March 16, 2024 | Trading Desk Notes For March 16, 2024

Short and long-term interest rates rose every day this week. Are higher rates starting to matter?

The S&P and the NAZ closed lower again this week – the first time those indices have seen back-to-back weekly declines since October.

Yields on the 10-year Note hit a 16-year high (~5%) in October (as stock indices hit a 5-month low) and fell to ~3.8% in December. Stock indices rallied with the bond market from October to December, but since December, the indices have continued to rally even as bond yields reversed higher. Is that “disconnect” starting to matter? (The purple line is the 10-year yield inverted, and the gold line is the NAZ.)

Since mid-January, the S&P has rallied ~8% while the forward interest rate market has repriced Fed activity this year from six or seven cuts to three.

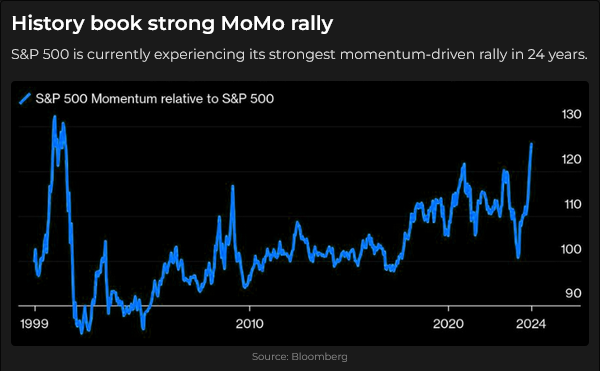

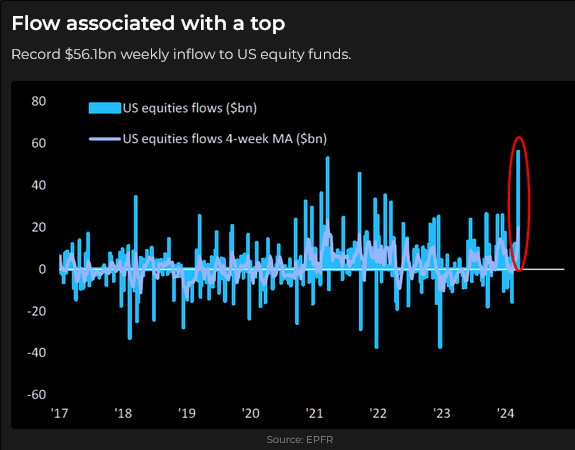

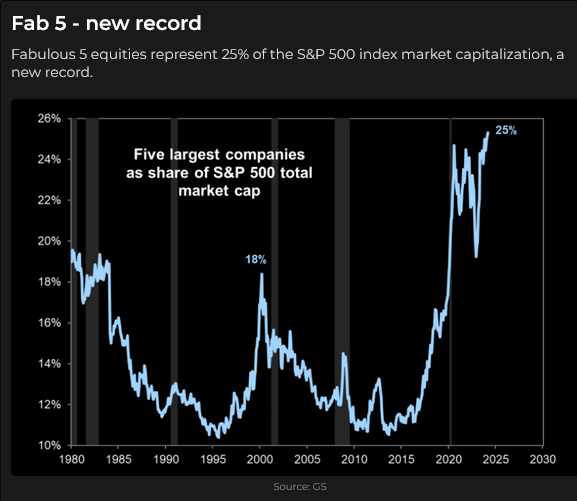

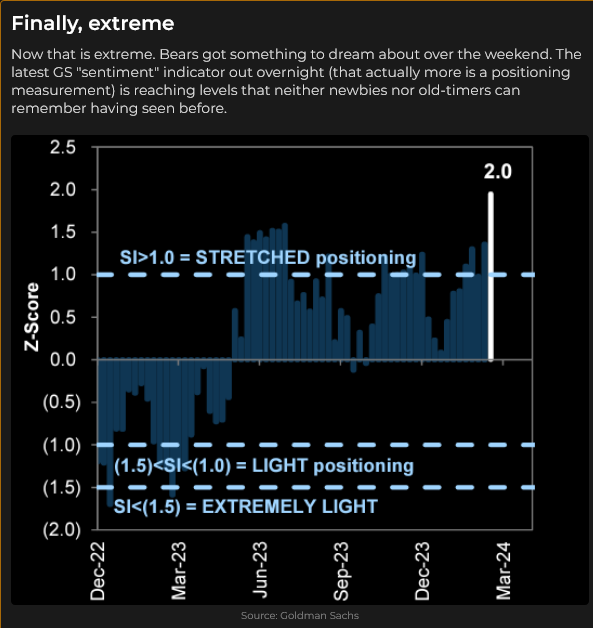

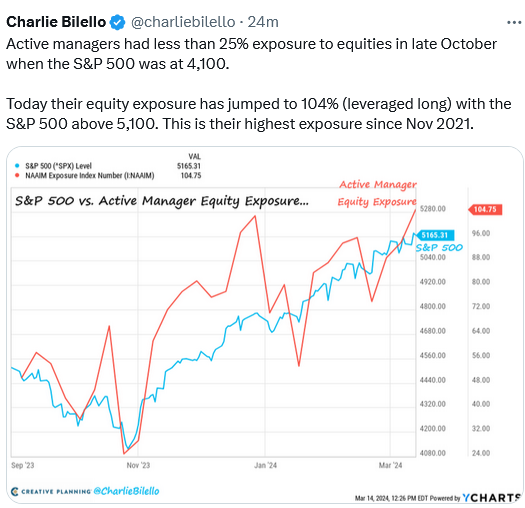

Over the past few weeks, I have argued that stocks are in an “irrational exuberance” phase, driven by momentum and FOMO, and are at risk of a sharp correction.

Friday, March 8, may have been a Key Turn Date

I pay a lot of attention to correlations between different markets. When several different markets turn on or around the same date, something significant has happened, and I call it a “Key Turn Date.”

