April 20, 2024 | Trading Desk Notes For April 20, 2024

Nasdaq had a lousy week and closed on its lows

Benchmark global stock indices had their best-ever monthly close in March, but they all turned lower in April, with some of the former high-fliers getting hit the hardest.

Nasdaq closed Friday at a 2-month low, down ~8.5% from March highs.

MSFT had its lowest close since January.

AAPL had its lowest close in 12 months, down ~18% from December’s All-Time highs.

Implied VOL on all stock index futures hit the highest levels since October when the 5-month “run for the roses” rally began.

The S&P closed higher for 18 of 22 weeks between November and March, gaining ~30%. (It has dropped ~7% from the highs.) As the rally extended, positioning became increasingly aggressive, especially in the tech sector. After such an extended rally, there was some “inevitability” of a correction.

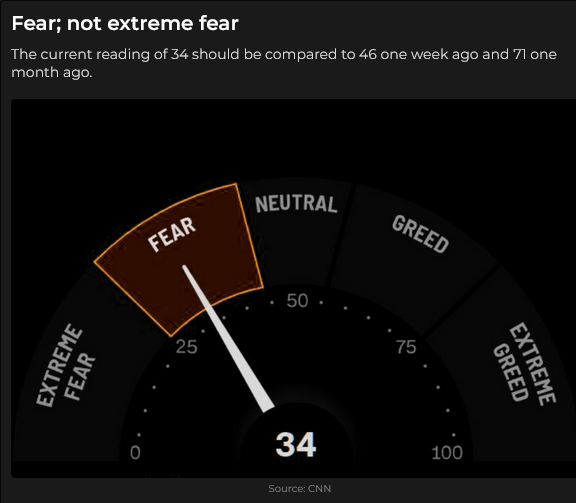

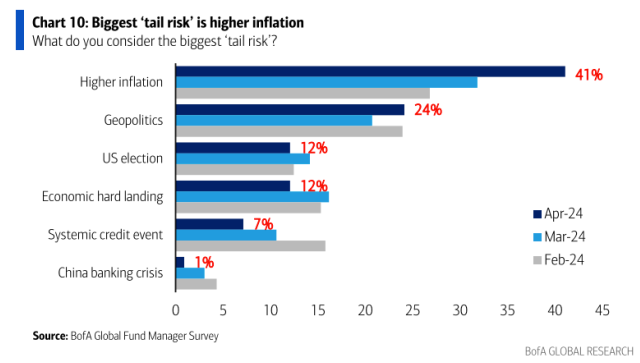

The initial trigger for the correction was robust US economic data and stronger-than-expected inflation, which caused higher interest rate expectations. A secondary trigger (beginning Friday of last week) was expectations of direct Israel/Iran conflict. More than 2/3 of the drop from the April 1 highs happened since last Friday.

The S&P rally started in October after a 4-month rise in Treasury yields to a 16-year high of 5% when 1) the Treasury announced plans to reduce the size of bond auctions, and 2) the Fed indicated that they would stop raising rates and would likely cut rates at least three times in 2024.

Israel and Iran appear to have stepped back from further escalations, and technical metrics indicate short-term oversold conditions. If equity indices can’t bounce from here, then longer-term bearish considerations may be in play.

Interest rates

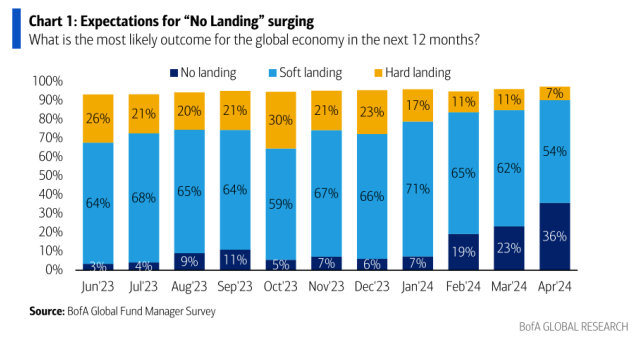

The BoA Fund Manager Survey shows that the “robust economy” is expected to continue.

