February 13, 2023 | Swimming Naked

Happy Monday Morning!

Those holding their breath for an easing in mortgage rates were delivered some tough news last week. The Canadian labour market added 150,000 jobs in January, more than TEN times economist estimates. Let’s not forget that December jobs numbers were TWENTY times estimates. Just what the hell is going on here? Either our economists are really, really bad at forecasting or the Stats Canada random number generator is in need of repairs.

My good friend Ben Rabidoux at North Cove Advisors might have the answer. Immigration. Per Rabidoux and Stats Canada, “On a year-over-year basis, employment for those who were not born in Canada and have never been a landed immigrant was up 13.3% in Jan, compared with growth in total employment of 2.8%.”

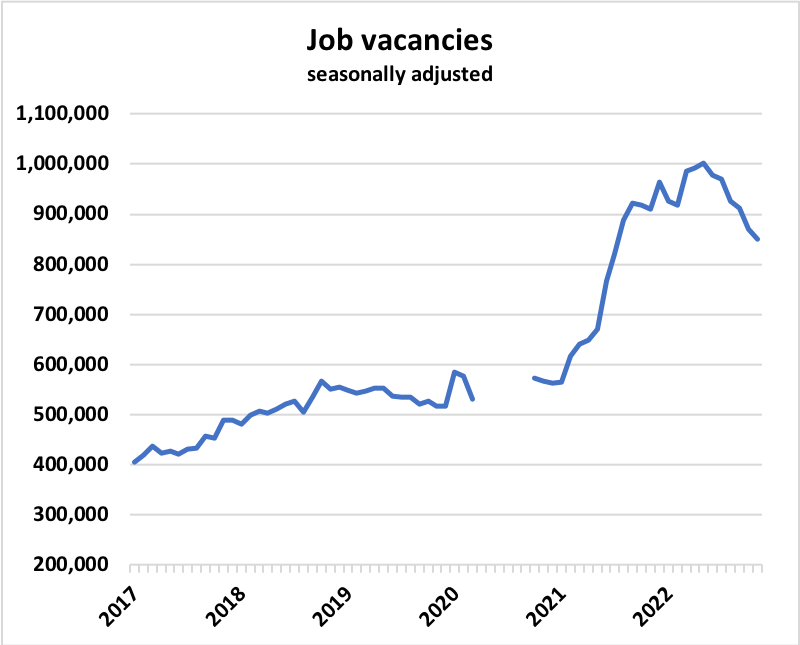

This makes sense. Job vacancies were sky-high in H2 2022.

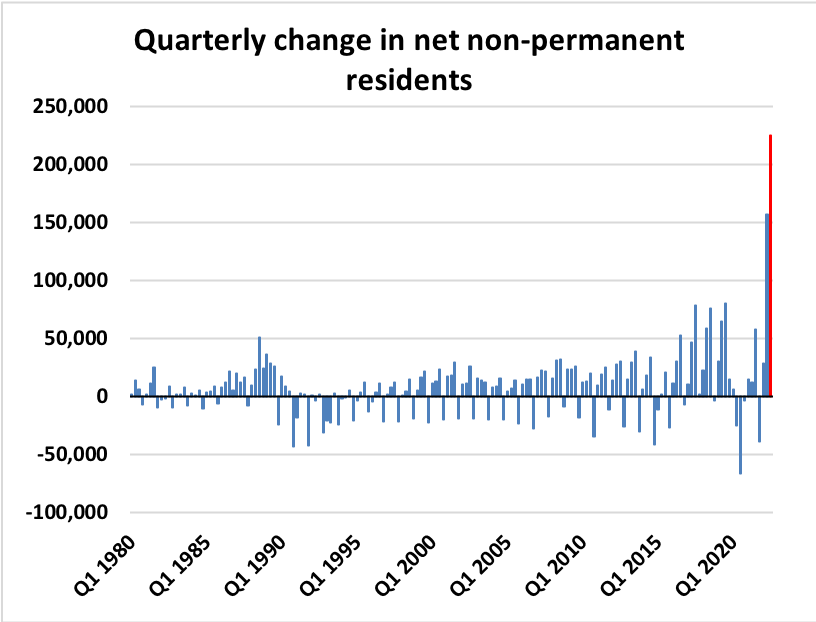

The Government responded by ramping non-permanent resident growth, which hit record highs over the past 2 quarters. “The increase of NPRs in the third quarter of 2022 was larger than any full-year increase since 1971 (when data on NPRs became available). This increase was driven by work permit holders…”

Rabidoux concludes, that what we’re seeing now in the jobs data are work permit holders filling existing job vacancies. It’s likely a one-time boom.

However, in the eyes of investors, the labour market is booming, suggesting inflation could be stickier than initially expected. Just a few weeks ago markets were pricing in two cuts from the Bank of Canada this year. That’s now down to zero.

The market is now pricing in a 7 in 10 chance of another hike by this summer.

Yields are back on the rise. The Canada 5 year bond yield has ticked up 50bps over the past few weeks, dashing earlier hopes for 5 year mortgage rates to fall into the low 4’s by the spring market.

Perhaps we should be bracing ourselves for HIGHER for LONGER mortgage rates. Maybe 5% is the new 3%?

