February 27, 2023 | Banking on the Gravy Train

Happy Monday Morning!

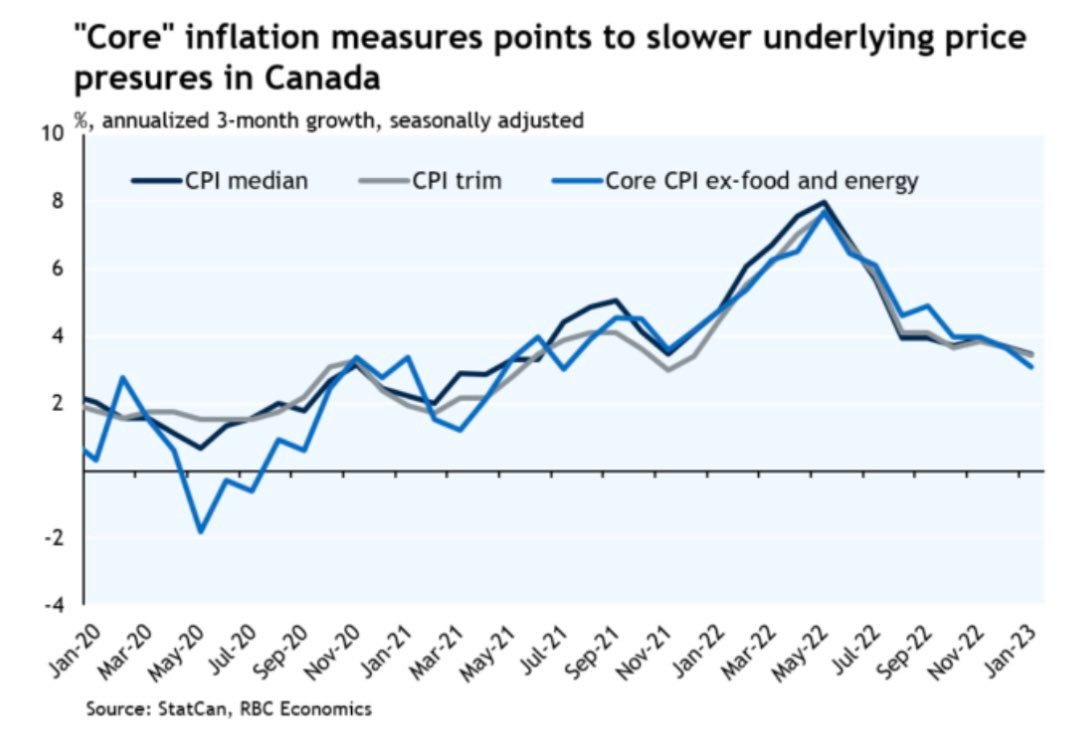

Some good news on the inflation front in Canada this past week. Headline inflation ticked in at 5.9% year-over-year, below market expectations of 6.1%. Inflation in services, which is one of the key figures policymakers are watching, eased to 5.3%, from 5.6% in December. The Bank of Canada’s preferred median and trim inflation measures continue to ease, now running at around 3.5% on a 3-month annualized basis. Progress.

