May 6, 2024 | Balance Sheet Woes

Happy Monday Morning!

The housing market is taking an early turn, cooling swiftly in the month of April. The month of April usually marks the middle of the busy spring selling season so it’s rather unusual to see things fizzle out this early.

The problem wasn’t so much that home sales were weak, up from last year albeit still 12% below their ten year average, but rather it was the sudden surge in new listings that poured a bucket of cold water on the party.

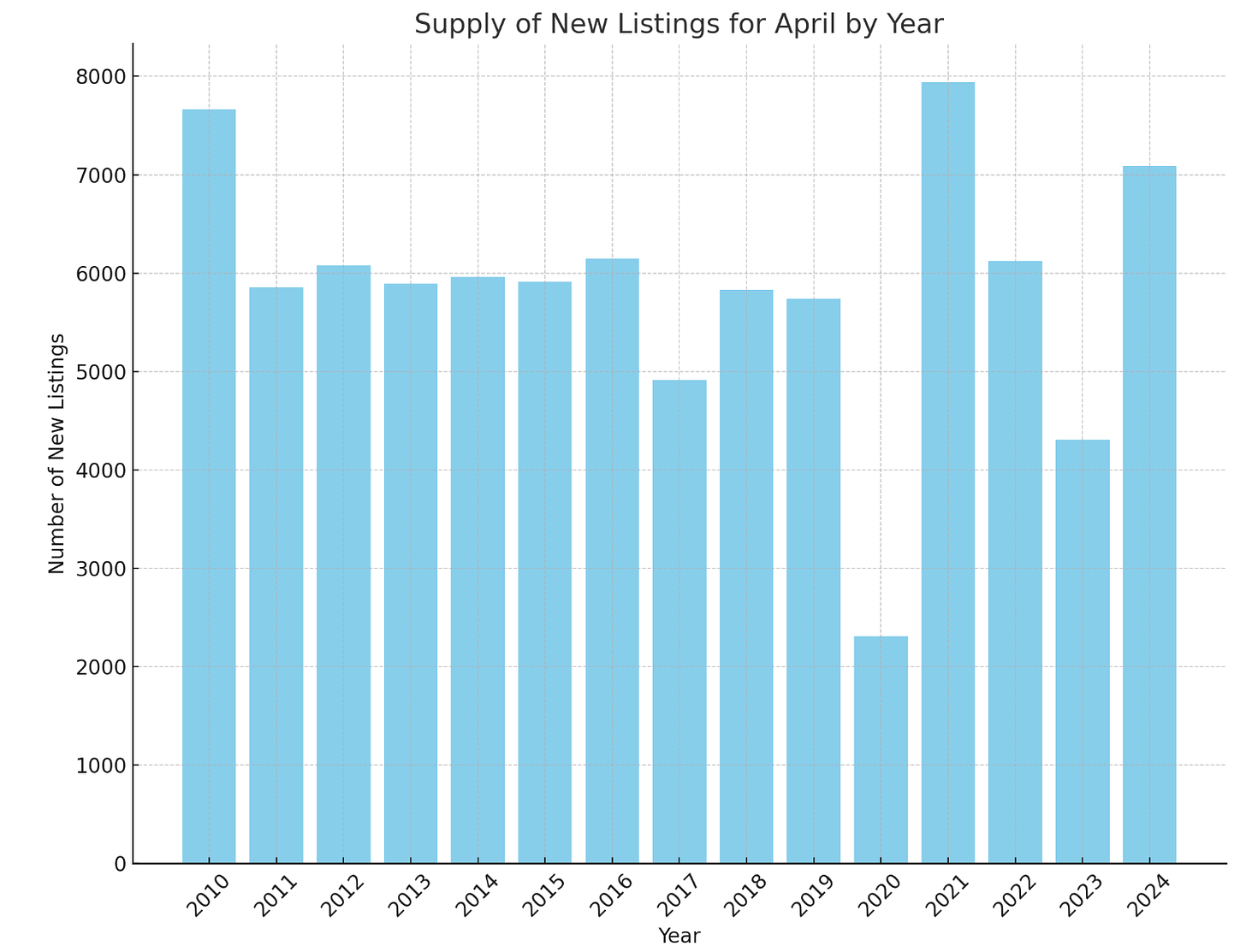

The number of new listings hitting the Greater Vancouver market ripped 64% year-over-year in April. This was the highest number of new listings since 2010, excluding the pandemic frenzy of April 2021 when everyone was eagerly buying and selling Real Estate.

