February 4, 2024 | Wall Street Guns Its Perpetual Motion Engine

Here are a couple of headlines concerning the economy that appeared atop Bloomberg’s front page on the same day last week. Taken together, they could make one’s head spin. First the happy news: IMF Lifts World GDP Outlook on U.S. Strength. But here’s the article just beneath: UPS to Cut 12,000 Jobs. A case of schizophrenia on the copy desk — or were they just trying to be provocative? Since no mainstream news outlet save USA Today out-cheerleads the economy (and crime-infested Gotham) more obnoxiously than Bloomberg, we can assume that the UPS layoffs were simply too important to bury on an inside page. The company is one of America’s biggest employers, and its ubiquitous delivery trucks are a visual bellwether for the economy — so much so that it would not exaggerate to say, “As UPS goes, so goes the nation.”

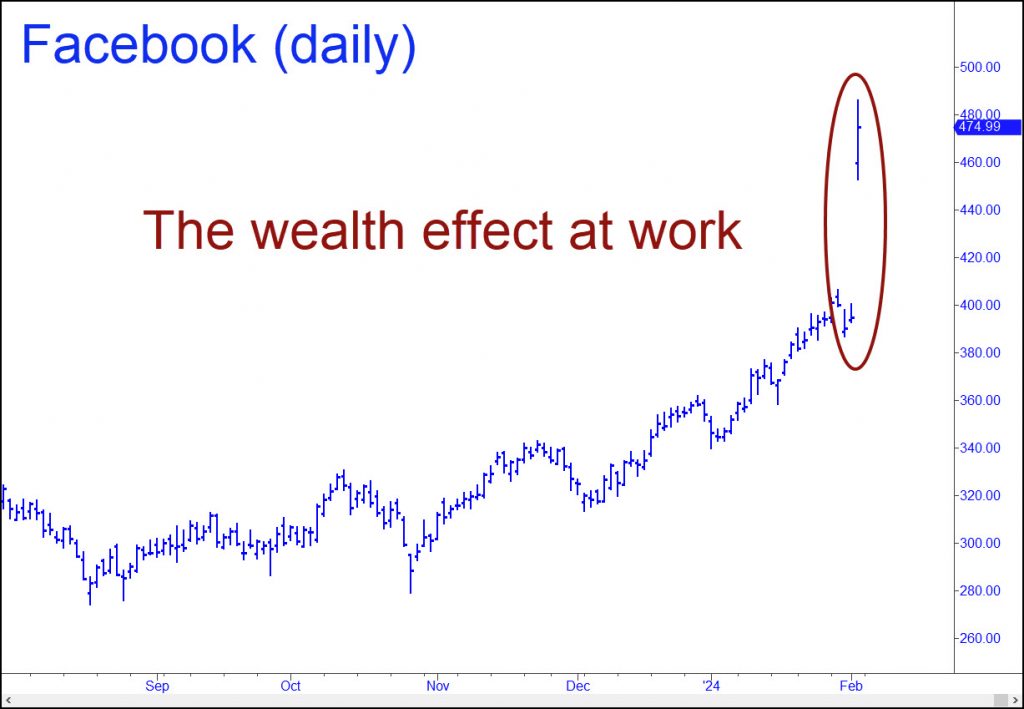

Amazon has been laying off as well, but it is predictable that both stories will ultimately get less ink than Facebook’s whoopee-cushion leap Thursday triggered by an earnings beat and some other smiley-face ‘surprises’ from Zuckerberg. The glorified advertising firm’s shares tacked on an instant $66 after the close, adding a reported $200 billion to the global ledger and $50 billion to Zoggerbird’s piggy bank. We’ve discussed these wild but frequent effusions before, and how they contribute enormous sums to the ‘wealth effect’ without altering the economy in any real or constructive way. Sure, a few of the big winners will reward themselves for all their hard work by buying ocean-going yachts and Lamborghinis in crazy colors. But most of the money will get plowed right back into the market, the better to pump still more gaseous wealth into a handful of stocks held unto death by portfolio managers.

A Dollar Krakatoa

Actually, even hydrogen has more substance than the dollars created when stocks get short-squeezed as Facebook did the other day. Such rallies leave huge gaps on the chart, air pockets within which neither money nor shares changes hands. If that’s not a perpetual motion machine, I don’t know what is. Under the circumstances, the temptation is irresistible for Wall Street’s adroit mechanics to stimulate and reproduce the effect whenever possible. AAPL’s manipulators do it all the time, goosing the stock at the opening several times a month on zero volume. Until Facebook’s huge move, Apple shares held the record for the most wealth-effect dollars created in a single day. Records are made to be broken, of course, and so we shouldn’t be surprised if some other stock in the lunatic sector one-ups Facebook’s monetary Krakatoa sometime soon. It’s so much easier than trying to expand the money supply the old-fashioned way — i.e., by having the central bank tinker with interest rates. That requires the sought dollars to be borrowed into existence. The short-squeeze method accomplishes the same goal without effort or even any buying, literally in the blink of an eye.

One record that is certain to be broken and which will make Facebook’s $200 billion tumescence look like small change will be the dollars that vanish into hyperspace when the bubble finally pops. There will be no dollar figure in Bloomberg’s headline that evening, since the loss will be far too large and all-encompassing to calculate, presumably in the many hundreds of trillions of dollars. The good news, if you could call it that, is that most of those dollars don’t even exist; they are just Monopoly money, but with twelve zeros added to each paper bill.

STAY INFORMED! Receive our Weekly Recap of thought provoking articles, podcasts, and radio delivered to your inbox for FREE! Sign up here for the HoweStreet.com Weekly Recap.

Rick Ackerman February 4th, 2024

Posted In: Rick's Picks

Next: Industrial Size Surplus »