April 1, 2024 | Productivity Emergency

Happy Monday Morning!

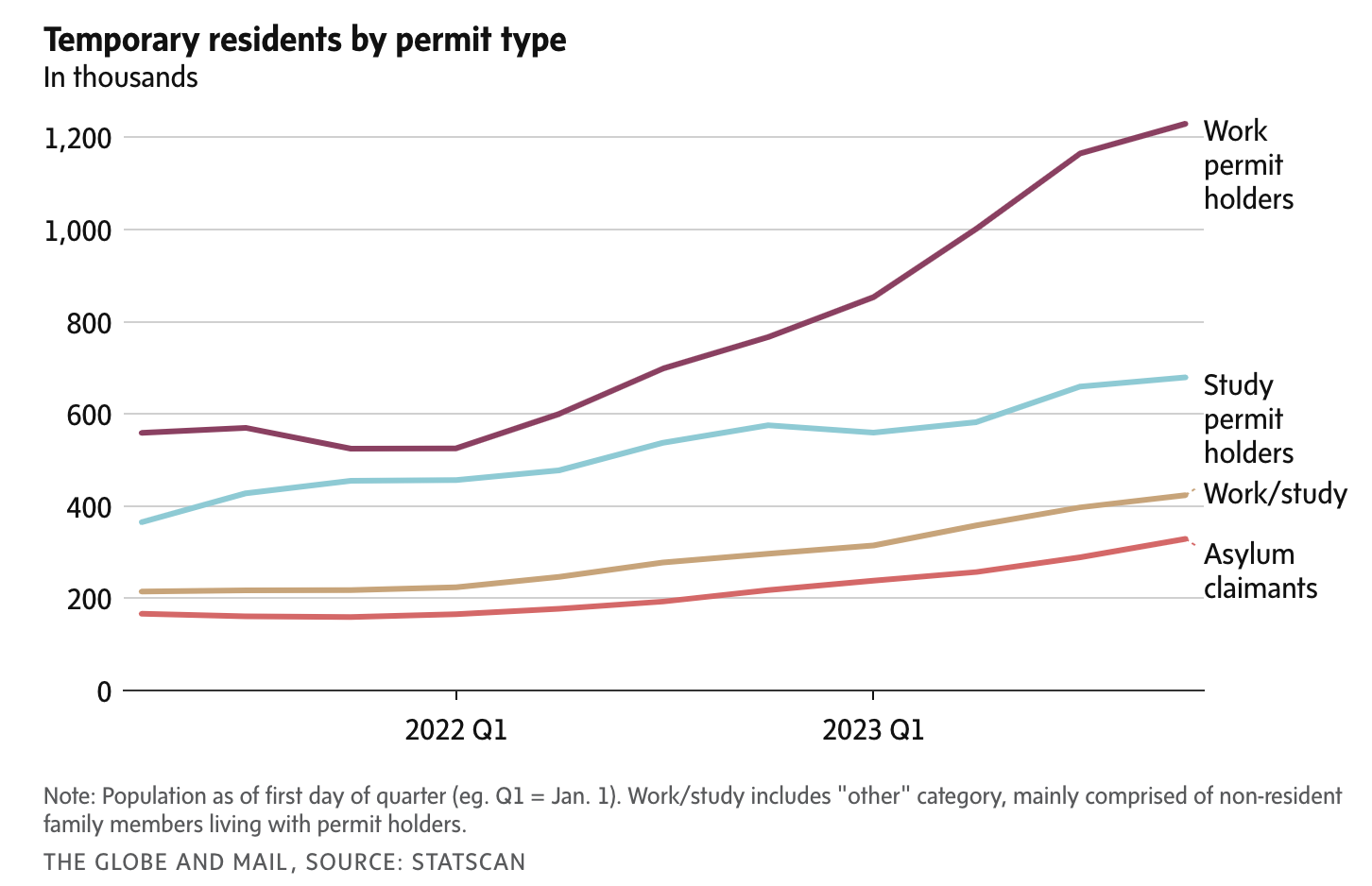

The Canadian population ballooned by nearly 1.3 million in 2023, Stats Canada reported this past week. The expansion was fuelled largely by the arrival of temporary residents, which include international students, asylum seekers and people in Canada on work permits. Last year, their ranks grew by slightly more than 800,000, according to the new Statscan figures.