These economic expectations and stronger-than-expected inflation reports are causing the market to believe the Fed will be higher for longer.

Currencies

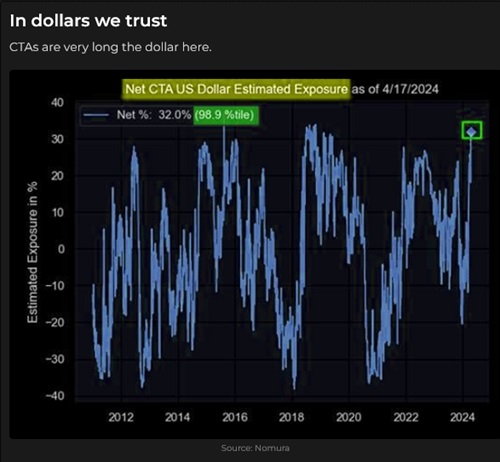

Since December, the US Dollar Index has risen on the idea that foreign central banks will cut rates sooner and possibly more than the Fed—interest rate differentials matter.

The Japanese Yen plumbed fresh 34-year lows this week despite statements from (Japanese and Korean) authorities that they are “concerned” about the strength of the US Dollar.

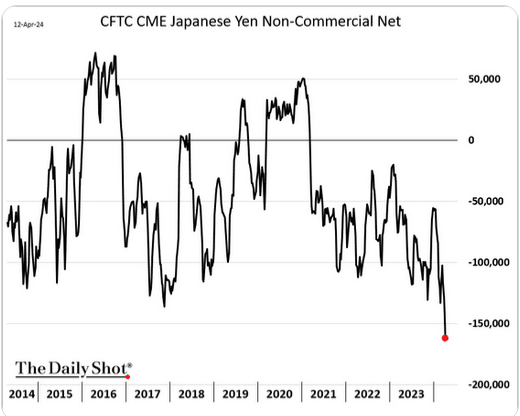

The net-short spec positioning against the Yen in the futures market rose to a new 9-year high this week while open interest is at record highs (X delivery period spikes.)

The Swiss Franc spiked Thursday night on reports of “explosions” in Iran (presumably, the Israelis were involved), but when markets assessed that the retaliation was modest, the Franc fell back.

This week, net-short spec positioning against the Swiss Franc rose to a new 5-year high, with open interest at multi-year highs. Speculative bets against the Swiss have ramped sharply since January, as the currency fell from All-Time highs against the Euro in December (and, effectively, All-Time highs against the USD—save for a brief spike in 2011).

The Canadian Dollar dropped nearly 5% from December highs to this week’s lows. The decline accelerated last week when the CAD took out its February and March lows.

The net-short spec positioning against the CAD has soared to a 7-year high from an (effectively) flat position in early March (that was quick!) A substantial chunk of that short position was established within a few days of the recent low.

The Mexican Peso has been the “strongest currency in the world,” rising over 50% against the USD from historic lows during the March 2020 COVID-19 crisis. As noted in my recent posts, Mexican short-term interest rates are around 11%, which has attracted carry trade and other speculative buying of the Peso. Net-long spec positioning is at a 4-year high.

In last week’s Notes, I wondered if the Peso had become “too strong” for Mexico and if Banxico might start cutting short rates, given that their inflation rate was around 4%. If the Peso began to fall, the long specs would probably become sellers. I decided to watch for an opportunity to short the Peso.

The Peso was weak on Monday and fell to a 6-week low on Tuesday as “risk-off” sentiment hit the markets (or you could say the MEX was highly correlated to the falling S&P.)

On Thursday evening (Pacific Coast Time), reports of “explosions” in Iran hit the market, and risk-off sentiment skyrocketed. The Peso fell ~6% in a matter of minutes (there’s not a lot of liquidity in MEX pairs during the “Asian” trade session at the best of times.) Within a couple of hours, as markets assessed that the “retaliation” had been modest, MEX bounced back to pre-explosion levels, but “somebody” who had been long MEX likely got destroyed on that “no bid” break.

Will the US Dollar weaken?

