January 20, 2024 | Trading Desk Notes For January 20, 2024

NDVA, MFST and META surge to new all-time highs; various other stocks also rise

NVDA is up ~20% since the end of 2023 with a current market cap of ~$1.5 Trillion, or roughly half that of AAPL and MSFT.

The powerful rally in Big Cap Tech took the Nasdaq 100 and the S&P to new all-time highs. People who manage other people’s money cannot afford to be underinvested (let alone short!) in this market.

The Vanguard Total Stock Market ETF has rallied along with other significant indices but has not surpassed its 2021 all-time highs, burdened with too many deplorable small-cap issues.

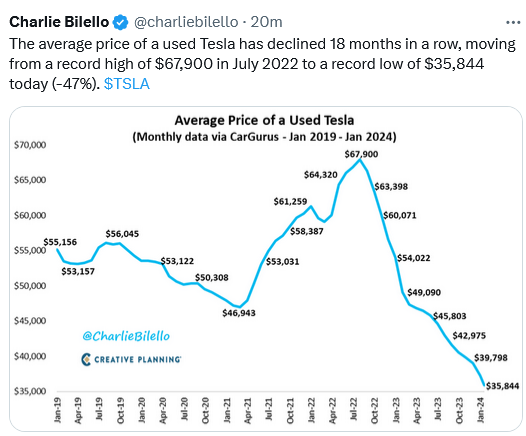

The Magnificant Seven may soon be pared back to the Magnificant Six, with TSLA given the boot for share price performance unbecoming a member. Perhaps the (government-mandated) vision of all citizens happily driving EVs in the not-too-distant future has gone out of focus as consumers recoil from repair costs, as EV inventories pile up on dealer lots, and as Ford announces production cutbacks for the F150 Lightning pickup truck. (Ford sold only ~24,000 Lightnings in 2023 compared to ~750,000 ICE F150s.)

The “everything rally” ended

Stocks, bonds, foreign currencies and (to some extent) gold rallied together in November and December in anticipation of several interest rate cuts in 2024. That commonality ended in late December / early January as bonds, gold and FX all turned lower while (big cap tech-dominated) stock indices remained steady to higher.

This week saw a dramatic repricing of the “several interest rate cuts in 2024” narrative as short-term interest rate expectations for December 2024 were raised by nearly 40 bps, and the odds of an interest rate cut in March fell from ~80% last week to ~40% this week. The market is now virtually dismissing the idea of a recession this year with a “soft landing” as the “worst case” scenario.

Consumer sentiment and spending are much stronger than expected, unemployment is near record lows, inflation is way down from last year, and the Fed will probably cut rates a few times while the economy chugs along with stock prices going higher – Volia, Goldilocks!

Bonds

The 10-year Treasury futures hit a 16-year low in October (yields at ~5%) and then had the best 2-month rally in decades, with yields falling to a low of ~3.8% in late December. Since then, bond prices have dropped, with yields at ~4.2% at Friday’s lows.

People skeptical of the stock market rally may say that the bond market is delivering a warning. They may be correct, but if the bond market is worried about “fallout” from continuing deficit spending (especially in an election year), isn’t deficit spending a boost for the stock market? Shouldn’t stocks and bonds have different trajectories? (Or what’s the point of 60/40?)

Mark January 31 in your calendar as a potential “big day” for bonds. Not only is that FOMC day, but it is also the Treasury quarterly refunding announcement date. Markets will be keen to see the total size of the refunding and especially the ratio of coupons to bills. (The November 1 refunding announcement, with a lower-than-expected allocation to coupons, was credited with igniting the 2-month bond rally.)

Currencies

The US Dollar Index hit a 15-month low in July and then rallied for 12 of the next 13 weeks as FX traders embraced the narrative of the Fed “staying higher for longer.” Stocks and bonds fell during this period.

The USDX pivoted lower around the end of October (as the stock and bond markets pivoted higher) on the new narrative that the Fed would be cutting rates several times in 2024.

Liquidity in the currency markets traditionally gets “thin” in December, which may have exacerbated the weakness in the USDX. Over the past 40 years, currency markets have seen significant directional changes around the turn-of-the-year period.

Gold

Gold came close to making a new low for the year in early October, but the Hamas attack on Israel sparked a rally which accelerated as the market worried about contagion throughout the Middle East following Israeli military action against Gaza.

Gold also benefited from a weak USD and falling interest rates in November and December and Comex futures briefly hit all-time highs on December 4 of $2,150 basis the February 2024 contract.

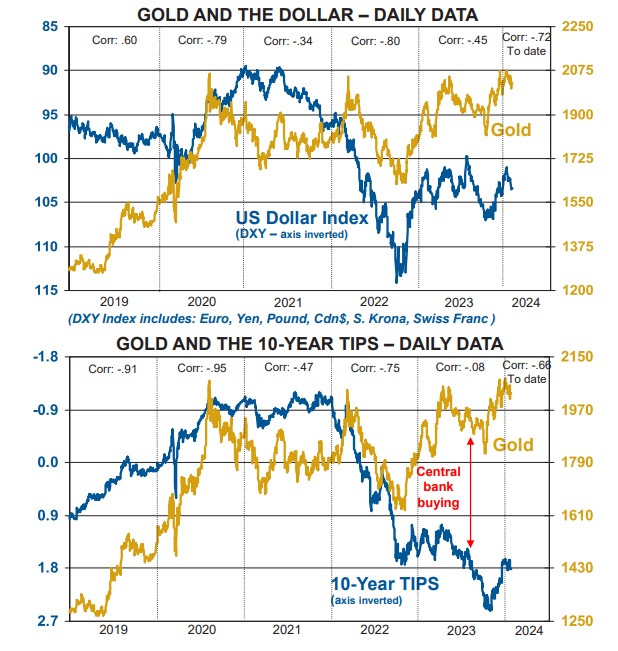

These two charts from Martin Murenbeeld show gold correlations with the USD and interest rates (10-year Tips) over the past five years. The “Central Bank buying” note in red alerts us that gold prices could have been much lower without buying from Russian and Chinese central banks, especially in 2023.

