March 13, 2023 | Gradually, then Suddenly

Happy Monday Morning!

Central banks finally broke something.

After leaving rates hovering near zero for over a decade and engaging in trillions of dollars worth of QE (Quantitative Easing) you can’t simply raise interest rates by 400bps in less than a year without something going boom in the night. It was never a matter of IF, but WHEN.

There are more qualified people than me to talk about the Silicon Valley Bank debacle so i’ll keep this brief.

- Fed raised interest rates at the fastest pace on record when adjusted for debt loads.

- Deposit rates failed to keep up without eroding bank profitability. So cash fled to higher yielding short term treasuries, money market funds, etc.

- Meanwhile surging interest rates destroyed the value of bank collateral (mostly Government bonds)

- Banks need to raise capital to fund withdrawals but if they liquidate these assets they realize losses on said assets. This compounds their weak capital base.

- Depositors get nervous and pull cash. Contagion. End.

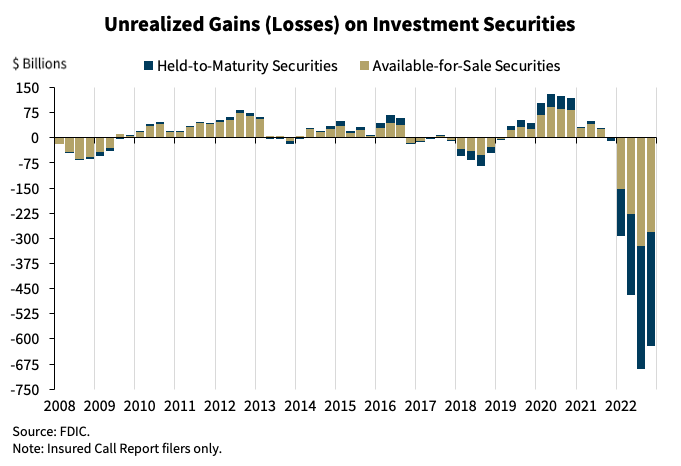

Banks are sitting on huge unrealized losses. The bonds they bought at ultra low interest rates were destroyed in price when the Fed jacked interest rates, and bonds are the collateral supporting the entire financial system.

For example, a 1% shift higher on a 9 year duration bond is a 9% hit on the bond price. So the Fed’s ability to hike rates was ALWAYs limited to the extent to which banks invested cash wisely. Silicon Valley Bank is not alone.

Lots of chatter that the Fed might be done with their rate hiking crusade. Any more bank failures and we’ll be talking about deflation, not inflation.

The Bank of Canada has already moved to the sidelines as confirmed last week when they announced an ongoing pause. Higher interest rates are finally starting to bite.

The proportion of mortgages with amortization periods longer than 30 years:

BMO: 32.4%

CIBC: 30%

TD: 29.3%

RBC: 25%

In other words, a lot of mortgages have suddenly morphed into interest only mortgages when the Bank of Canada set off a wave of trigger rates. Something considered inconceivable just 12 months ago. Banks are allowing borrowers to kick the can because your house is the banks collateral and they don’t need your house hitting the MLS in a forced liquidation.

This partly explains the lack of inventory on the market.

It’s not just the residential side. Issues are bubbling up in the commercial Real Estate sector as well. The office market is in shambles, and we know development land has become illiquid. We highlighted a few weeks ago the sudden collapse of Coromandel, a Vancouver developer with nearly $1B in land holdings. They too are not alone.

As the old saying goes, “How did you go bankrupt?”

Two ways. Gradually, then suddenly.