There are perennial USD bears who argue that the Dollar is not worth the paper it’s printed on. I understand. But in the world of currency trading, we’re looking at one currency relative to another, and if one currency is “the cleanest dirty shirt in the laundry basket,” that’s the one you want to own.

The last time the United States had a trade surplus was in 1975. Every year since then, the USA has run a (goods and services) trade deficit with the rest of the world, which is approaching $1 trillion annually. Many analysts would argue that this deficit shows that the USD is overvalued against other currencies, especially Asian currencies. I agree. Many analysts would further say that several countries, especially Asian countries, have a deliberate mercantilist policy to keep their currency low to increase export earnings. I agree.

But despite this trade deficit, money keeps “coming to America for safety and opportunity” – in effect, “balancing the books” against the trade deficit.

The USD is strong against other currencies because of “American exceptionalism,” a strong economy, self-sufficiency in fossil fuel energy, and military superiority. It is a safe haven and the world’s reserve currency.

Gold

Comex gold futures closed Friday at a new All-Time high, up ~$350 (17%) since the breakout rally on March 1.

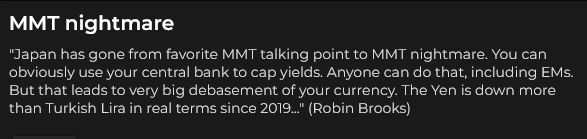

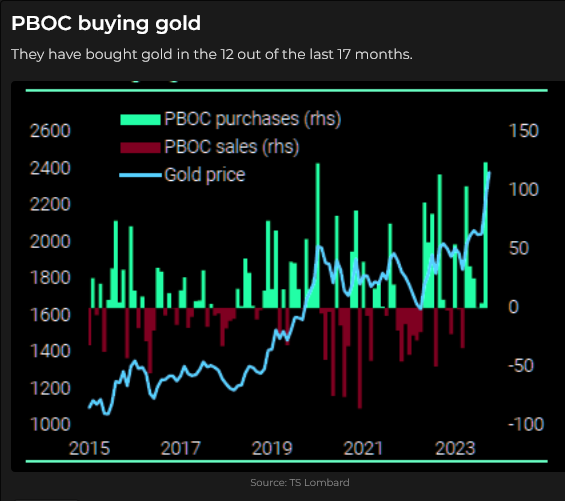

Last week, I wrote about the “mystery” of gold rising while the USD and interest rates also rose. People understand that geopolitical tensions boost the price of gold and that central banks (especially China) have increased their purchases since the Russian invasion of Ukraine. The declining purchasing power of fiat currencies has also been a motivating factor for gold buyers, as has the rapid increase in government debt and debt service costs (and the possibility that “someday” central banks will have to bail out the governments.)

However, there is a sense that “something else” is driving the gold price higher, given that European and North American markets are certainly not showing signs of a stampede into gold. (Gold ETF holdings have been a net negative since 2021; Comex open interest, volumes and positioning have been “steady” for the past several weeks.)

I’ve proposed that Chinese retail buying may not get the credit it deserves, given the premium of Shanghai spot prices over London/New York. Wealthy Chinese citizens have many good reasons to buy bullion.

A London-based gold analyst, Ross Norman, reported that “monumental” gold options had been bought in the opaque OTC markets, speculating that hedge funds may have been making highly leveraged bets that gold prices would soar.

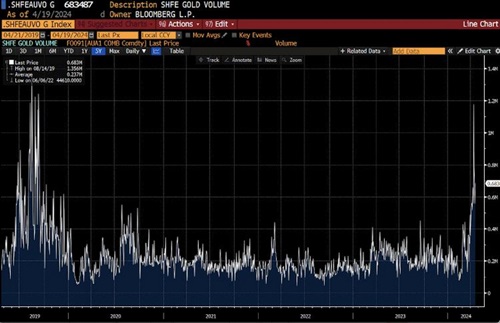

Ross had a new idea this week that makes a lot of sense to me. It is a refinement of my Chinese retail buying idea. Ross suggests that Chinese retail is aggressively buying gold futures on the Shanghai futures market, and this chart shows a massive increase in trade volume in the past few weeks.

Ross suggests that Chinese speculators have a history of storming into a market and driving it far higher than it otherwise would go. (Read the “Ross had a new idea” link above for more detail.)