On March 8, the S&P, the NAZ, the SOXX and gold made All-Time Highs and turned lower. Bitcoin also made an ATH on March 8, traded higher for the next few days, but closed lower this week, below the March 8 high.

The Euro made an 8-week high on March 8 and turned lower.

The CAD made a 5-week high on March 8 and turned lower.

The US Dollar Index made an 8-week low on March 8 and turned higher.

The 2-year Note made a 4-week high on March 8 and turned lower.

The softer-than-expected US employment report on March 8 supported expectations of rate cuts starting in June. This week’s inflation reports reversed those expectations, and prices now reflect inflation and interest rates staying higher for longer.

Gold

Gold rallied ~ $170 in 8 trading sessions, taking the Comex April futures to an All-Time high above $2,200 on March 8. Open interest has increased by ~30% since the end of February, while the COT reports show that net long speculative positioning has increased by ~40%.

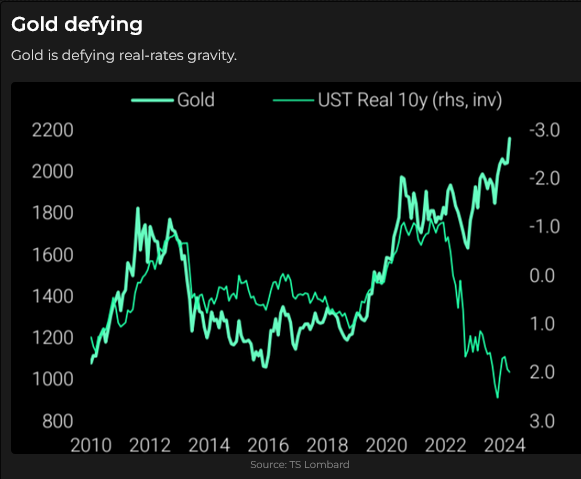

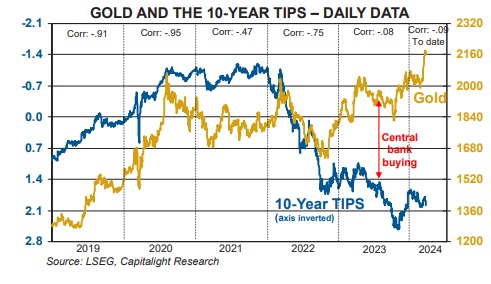

Gold and real US interest rates have been strongly correlated for several years, but that relationship broke down in 2023 as gold prices rose despite rising real interest rates.

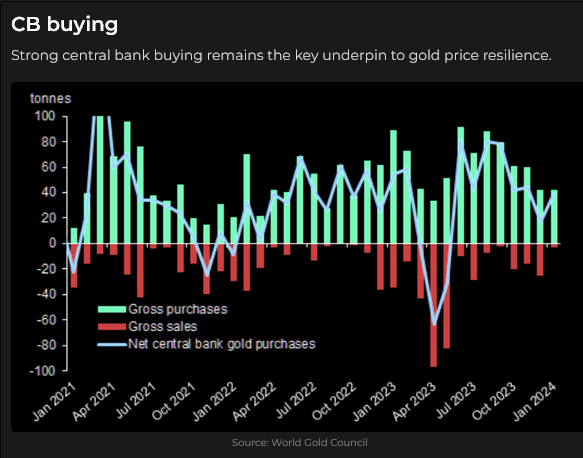

When a strong correlation breaks down, people wonder why and, in this case, analysts, like my friend Martin Murenbeeld, suggest that strong central bank buying may have “offset” the downward pressure that rising real interest rates would otherwise have imposed on gold.