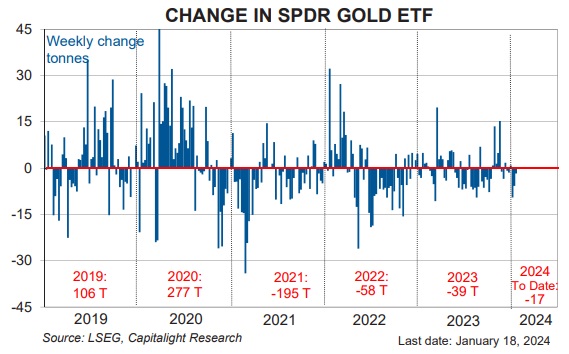

This chart from Martin Murenbeeld shows that the “appetite” for gold ETFs since 2020 has been negative, despite brief spikes on the Russian invasion of Ukraine in early 2022, the banking “crisis” in March 2023 and the start of the Hamas/Israeli conflict in late 2023.

This Gold Miners ETF chart shows that the share prices of the leading gold mining companies have underperformed gold over the past few months. (Gold mining company shares have underperformed gold for several years.)

My short-term trading

I started this week short CAD and the S&P – positions established on Friday last week.

At Wednesday’s lows, I was ahead by ~60 points on the short S&P. I lowered my stop to lock in at least a modest profit and was stopped in the overnight rally. Being stopped was good since the market rallied ~ 125 points from Wednesday’s lows to Friday’s all-time high close.

I was ahead by ~80 points on the short CAD at Wednesday’s lows and lowered my stop to around breakeven, but I didn’t like the price action across markets on Thursday and covered the trade for a gain of ~55 points. That was a good move as the CAD rallied > 60 points from Wednesday’s lows to Friday’s close. I was flat going into the weekend.

I’ve only made five trades in January, and four were profitable. I broke even shorting the S&P twice and made decent gains shorting the CAD twice and gold once.

On my radar

The Fed is in a blackout period ahead of their meeting on January 30 and 31, so, thankfully, there will be no Fed speakers for the next two weeks.

Corporate quarterly reports will be coming thick and fast over the next couple of weeks, and (the big-cap tech reports especially) may have some market impact.

Hard economic data has painted a picture of a more robust economy than soft (surveys) data lately. People may be “concerned,” but the economy is chugging along.

The Bank of Canada meets on Wednesday, but no policy change is expected.

Quote of the week

“It doesn’t matter when the Fed cuts. It matters why the Fed cuts.” Mark Dow @mark_dow

The Barney report

We had our first snow of the season this week, and Barney loves snow. There’s an abandoned railroad track near our house where I can let Barney run off-leash without worrying about automobile traffic – but there are deer in the area and lots of deer tracks in the snow. We’re still working on Barney’s recall!

Listen to Victor talk about markets

Mike Campbell and I discussed the incredible run for the roses in the tech stocks on the Moneytalks show this morning. Mike’s feature guest this week is Tony Greer, a terrific market analyst. You can listen to the show here. My spot with Mike starts around the 1 hour 4 minute mark.

I also did my monthly 30-minute interview with Jim Goddard on the This Week In Money show today. We discussed my macro view of markets and drilled down on big-cap tech, gold, bonds, currencies and the energy market. We also examined why I prefer sentiment and positioning data over market predictions. You can listen to the show here. My spot with Jim starts around the 40-minute mark. My long-time friend Ross Clark, an excellent technical analyst, talks with Jim during the first 12 minutes of the show.

The 36th Annual World Outlook Financial Conference

Tickets are now on sale for the 2024 WOFC, which will be held at the Westin Bayshore Hotel in Vancouver on February 2 & 3, 2024. Click here for more information and to purchase tickets.

The Archive

READERS CAN ACCESS WEEKLY TRADING DESK NOTES GOING BACK SEVEN YEARS BY CLICKING THE GOOD OLD STUFF-ARCHIVE BUTTON ON THE RIGHT SIDE OF THIS PAGE.

Headsupguys

There’s a reason I put a link to Headsupguys in my Notes every week. I’ve had friends who took their own lives, and Headsupguys helps men struggling with depression.

Subscribe: You have free access to everything on this site. Subscribers receive an email alert when I post something new – usually 4 to 6 times a month.

Victor Adair retired from the Canadian brokerage business in 2020 after 44 years and is no longer licensed to provide investment advice. Nothing on this website is investment advice for anyone about anything.

STAY INFORMED! Receive our Weekly Recap of thought provoking articles, podcasts, and radio delivered to your inbox for FREE! Sign up here for the HoweStreet.com Weekly Recap.

Victor Adair January 20th, 2024

Posted In: Victor Adair Blog