December 18, 2023 | The Equity Bear Market is Likely Only Started

Asset markets leapt last week as the US Fed (and Bank of Canada) held monetary policy unchanged for the 5th consecutive month, having hiked last in July. US Chair Powell fueled euphoria when he said the Fed was talking about rate cuts in 2024–the crowd went wild. Just weeks before, Powell had said they were not even thinking about easing. We can only guess what changed his tune this time, but we enter another “unexpected” Fed turning point, and other central banks are expected to follow.

The bond market traditionally leads stock markets at turning points. Government bond prices tend to fall while central banks tighten and rebound sharply as they pause and resume cutting. Conversely, equities tend to rally during tightening cycles and then dump through the easing.

The 2007-09 cycle was pretty typical: the Fed administered its last hike to 5.25% in June 2006, followed by a first cut (50bps) in September 2007 as “soft-landing” confidence went viral. In reality, the ‘Great’ recession began in December 2007.

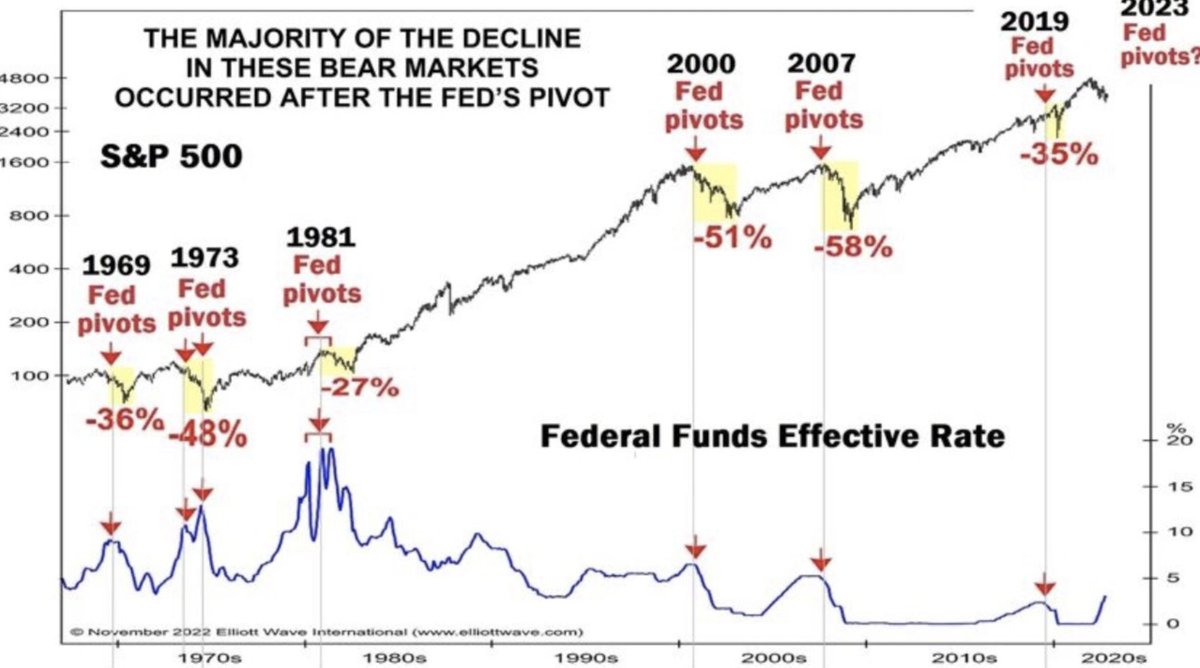

Treasury yields peaked in July 2007, and the stock market peaked three months later in October 2007. Then, Treasury prices rallied sharply while the Fed slashed the overnight rate back to zero by December 16, 2008, where bond yields bottomed/prices peaked. Stock markets did not bottom until three months later, in February/March 2009, after the averages had lost more than 50%. As shown below, via Puru Saxena, it’s typical for stock markets (S&P 500, in black, since the 1960s) to suffer the bulk of bear market declines while the US Fed is lowering its policy rate (Fed rate at the bottom in blue).

Canada’s stock market tends to follow in lockstep. The TSX (below since 2007, courtesy of my partner Cory Venable) also topped in October 2007, sold off and rebounded into May 2008 before halving into February 2009. Similar and potentially greater downside risks loom for the TSX this cycle.

I’m having some deja vu in all of this. Sixteen years ago, in December 2007, I wrote on this blog:

I’m having some deja vu in all of this. Sixteen years ago, in December 2007, I wrote on this blog:

A lot of people have been asking me lately whether now is a good time to reduce their equity and risk exposure, if they had not done so to date, or whether it is best to wait for prices to come back a bit before paring down their holdings. Many have experienced paper losses through 2007, and they are hoping they will not have to sell now and realize these losses.

My advice? We have not seen anything yet. If you don’t like the losses over 2007, you are likely to react very badly to market losses once a real bear market gets into full swing. Watch out for mental math and emotional accounting around your allocation decisions. If you are over-exposed to risk, it is better to re-adjust and reduce exposure pre-emptively now rather than in the midst of panic selling when all the other poorly prepared investors will be running for the exits.

In January 2008, our humble management discipline and cycle awareness prompted me to write This Bear Market is Only Started. These timeless observations bear repeating now:

Making market gains is a pointless, deluded activity without a discipline for keeping them.

The present bear market started in July 2007 and has been stealthily eating away at passive portfolios over the past 6 months. Six months into a bear market is typically when the worst losses begin in earnest. The bottoming process is likely to take the next several months not days or weeks. It is still not too late to protect your savings.

Remember market tops are reached when every last sucker has been sucked in. It appears that this cycle, the top was hit last July. Once all the buyers have bought, there is no one else to support the pyramid scheme, and selling begins in earnest. It is no laughing matter. Financial losses cause real psychological, emotional and physical pain to investors as marriages break up, suicides rise, and lives are damaged.

How bad could things get from here? It is impossible to know in advance, but equity losses of 20-30% would not be bizarre or unusual from here. It would also be common for such losses to take the next economic expansion of 3-5 years in order for capital to recoup its value.

Everyone that has taken the “buy and hold” sleeping pill needs to ask themselves this: how will you react, feel, fare, if you suffer capital losses in the -20%+ range over the coming weeks or months. And if you conclude you would not be ruffled or annoyed– by all means sleep on. For the rest of you who did not realize you signed up for this kind of a reckless rollercoaster ride, it is still not too late to wake up.

STAY INFORMED! Receive our Weekly Recap of thought provoking articles, podcasts, and radio delivered to your inbox for FREE! Sign up here for the HoweStreet.com Weekly Recap.

Danielle Park December 18th, 2023

Posted In: Juggling Dynamite