Why the sudden jump in new listings? Are sellers finally capitulating, crumbling under the weight of higher mortgage rates? We’re not sure, but here’s what we do know.

New listings have been hovering near twenty year lows for a good portion of the last eighteen months. Higher rates froze activity, so people didn’t list their homes for sale. New listing activity was artificially suppressed.

The recent surge in listings is unlikely to be tied to the capital gains tax announcement, considering it was announced on April 16th and it takes about a week to get a listing live on the MLS, this would leave 5 business days of potential listings, which is not enough time to influence listing count for the month.

It should be noted that the surge in new listings is a one month phenomenon! One month is not a trend and this could easily reverse course. However, a sudden 64% surge is rather peculiar.

Here’s what i’m seeing. Inventory is still tight for entry level houses and townhouses. End user product that caters to young families on a budget is still in very short supply! In my opinion there is a STRUCTURAL deficit of missing middle housing here.

Inventory is building rapidly in the condo space, as investors have moved to the sidelines. The outlook for future price appreciation looks bleak and nothing cash flows. In fact, many investors are hitting the sell button as mortgages renew at higher rates and they’re suddenly stuck in deeply negative cash flowing investments and unable to raise rents due to the nature of the BC Government’s punitive tenancy laws.

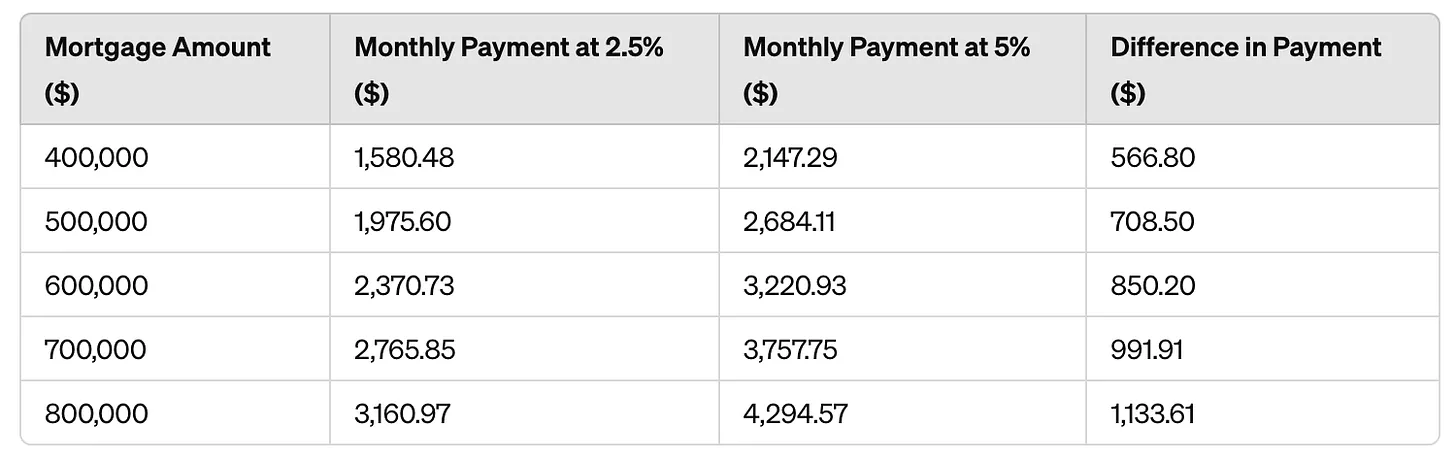

When your mortgage doubles from 2.5% to 5%, the jump in your mortgage payments leaves a big hole on the landlord balance sheet.

