April 12, 2024 | CPI Shocker Could Affect The U.S. Election

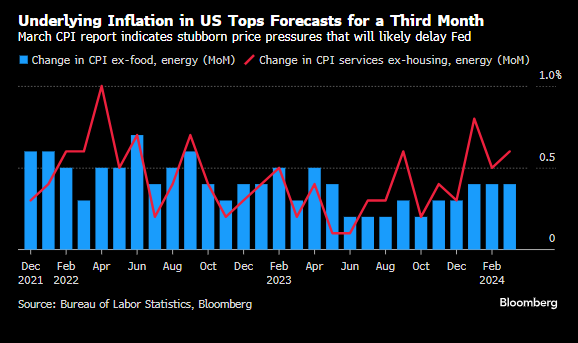

The U.S. Consumer Price Index exceeded expectations, growing by 4.8 percent (annualized) in the month of March, while Core CPI rose 3.8 percent from last year.

The markets corrected sharply after the surprise as the market expected lower inflation leading to rate cuts.

President Joe Biden said that he still expects the Federal Reserve to cut rates before the end of this year.

Will Joe Biden get his wish? How does stronger inflation affect the election?

In a shocking report that showed inflation rising faster than expected for the third consecutive month, traders’ hope for a cycle of aggressive rate cuts evaporated. Shelter costs remained sticky with rents going higher.

Before this report as many as four rate cuts, for a total of 200 basis points, were expected by the end of this year.

These numbers are for core CPI measures in the blue bars, and CPI Services in the red line. With this trend turning higher it is hard to imagine that the Fed can justify a rate cut in June. And later this year the year-over-year numbers will look bigger compared to a slump in the CPI from June to August 2023.

The U.S. dollar strengthened, pushing the Canadian dollar lower. The Bank of Canada might have to hike rates if it wants to avoid a sub-70 cents dollar.

The U.S. election will be in early November, and Biden’s campaign is desperate for some good economic news as polls show Biden lagging Donald Trump in some key swing states.

In the markets traders are having to adjust to the possibility that 10-year bond rates might go back up to the 4.6 percent level. And this is happening when a record amount of new supply of government bonds is expected to hit the market in the next six months. Last month the 10-year Treasury was issued at 4.166 percent.

Traders were caught on the wrong side of the trade with their expectations for a weaker CPI, which meant interest rates would have dropped. But traders will get over this quickly, while election campaigners will have to live with the possibility of no rate cuts for the next six months.

Most Americans are well aware that inflation has not gone away. Every day they are reminded at the grocery store, the gas station and the travel booking site that prices are substantially higher than a few years ago. Restaurant meals are now ridiculously expensive, although people are still willing to pay the price. House prices and rents have been rising in the U.S. Credit card stress has arrived:

This month’s CPI and those that will follow in the spring and summer might force the Fed to delay cuts until September. And if the Fed cuts in September, without a clearcut justification from the data, there will be widespread calls of election interference to support Biden.

For the Fed to keep its reputation for independence, a rate cut might have to wait until after the November election.

Hilliard MacBeth

The opinions expressed in this report are the opinions of the author and readers should not assume they reflect the opinions or recommendations of Richardson Wealth or its affiliates. Assumptions, opinions and estimates constitute the author’s judgment as of the date of this material and are subject to change without notice. We do not warrant the completeness or accuracy of this material, and it should not be relied upon as such. Before acting on any recommendation, you should consider whether it is suitable for your particular circumstances and, if necessary, seek professional advice. Past performance is not indicative of future results. The comments contained herein are general in nature and are not intended to be, nor should be construed to be, legal or tax advice to any particular individual. Accordingly, individuals should consult their own legal or tax advisors for advice with respect to the tax consequences to them, having regard to their own particular circumstances.. Richardson Wealth is a member of Canadian Investor Protection Fund. Richardson Wealth is a trademark by its respective owners used under license by Richardson Wealth.

STAY INFORMED! Receive our Weekly Recap of thought provoking articles, podcasts, and radio delivered to your inbox for FREE! Sign up here for the HoweStreet.com Weekly Recap.

Hilliard MacBeth April 12th, 2024

Posted In: Hilliard's Weekend Notebook