January 6, 2024 | Trading Desk Notes For January 6, 2024

After closing higher for nine consecutive weeks and making new All-Time Highs, Nasdaq 100 futures took a “refreshing” pause to start the New Year

The NAZ rallied ~60% in 2023, its best performance since the fabulous 1999 Dot.com days. (Veteran campaigners may remember that the NAZ rose an additional 30% by March 2000 but then fell ~68% over the next 12 months. 18 months later, it was down ~84% from the March 2000 record highs.)

AAPL shares hit All-Time Highs in mid-December, then fell nearly 10% to this week’s lows.

AAPL shares have had a spectacular rally over the last 20 years. They traded as low as 25 cents in 2003 on a split-adjusted basis.

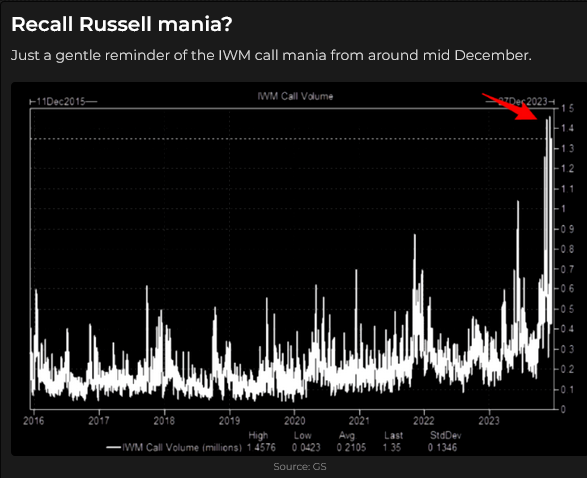

Russell 2000 (small cap) futures rallied ~28% from their October lows to December highs, the best 2-month gain of any of the major indices as investor sentiment swung from risk-off to risk-on, driven by the perception that Fed policy had changed from “higher for longer” to “several cuts in 2024.”

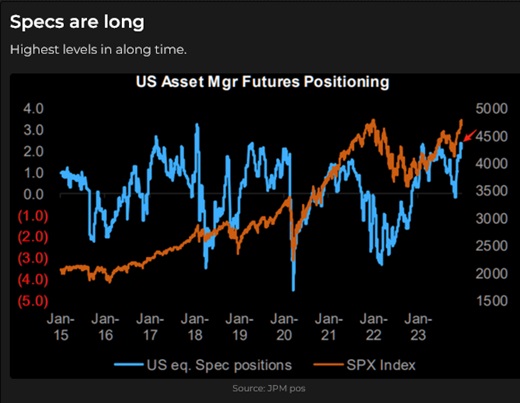

During the November/December stock market rally, buying was accelerated by people having to “reverse” bearish positions established in the August to October downtrend.

ARKK shares, down ~80% in October from their 2021 All-Time highs, rallied nearly 60% in two months as “risk appetite” improved. (At this week’s lows, ARKK was off ~12% from the December highs.)

Interest rates

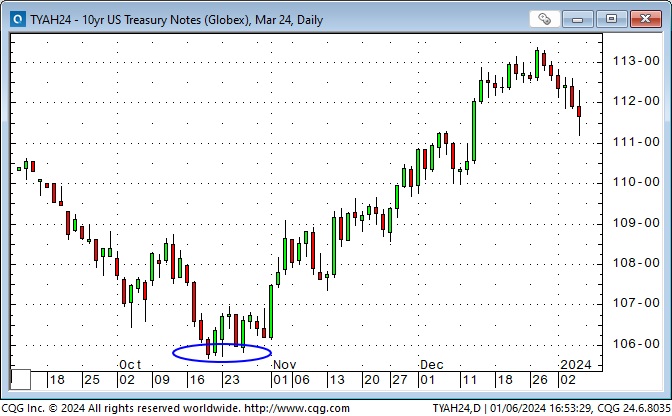

The perceived shift in Fed policy from “higher for longer” to “several cuts in 2024” caused dramatic repricing in credit markets between October and December. The 3-month SOFR December 2024 futures rallied ~115 bps, reflecting the market’s view that short rates would be ~160 bps lower in December 2024 than in December 2023. At this week’s close, the market had reduced the December 2024 expectations by ~20 bps.

10-year bond futures traded to a 16-year low in October (a cash market yield of ~5%) but had their best 2-month rally in years in November and December (with the yield down to ~3.8%.) Bullish bond market sentiment has weakened since late December, indicating that prices had risen too quickly.