As of January 01, Canada was home to 2.67 million temporary residents, a near doubling in just two years. They now make up 6.5% of the country’s population, a number which urgently needs to get down to 5% by 2027 according to a new shift in policy from immigration minister Marc Miller.

As we discussed last week, if Miller is successful in fixing the problem his government created, it will bring population growth down from 1.3 million to about 290,000 within the next year, per analysis from my good friend Ben Rabidoux who joined me on The Loonie Hour podcast this past week.

Make no mistake, a swift reduction in population growth is the single most effective policy measure that can provide immediate relief to the housing market. After all, we won’t be building ourselves out of this mess anytime soon. Housing starts continue to roll over, choking on higher interest rates.

Meanwhile, the record high for housing completions totalled 257,243 units back in 1974. In other words, barring a technological revolution in home building, we have serious capacity constraints. Hard to believe we are less productive today when it comes to building housing than we were 50 years ago. No wonder the Bank of Canada is sounding the alarm.

Perhaps it has something to do with the layers of bureaucracy getting in the way, at nearly every level. Everywhere you turn more compliance, more paperwork to fill out, and a ballooning public sector to administer it.

Look no further than the new ‘Renters Bill of Rights’. A solution in search of a problem, the new bill proposes landlords to disclose a clear history of apartment pricing, a nationwide standard lease agreement, and a requirement for landlords to report tenants rental history to the credit bureaus.

This announcement is so insanely ridiculous it has me scratching my head wondering who is being paid to advise this government on housing policy?

Documenting past rent prices will do nothing to alleviate rent inflation, nor does it give any tenant additonal bargaining power when vacancy rates across all major metros are sub 3%. Are the feds creating a new app to report rents and credit scores? Perhaps we can call this one ‘RentCan’…

Then you have the national lease agreement, which makes no sense considering tenancy laws are provincial jurisdiction, all of which already have standard tenancy agreements in place.

In addition to that we’re going to ask Mom & Pop landlords, who make up the bulk of the rental market, to report tenant payment history directly to the credit bureaus? This is incredibly far-fetched and a paperwork nightmare.

Speaking of nightmares, it was just reported that the Federal government’s Under Utilized Housing tax has been a total flop. It was projected to collect $200M in taxes but so far has only collected $49M but has cost CRA $59M to administer. The worst part is that homeowners are spending, on average, between $500-700 in accounting fees just to remain compliant.

If you’re a resident of Vancouver such as myself you now have to file an annual empty homes tax declaration, a BC speculation tax declaration, a Federal government under utilizied housing tax declaration, and soon if you’re a landlord- a bare trust declaration, past rental and tenant credit history.

Figuring out the productivy dilemma in this country really isn’t that hard. There is too much bloat.

As the BoC’s Carolyn Rogers noted, you’ve seen those signs that say, “In emergency, break glass.” Well, it’s time to break the glass.

Canada’s productivity in the business sector has seen an average annual decline of 0.3% over the past five years, while the U.S. has managed a 1.7% gain.

As a result, GDP per capita has dropped for six consecutive quarters, and is now no higher than it was in 2017. After mostly keeping pace with the U.S. on this measure for 25 years, Canada has fallen far behind since 2015. You can draw your own conclusions.

STAY INFORMED! Receive our Weekly Recap of thought provoking articles, podcasts, and radio delivered to your inbox for FREE! Sign up here for the HoweStreet.com Weekly Recap.

Steve Saretsky April 1st, 2024

Posted In: Steve Saretsky Blog

Next: All In and Then Some »