I agree that the central banks have been a potent force and that continuing government deficit spending is a good reason for rising gold prices. However, I wonder if this recent spike has been driven by the same “animal spirits” that have buoyed stocks and crypto markets. If so, will rising interest rates pull gold prices lower?

My short-term trading

I started this week with a Yen bull call spread, long corn calls, long SOFR (short-term US interest rates), and short CAD.

I covered the corn calls for a tiny loss. Since I bought the calls, corn had rallied a bit, but Theta was working against me.

I covered the SOFR futures for a slight loss. I had been nicely ahead at the March 8 highs, but the market moved against me since then, so I got out.

I bought OTM Yen calls two weeks ago and sold higher calls after the market had a good rally, essentially giving myself a “free call” on the Yen going into next week’s BoJ meeting.

I kept the short CAD position, which has been going my way.

I shorted gold and the S&P this week and kept those positions into the weekend.

On my radar

The BoJ meets on Monday and Tuesday and may take an initial step to tighten monetary policy. If traders think Japanese investors will start to sell UST holdings and repatriate funds to their domestic market, that may positively impact the Yen and hurt the US Treasury market.

The FOMC meets on Tuesday and Wednesday and may give the market some “guidance” about future policies.

If March 8 was a Key Turn Date, there may be further downside pressure on markets that have rallied on “speculative excesses.”

Inflation: I’m staying with my view that inflation will remain higher for longer. I think the “core” cause of inflation was the massive fiscal stimulus during and after the covid time, and I expect government deficit spending will continue. That devalues the purchasing power of fiat currencies, which is the essence of inflation. I expect the Fed will tolerate or accept an inflation rate above 2%.

The ECB looks likely to cut interest rates before and more than the Fed, which will probably pressure the EURUSD and most other currencies against the USD.

I’m watching the Swiss Franc fall against the Euro and the USD. COT data shows (large and small) specs holding near-record net short CHFUSD positions.

MEXUSD is at 9-year highs, up ~55% from the covid lows four years ago, with large specs holding a 4-year record net long position. Is it vulnerable to a turn?

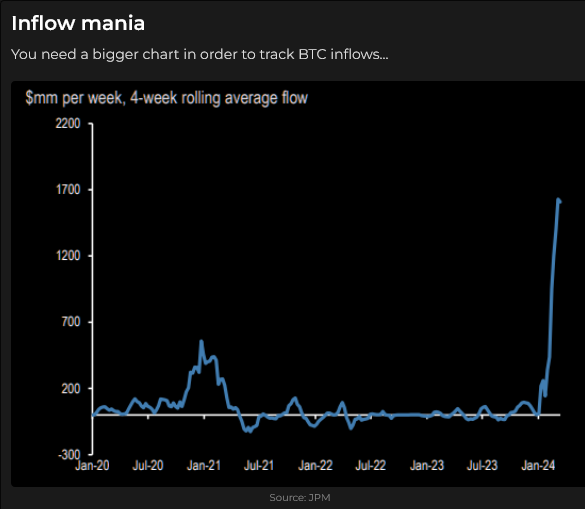

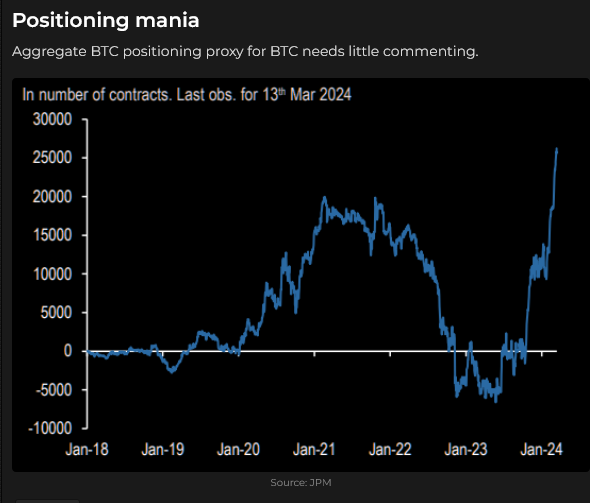

I see a sentiment correlation between soaring crypto and “hot” stocks. They have gone up together and may fall together.