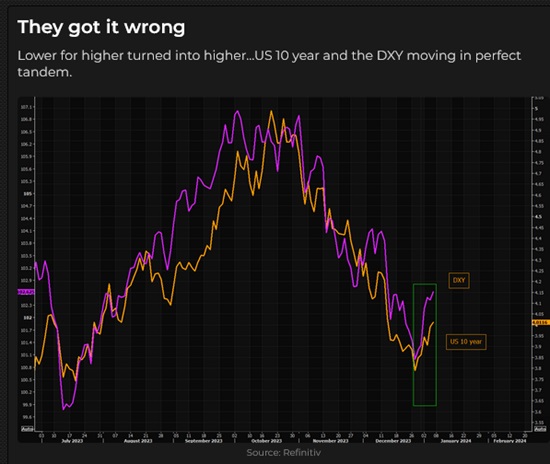

This chart from June 2023 to January 2024 shows the close correlation between the Nasdaq and the US 10-Year Treasury bond.

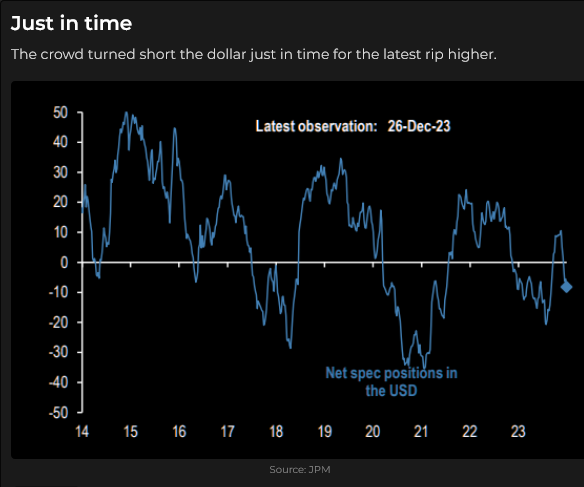

Currencies

The US Dollar fell against virtually all other currencies from late October to late December as the perceived shift in Fed policy from “higher for longer” to “several cuts in 2024” created an “all one market” environment that saw stocks, bonds and gold rise while the USD fell. Like stocks, bonds, and gold, the US dollar index reversed course in the new year.

This chart from June 2023 to the first week of 2024 shows the close correlation between the US Dollar Index and the US 10-year Treasury.

Gold

Gold nearly made a new low for the year in early October but rallied ~$200 (~11%) following the Hamas attack on Israel and the Israeli response. In November and December, the price continued to rally on geopolitical stress (would the Israeli/Hamas war widen?), reports of record Central Bank (Russian and Chinese) buying, falling interest rates and a falling USD. A “perfect world” for gold!

Comex gold futures rallied to an All-Time High ($2,150 basis February) in thin Sunday afternoon trading on December 4, but that rally reversed quickly, and prices were ~$150 lower six days later.

Like the other markets noted above, gold has had a mild “course reversal” since late December.

My short-term trading

I started this week with short positions in CAD and gold that I established last week when those markets (and all the other markets in the “all one market” group) began to show signs of having gone up too far too fast.

I covered the short CAD near its lows on Tuesday for a gain of ~60 points and covered the short gold on Friday for a gain of ~$40 oz. when it rallied back after making new lows for the week on the “stronger-than-expected” NFP report. Those were the only trades I made this week, and I went into the weekend flat.

On my radar

The US CPI report for December is due on Thursday, January 11, and will be the BIG (scheduled) event of the week.

Corporate buybacks were massive in December, but there will be a growing “blackout period” in January ahead of corporate reports, so there will be reduced buying from that cohort.

Taiwan elections are set for next Saturday, January 13.

The CFTC COT data, usually released each Friday afternoon, was not reported on January 5 and may be delayed until January 12. This is my best source of “positioning” information, so I regret the CFTC’s decision to delay the report.

Thoughts on trading

As noted in previous reports, I’ve been waiting for signs that the big moves in November/December across the “all one market” group would reverse, and I “dipped my toe in the water” last week with short positions in CAD and gold.

I expected “new money” flows to cause the stock indices to rally this week, and I planned to wait and see if that rally would run out of steam and set up a shorting opportunity. The rally didn’t happen, and I missed getting short.

Last week, I wrote, “In 2024, I will be more patient in picking trades. I will trade bigger size and use wider stops, but losses will be limited to less than 1% (of account equity) per trade.”

I’m off to a good start concerning being more patient, given that when I missed the opportunity to short the stock indices, I just “let it go” rather than chasing the markets lower. I’m trying to make money with my trading; I’m not trying to prove that my “forecasts” are correct!