If Ross is right about a tidal wave of highly-levered Chinese retail buying driving the gold market – watch out – our traditional valuation metrics for the gold price will be meaningless! (The Shanghai Futures Exchange just increased gold margin requirements.)

Here’s a chart of the Shanghai stock index showing what happened in 2007 and again in 2014 when Chinese retail buyers drove prices sky-high.

One last point: I’m not saying, “Buy gold because Chinese retail buyers will drive it to the moon.” Ross notes that they seem to have been big buyers, which may continue, but if/when they stop buying, prices could have a substantial correction.

My short-term trading

I started this week with a short S&P position established last week. When Iran attacked Israel over the weekend, I initially assumed the market would open lower on Sunday afternoon. I covered my short position for a modest gain when it didn’t. (I don’t want to be short if a market won’t fall on bearish news.)

I bought the S&P a couple of times later in the week, looking for a bounce from oversold levels, and was stopped for tiny losses.

I shorted gold, thinking that “risk-off” sentiment might cause prices to fall, but my tight stop was hit Thursday night when the “explosions” happened in Iran.

I bought the Swiss Franc, but my stop was hit for a slight loss on a dip shortly before the Swiss soared on the Thursday night “explosions.”

I bought the CAD on Thursday and held the position into the weekend with a small unrealized gain.

My net P+L for the week was another slight loss.

Thoughts on trading

As I’ve said before, trading is not a game of perfect! I had a frustrating week, given that I was looking to short the MEX, but I didn’t see a good setup (a good risk/reward entry point), so I didn’t benefit when it tumbled. I was stopped on my long Swiss just before it soared, and I covered my short S&P far too early. But I survived.

I make money trading not because I have a great crystal ball but because I’m disciplined about managing risks. My win/loss ratio is probably less than 40/60 over time, and sometimes it feels like 0/100!

Sizing is probably my most important risk management tool, which means that even if I have a very bad week, I’ll probably lose less than 2% of my trading capital.

A trader’s main job is to defend his capital – to survive.

Quote of the week

“Nobody ever thanks you for not taking a holiday!” – Peter Appleby, veteran lumber futures trader.

The Barney report

I took Barney out around noon today for a quick walk in the forest. He found a good stick to chew on, and we were nearly back home when he spotted a rabbit. When he sees a rabbit, he goes into an ultra-slow-motion stalking mode as though he is Mr. Invisible and will be able to sneak up on it. It never works, but it’s fun to watch.

Listen to Victor talk markets with Mike Campbell

This morning, on the Moneytalks show, Mike and I discussed the Iran/Israel attacks and their impact on stocks, currencies, and gold. You can listen to the entire show here. My spot with Mike starts around the one-hour, nine-minute mark.

I also did my monthly 30-minute interview with Jim Goddard this morning on the This Week In Money show. We discussed the attacks and their effect on markets, the re-pricing of inflation, stocks, currencies and gold, and what’s on my “radar” for next week. Jim also interviewed my longtime friends Ross Clark and Danielle Park. You can listen to the entire show here. My spot with Jim begins around the 54-minute mark.

The Archive

READERS CAN ACCESS WEEKLY TRADING DESK NOTES FROM THE PAST SEVEN YEARS BY CLICKING THE GOOD OLD STUFF-ARCHIVE BUTTON ON THE RIGHT SIDE OF THIS PAGE.

Headsupguys

There’s a reason I put a link to Headsupguys in my Notes every week. I’ve had friends who took their own lives, and Headsupguys helps men struggling with depression.

Subscribe: You have free access to everything on this site. Subscribers receive an email alert when I post something new, usually four to six times a month.

Victor Adair retired from the Canadian brokerage business in 2020 after 44 years and is no longer licensed to provide investment advice. Nothing on this website is investment advice for anyone about anything.

STAY INFORMED! Receive our Weekly Recap of thought provoking articles, podcasts, and radio delivered to your inbox for FREE! Sign up here for the HoweStreet.com Weekly Recap.

Victor Adair April 20th, 2024

Posted In: Victor Adair Blog