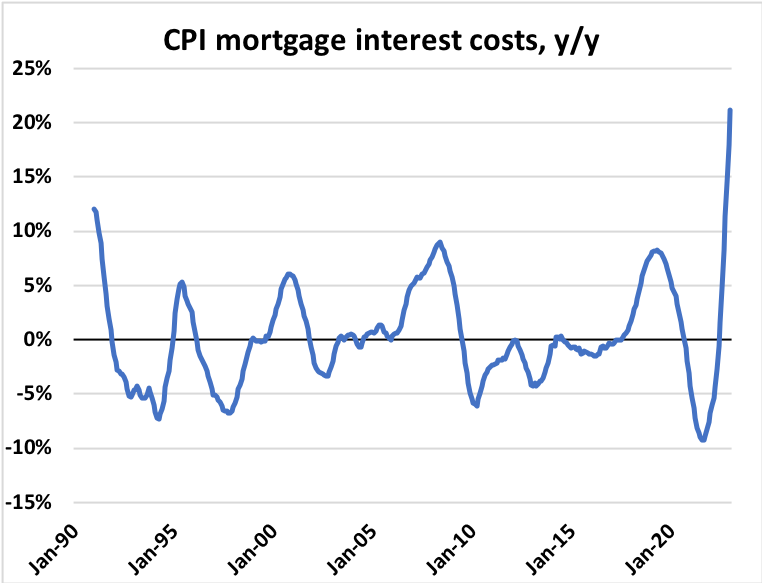

Meanwhile, mortgage interest costs in Canada surged 21.2% annually in January, the largest increase since the early 1990’s when the data set was first created. According to the always insightful Ben Rabidoux of North Cover Advisors, rising mortgage interest costs alone added 0.6 percentage points to the headline 5.9% print. In other words, in his pursuit of fighting inflation, Tiff Macklem is actually creating inflation too. Rather ironic, I know.

Now for the bad news. While inflation is easing in Canada, it is proving to be more sticky in the US. Prices in the US, according to the Federal Reserve’s preferred metrics, rose 5.4% from a year earlier and the core gauge was up 4.7%, both hotter than forecast after slowing for several months.

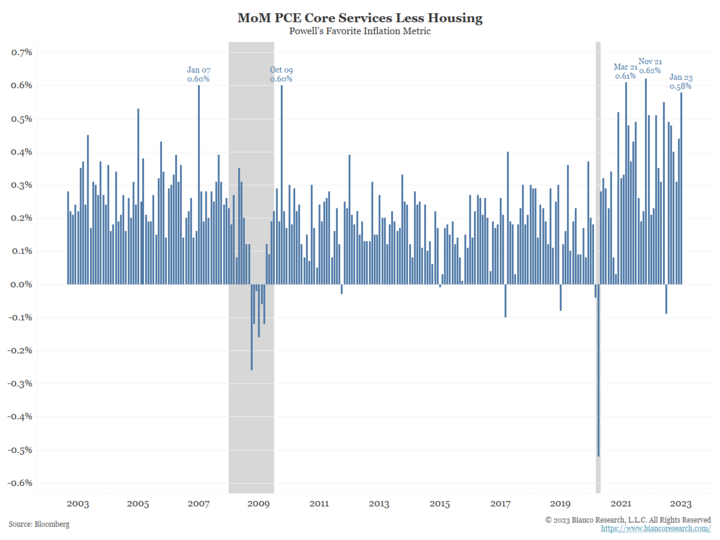

More importantly, Core PCE (Personal Consumption Expenditures) less housing services, the metric Fed Chair J Powell is watching the most, soared 0.58% in January, one of the highest readings ever! In other words, no central bank pivot anytime soon.

Markets are now fully pricing in rate hikes from the Fed at their next three meetings. So while the Bank of Canada might be done raising rates, the worlds most important central bank is not done raising rates, and that is what matters most. Bond yields continue to push higher.

The all important Canada 5 Year bond, which prices the 5 year fixed rate mortgage, is now nearing 3.6%, up nearly 80bps over the past month.

Many Canadian households need to prepare for HIGHER for LONGER interest rates. It is clear we are in a highly volatile, highly unpredictable environment. Markets are whipsawing with every new data point.

These are strange times. Weakest home sales in 14 years, yet lowest number of new listings in 23 years. Multiple offers on entry level homes, while other more expensive homes languish on the market. Imagine being a developer trying to decide if you should risk launching a $50M condo project to market. No wonder housing starts are rolling over, falling 13% month-over-month in January to their lowest levels since the onset of the pandemic.

This has spillover effects too. As new housing get delayed, city revenues will feel the crunch. Just this past week we found out the City of Vancouver has proposed a 9.7% hike in property taxes for 2023, while warning that average property tax increases of 8.6% per annum are likely needed over the next four years. It turns out the city was banking on the Real Estate gravy train to continue..

Not sure where we go from here, but higher for longer likely means stagnant for longer too. An environment that will require painful adjustments for some.

STAY INFORMED! Receive our Weekly Recap of thought provoking articles, podcasts, and radio delivered to your inbox for FREE! Sign up here for the HoweStreet.com Weekly Recap.

Steve Saretsky February 27th, 2023

Posted In: Steve Saretsky Blog