Unless interest rates move lower, and quickly, it’s hard to imagine this trend reversing course. In fact, it is likely to accelerate with the swell of pre-sale buyers closing on their now negative cash flowing units.

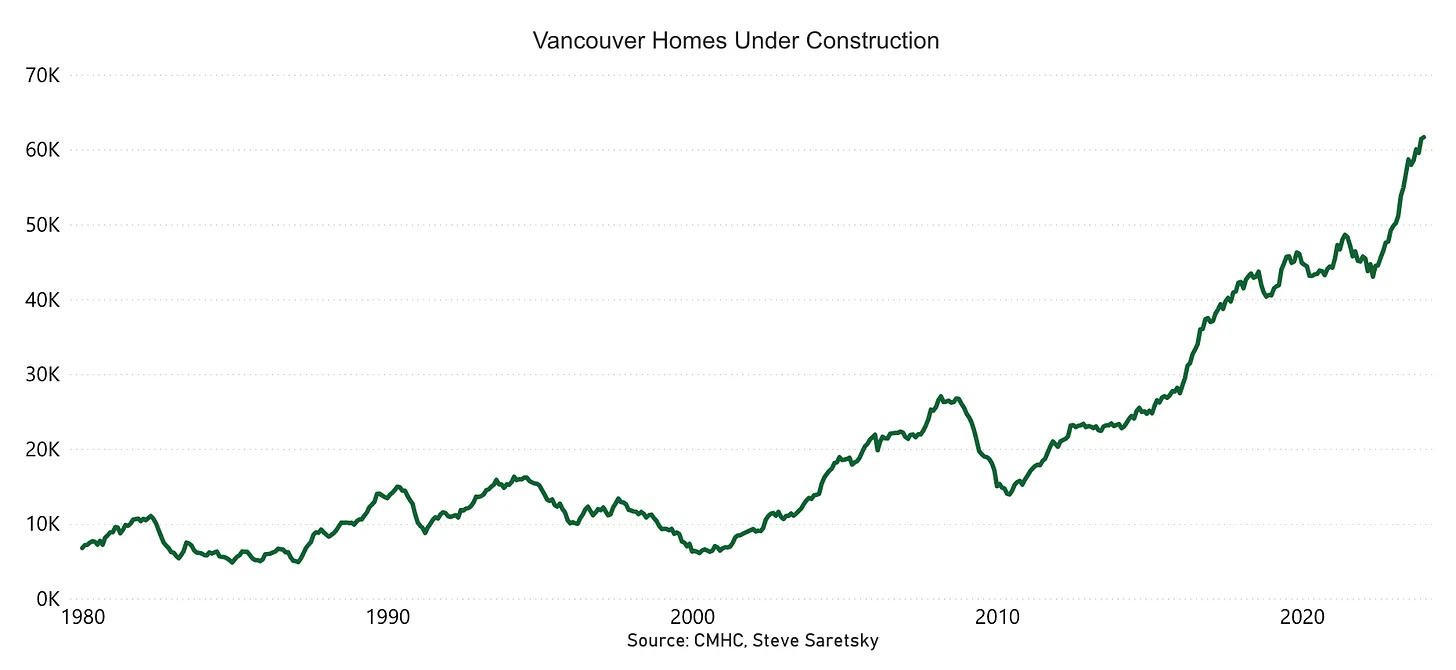

The biggest downside risk for the market is investors stampeding for the exits. Future price appreciation looks bleak, it’s near impossible to cash flow at today’s mortgage rates, and we have a record number of new condos under construction that could add to resale inventory levels.