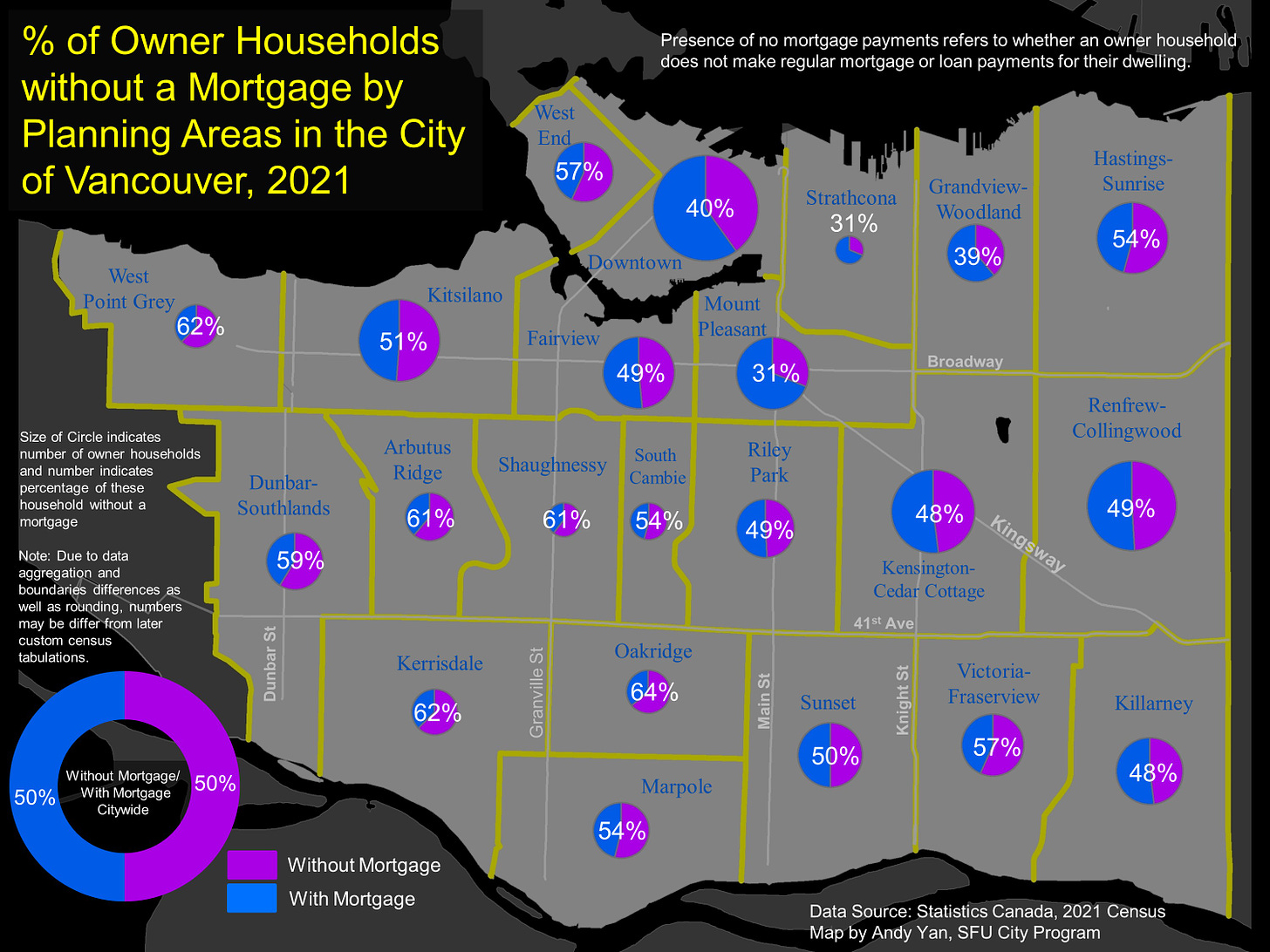

That will be painful for some, and nearly unnoticeable for others. Recent data from Stats Canada and Director of SFU’s City Program, Andy Yan, shows that Half of Vancouver owner occupied households are mortgage-free. This includes any HELOC debt.

Keep in mind this is Owner occupied housing. It suggests a lot of principal residences are mortgage free. That’s what you call holding power and probably explains the lack of new listings over the past six months.

However, investment properties are not included in the study above, and that’s where the leverage lies. Highly levered investors will be pushed to the brink.

For those paying attention to the news cycle, major Vancouver developer, Coromandel just went down for the dirtnap. A total of 16 projects with over $700M in debt is up in limbo.

It’s noted that eight secured lenders have issued default notices, and made demands on their loans, with the largest secured debts being $40 million for Cambie 45, $53.6 million for Laurel 57, and $80.6 million for Southview Gardens.

Per court documents, “The Petitioners have insufficient cash flow to complete development on the Projects, have been unable to refinance their existing debts and liabilities, or sell assets at sufficient prices to avoid loss, all in the face of demands for payment by their secured creditors. As a result, the development work on the various Properties is in jeopardy.”

A subtle reminder that leverage cuts both ways. Only when the tide goes out do you discover who’s been swimming naked.

STAY INFORMED! Receive our Weekly Recap of thought provoking articles, podcasts, and radio delivered to your inbox for FREE! Sign up here for the HoweStreet.com Weekly Recap.

Steve Saretsky February 13th, 2023

Posted In: Steve Saretsky Blog

Next: Hard Landing in Motion »