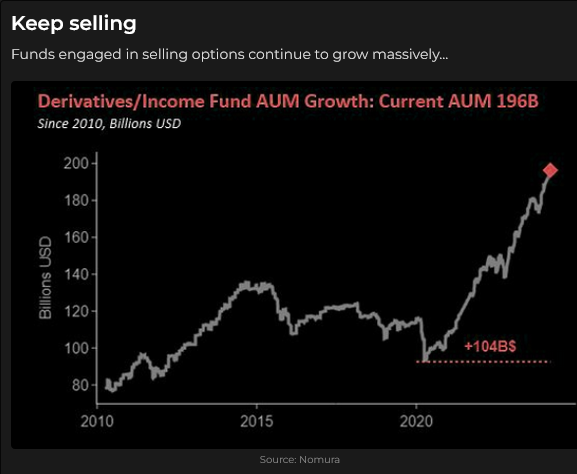

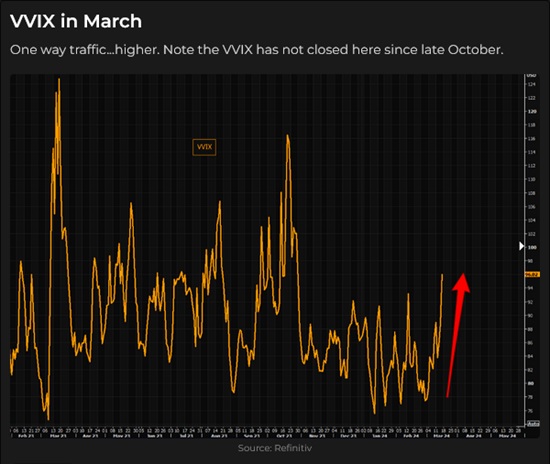

Volatility across assets has been squashed. Complacency is undoubtedly a factor, but I suspect that, as part of the “irrational exuberance” mood, there has been a lot of speculative put-selling (“free money, bro”) and a flow of money into “yield enhanced products” that sell options. If speculative markets reverse, option VOL will rise and may accelerate selling pressure (actually, it’s already starting to happen.)

Thoughts on trading

Last week, I recommended an interview between Peter Brandt and Jason Shapiro that was released the day after I posted the March 9 TD Notes. I’ve watched the interview twice, and it is one of the best trader-to-trader interviews I’ve ever seen (and I’ve seen a lot).

I subscribe to services offered by both Peter and Jason. They are successful veteran traders, and they were both in Jack Schwager’s “Unknown Market Wizards” book.

Although their trading styles differ dramatically, they both stress that risk management is critically important. I like to say that I make money because I’m good at managing risk, not because I have a great crystal ball. Peter and Jason would agree!

Here’s the link to the interview: https://www.youtube.com/watch?v=0_UAFUeAfmw

The Barney report

I was walking Barney on a leash two days ago when a rabbit popped out of the bush. Barney lunged at it, and the leash broke. Barney disappeared after the rabbit. I ran after him but couldn’t see where he had gone. I started my “Barney come back” whistling, and a few minutes later, he returned – thankfully, without a rabbit!

This morning, we were out before sunrise and met two people with a dog on the abandoned railroad tracks. Playtime, and a few minutes later, two very muddy dogs, which meant Barney and I went straight to the shower when we got home. Now he’s snoozing while I write my Notes.

Listen to Victor talk markets with Mike Campbell

On this morning’s Moneytalks show, Mike and I discussed how rising interest rates are starting to matter for stocks, gold, and currencies and how March 8 may have been a “pivot” day for sentiment across markets. We also discussed the BoJ and FOMC meeting this coming week and how markets are vulnerable to a VOL spike if some of the hot markets reverse. You can listen to the entire show here. My session with Mike starts around the 59-minute mark.

I also did my monthly 30-minute interview with Jim Goddard on the “This Week In Money” show. We discussed my macro view on markets and drilled down on stocks, interest rates, currencies and gold. You can listen to the interview here. My session with Jim starts around the 9.38-minute mark.

The Archive

READERS CAN ACCESS WEEKLY TRADING DESK NOTES FROM THE PAST SEVEN YEARS BY CLICKING THE GOOD OLD STUFF-ARCHIVE BUTTON ON THE RIGHT SIDE OF THIS PAGE.

Headsupguys

There’s a reason I put a link to Headsupguys in my Notes every week. I’ve had friends who took their own lives, and Headsupguys helps men struggling with depression.

Subscribe: You have free access to everything on this site. Subscribers receive an email alert when I post something new, usually four to six times a month.

Victor Adair retired from the Canadian brokerage business in 2020 after 44 years and is no longer licensed to provide investment advice. Nothing on this website is investment advice for anyone about anything.

STAY INFORMED! Receive our Weekly Recap of thought provoking articles, podcasts, and radio delivered to your inbox for FREE! Sign up here for the HoweStreet.com Weekly Recap.

Victor Adair March 16th, 2024

Posted In: Victor Adair Blog