I pay a lot of attention to sentiment and positioning for my short-term trading. I’m only interested in “forecasts” because they give me some idea of sentiment.

For example, Gold sentiment was very bullish at the end of 2023, and (not surprisingly) speculative accounts in the futures market held the largest net long positions since April 2022 – following the Russian invasion of Ukraine. But this week, gold prices fell despite “bullish” geopolitical news (Red Sea drama, the death of a Hamas leader in Lebanon, bomb blasts in Iran, heavy missile exchanges in the Ukraine war.) The adage is that a market that won’t rise on bullish news is at risk of falling. (Everybody that wants to be a buyer has already bought!)

The fact that gold didn’t rally on positive geopolitical news this week helped me stay with my short position. To be fair, there was “bad news” for gold this week, with the USD and interest rates rising, and that may have ‘offset” the bullish geopolitical news.

I read a lot of market commentary (it’s an old habit!), so I’m aware of the wide variety of opinions about economic growth, employment, geopolitical issues, the possibility of a recession, the likely outcome of the elections, the future path of inflation, Fed policy etc., and how these issues may impact the markets I trade.

I’m also aware that I’m at risk of having a “confirmation bias,” that is, I may “cherry-pick” opinions or trade ideas which support my trading ideas. I think having a “confirmation bias” is unavoidable, and it is, therefore, another risk that needs to be managed. One way of managing it is to remind myself that I’m trading “price” and not opinions.

There is no such thing as “perfect trading.” No matter how well I trade, I could have done better. So another aspect of being patient is “letting it go” when I make a mistake, miss a trade, or have several losing trades in a row.

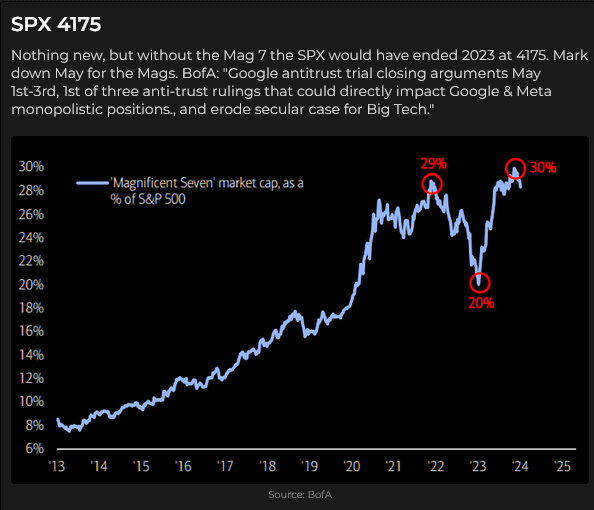

Thought-provoking market ideas

The Barney report

Barney has helped me become more patient. He needs my time and attention; he needs to walk three times a day regardless of what is happening in the markets or the weather. Sometimes, he’ll whimper for attention when I’m busy at my desk, and other times, he will show me what “being patient” looks like!

Listen to Victor talk markets with Mike Campbell

On the January 6 Moneytalks show, Mike and I talked about how I use sentiment and positioning in my trading. We used the gold market and the big swings in equities from August to December to illustrate how sentiment changes create price changes. You can listen to the show here. My 8-minute segment with Mike starts around the 55:30 mark.

The 36th Annual World Outlook Financial Conference

Tickets are now on sale for the 2024 WOFC, which will be held at the Westin Bayshore Hotel in Vancouver on February 2 & 3, 2024. Click here for more information and to purchase tickets.

The Archive

READERS CAN ACCESS WEEKLY TRADING DESK NOTES GOING BACK SEVEN YEARS BY CLICKING THE GOOD OLD STUFF-ARCHIVE BUTTON ON THE RIGHT SIDE OF THIS PAGE.

Headsupguys

There’s a reason I put a link to Headsupguys in my Notes every week. I’ve had friends who took their own lives, and Headsupguys helps men struggling with depression.

Subscribe: You have free access to everything on this site. Subscribers receive an email alert when I post something new – usually 4 to 6 times a month.

Victor Adair retired from the Canadian brokerage business in 2020 after 44 years and is no longer licensed to provide investment advice. Nothing on this website is investment advice for anyone about anything.

STAY INFORMED! Receive our Weekly Recap of thought provoking articles, podcasts, and radio delivered to your inbox for FREE! Sign up here for the HoweStreet.com Weekly Recap.

Victor Adair January 6th, 2024

Posted In: Victor Adair Blog