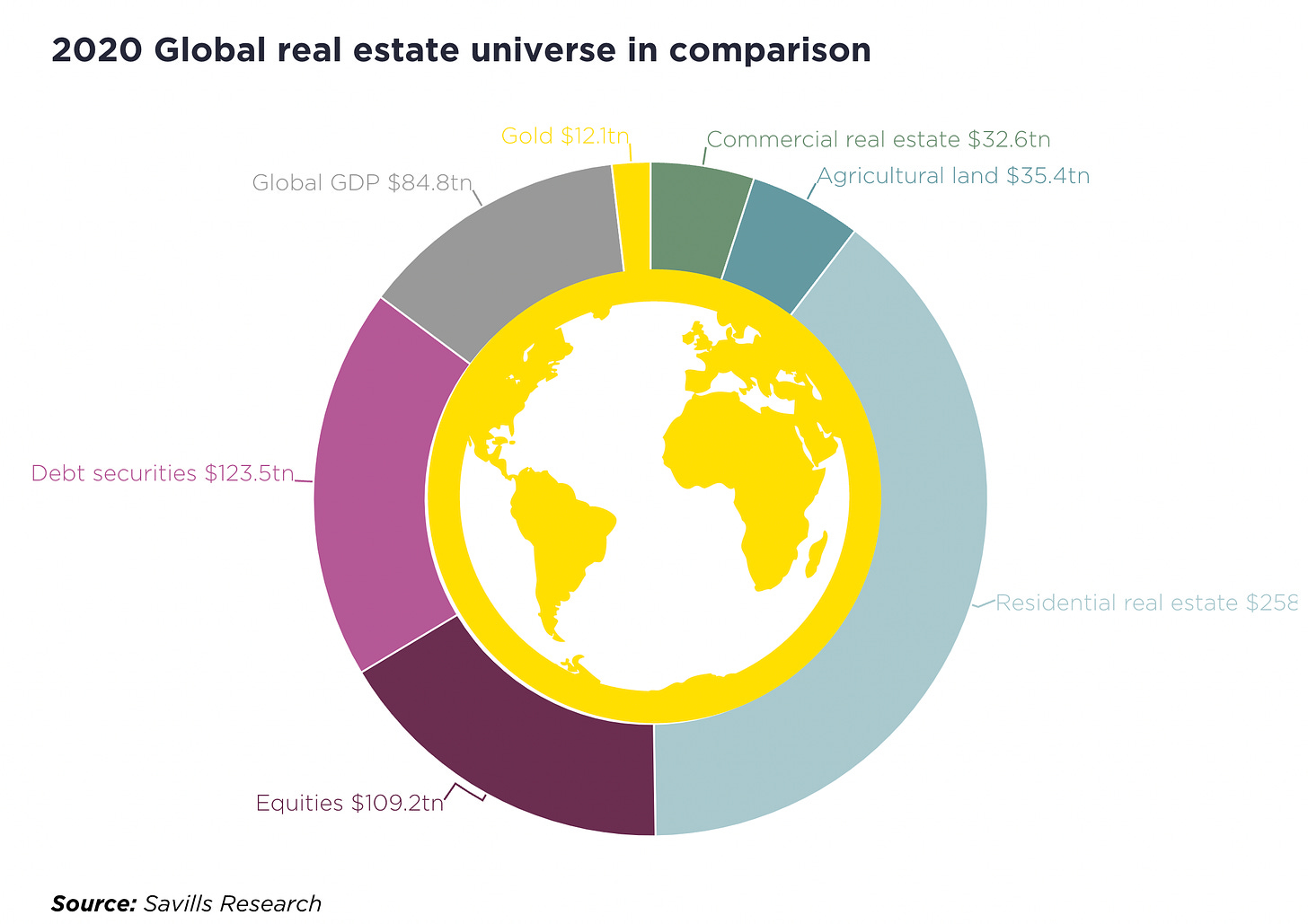

The value of all the world’s Real Estate is over $300 Trillion. And there is a lot of debt underpinning the value of that Real Estate.

In other words as that debt gets repriced, so too does the asset. Silicon Valley Bank is just a subtle reminder of what happens when you are suddenly forced to mark to market that collateral. Central banks will soon be forced to reverse course sooner rather than later.

STAY INFORMED! Receive our Weekly Recap of thought provoking articles, podcasts, and radio delivered to your inbox for FREE! Sign up here for the HoweStreet.com Weekly Recap.

Steve Saretsky March 13th, 2023

Posted In: Steve Saretsky Blog

Next: Where to Go? »