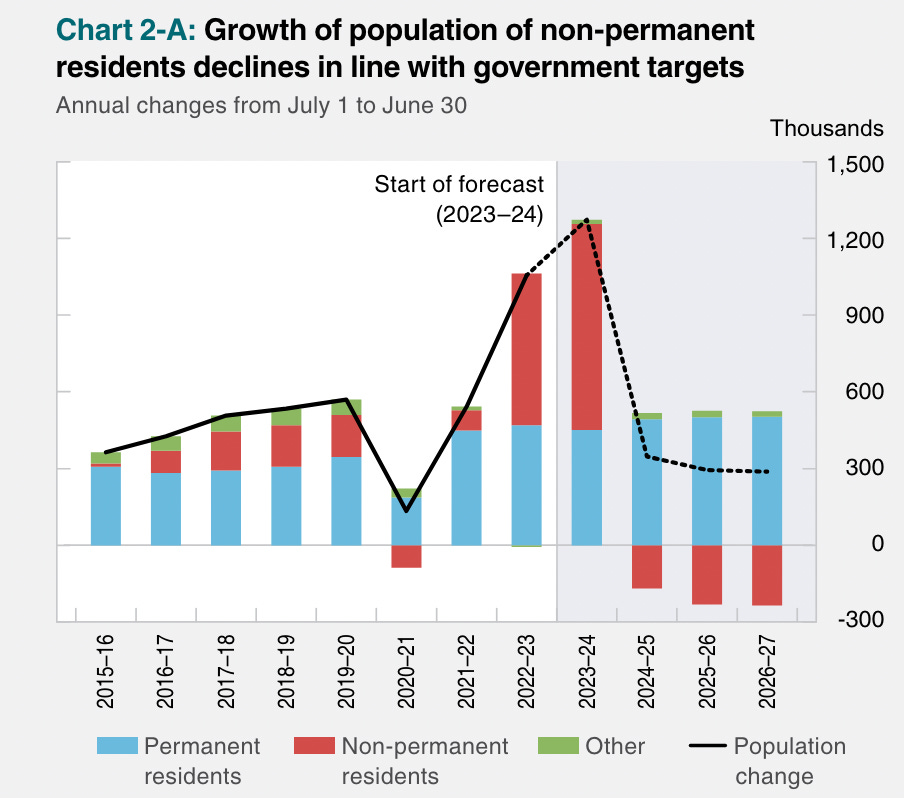

We are also seeing signs that the rental market is cooling and rent growth is flatlining. Not hard to see this continue if the feds follow through with their promise to slow population growth from 1.2 million to 300,000 over the next year.

Yes, the outlook for condo investors is bleak, but the same can not be said for single family houses which remain in short supply and will continue to be in short supply with the increased densification being pushed by all levels of government. We are in a very bifurcated market.

The same story appears to be playing out in the GTA.

New listings surged 47%, and excluding 2020, the first full month of lockdowns, it was the slowest April for sales in at least a decade.

A report released this past week from real estate research firm Urbanation found rents in the GTHA fell by 7.4 per cent from the third quarter of 2023 to the first quarter of 2024.

It is the largest six-month decline recorded in 15 years of the company’s data tracking outside of the pandemic period in late 2020 and early 2021.

“While the market remains expensive with rents 15 per cent higher than two years ago,” Urbanation president Shaun Hildebrand said, “renters waiting for some reprieve in the market have found it thanks to a temporary supply infusion from condo investors.”

Supply from newly completed condos made a significant impact on the rental market, the report said. Over the past four quarters, more than 23,000 new condo units were registered — a 21 per cent rise from the prior year.

Again, unless the Bank of Canada cuts rates aggressively and restarts the housing bubble, investors are more likely to be adding to the supply curve, not subtracting from it. That is, at least until the lack of new housing starts sows the seeds for the next housing crunch several years from now. Position accordingly.

STAY INFORMED! Receive our Weekly Recap of thought provoking articles, podcasts, and radio delivered to your inbox for FREE! Sign up here for the HoweStreet.com Weekly Recap.

Steve Saretsky May 6th, 2024

Posted In: Steve Saretsky Blog