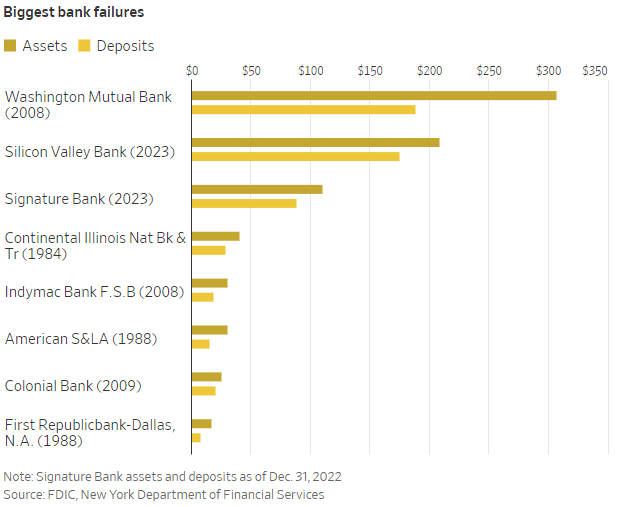

The Silicon Valley Bank (SVB, founded in 1984) and Signature Bank (publicly traded since 2004) closures over the weekend are the second and third largest US bank failures in history (the largest eight failed banks in assets and deposits, are shown below).

Banking failures tend to be contagious. To quell depositor fears, the US Treasury has advised that Federal Deposit Insurance will backstop 100% of bank deposits, even though over 80% were over the traditional $250,000 max FDIC coverage limit per account. See SVB, Signature Bank Depositors to Get All Their Money as Fed moves to Stem Crisis. So far, investors in both banks are to fully absorb their losses, as they should.

Both banks saw deposits soar during the pandemic as governments and central banks pumped cash directly into businesses and households, and interest rates fell to the lowest level since 1930. Signature Bank deposits doubled in two years as it became one of the largest lending banks to speculative crypto startups and digital asset investors. SVB focused on lending to tech startups and venture capital firms and saw its deposits soar 233% between 2020 and 2022 as tech companies piled operating capital into bank accounts.

Rather than increasing the interest paid to depositors as central banks hiked base rates over the past year, management opted to maximize short-term profits by pocketing fat spreads. (Most banks have done the same thing, up until now.)

Then, rather than manage their liquidity responsibly with prudent hedging strategies, both banks allocated too much cash to longer-dated bonds, whose prices tumbled as central bank hikes continued.

Finally, a demand slowdown over the past year, and the availability of higher interest rates on offer elsewhere, prompted customers to withdraw cash from bank accounts. This escalated into a bank run last week as some high profile investors warned bank liquidity was low.

As we have been explaining for many months, tightening cycles move at lags of 12 to 24 months, so, much of the record central bank moves between 2022 and 2023 will be felt over the next year.

Stock futures initially soared on news of the FDIC backstop for 100% of deposits and wagers that stress will prompt the US Fed to pause or reduce further tightening plans for 2023. Risk happens fast in highly levered markets. From last week’s 80% probability of a 50 bps hike on March 22, markets are now pricing a 44% probability of a pause.

Treasury bonds seem to agree, as they continue to rally this morning. It is typical for Treasuries to rally on inflows when central banks move to the end of their tightening efforts and then into easing once more (usually several months later), so this makes sense.

It’s worth understanding though, that the intensifying stress part of the credit cycle is historically very bearish for stocks and the weakest credit types.

The NY Times article “Stocks Soar 11 Percent on Aid to Banks” from October 2008 celebrated the initial relief rally after policymakers intervened to restore confidence in the fall of 2008. After a short-lived rally, risk markets continued to plunge into March 2009.

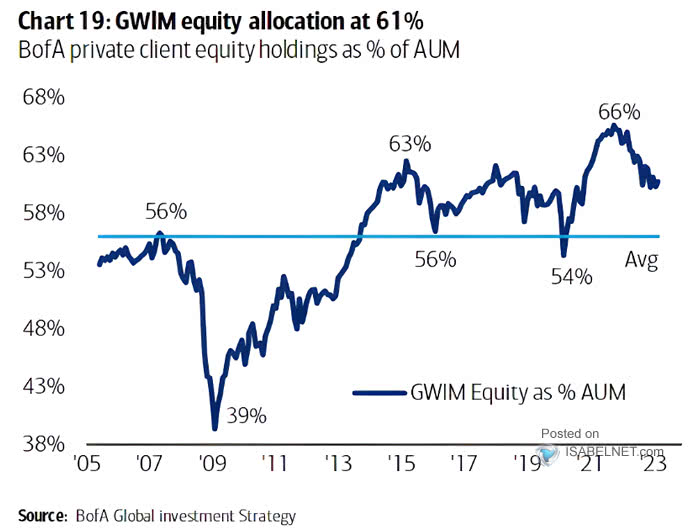

A similar progression this time will hit retail portfolios hard as the average equity allocation remains near cycle highs at 61%, versus 40% typical around past cycle lows (chart below courtesy of ISABELNET.com).