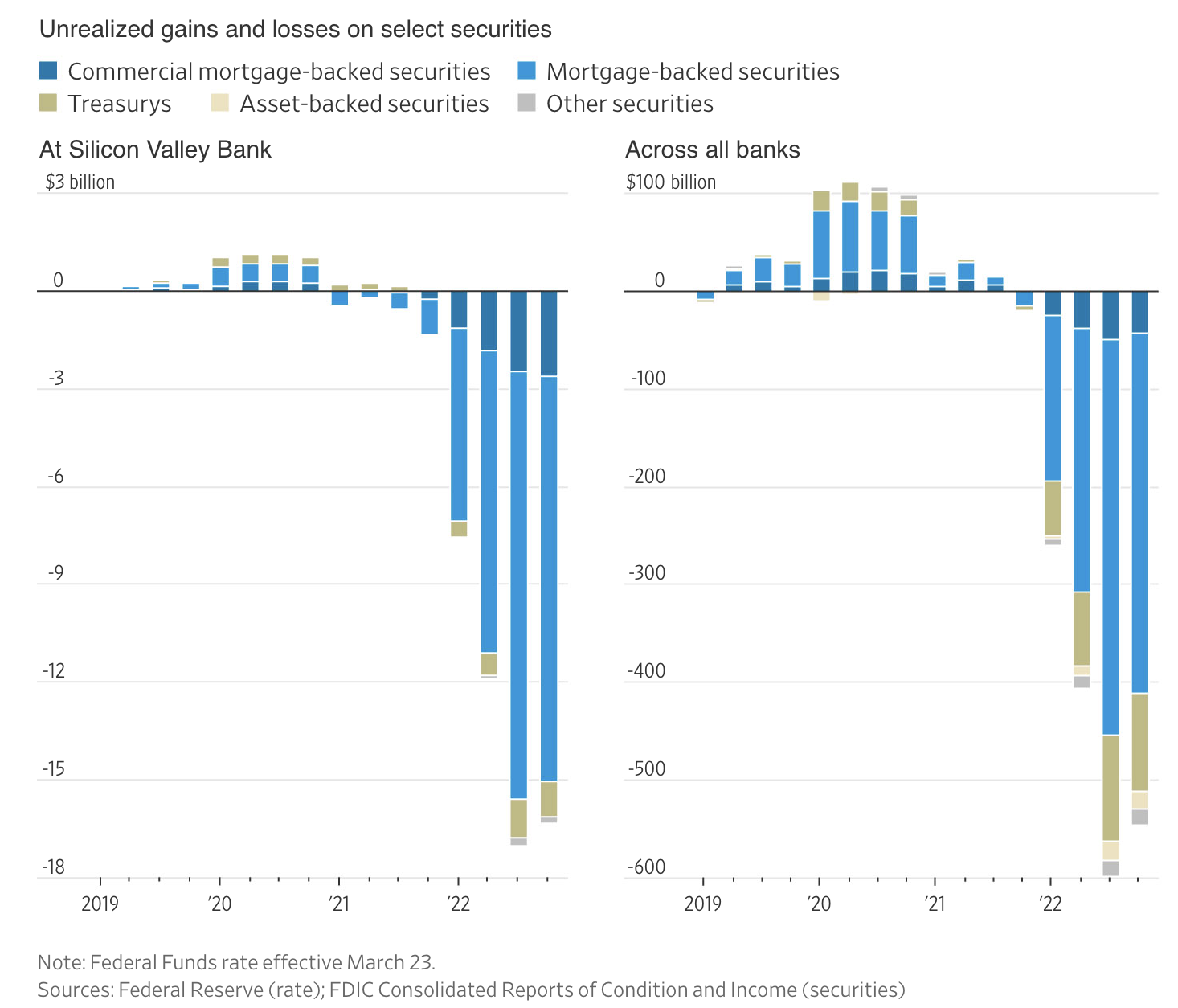

As became painfully evident in the subprime meltdown of 2007-2008, other bonds/loans and mortgage-backed securities are only as sound as the borrowers behind them. And most of the unrealized losses on lender balance sheets today are in mortgage and other asset-backed securities (blue and grey bars below), not Treasuries (in green), courtesy of the Wall Street Journal, see, Where Financial Risk Lies, 12 charts.

After 12 years of easy money, there are a lot of weak players and sketchy loans out there, especially in the wildly overbuilt and overvalued commercial real estate sector. There, venture capital and private equity firms have been feasting like fungus in the opacity of values marked to fantastical ZIRP and TINA-inspired estimates for a decade. Eventually, the reality of lower market prices will have to be accounted for.

As a liquidity crunch spreads, redemption requests rise amid payment defaults and tumbling property values. Extend and pretend are running out of options. See Bloomberg, SVB Collapse could mean a $500 billion Venture Captial haircut. Here’s a taste:

Some VC and private equity firms are turning toward strategies to “extend” and “pretend,” meaning they would hold on to assets or prop up capital to avoid true price discovery, Patankar added in a Friday interview. Examples of this include net asset value loans that let general partners borrow against a pool of portfolio companies within a fund, GP-led secondary structures where a fund sponsor sells one or more assets from a fund it already manages to a new fund, and alternative financing via private credit.

But those methods can only delay but not deny the ultimate fundamental problem of “untenable” and “unrealistic nature” of venture valuations, he said. “There are enough zombie companies with frothy valuations that need restructuring, price discovery and of course re-tooling of their business models to a world of tighter credit, subdued revenue and higher rates,” Patankar said.

CNBC’s Diana Olick reports on news from the commercial real estate sector. Here is a direct video link.