December 8, 2023 | Canadian Lenders are Sleepwalking into The Next Recession

Canadian lenders are ill-prepared for the impact of higher interest rates on Canadian borrowers.

The banks have sophisticated models that help them make predictions about the future.

But those predictions are only as good as the assumptions fed into the model.

Are those assumptions realistic?

With the help of Nigel D’Souza, research analyst with Veritas Research, I examined the assumptions that banks make to assess the size of provisions for loan losses.

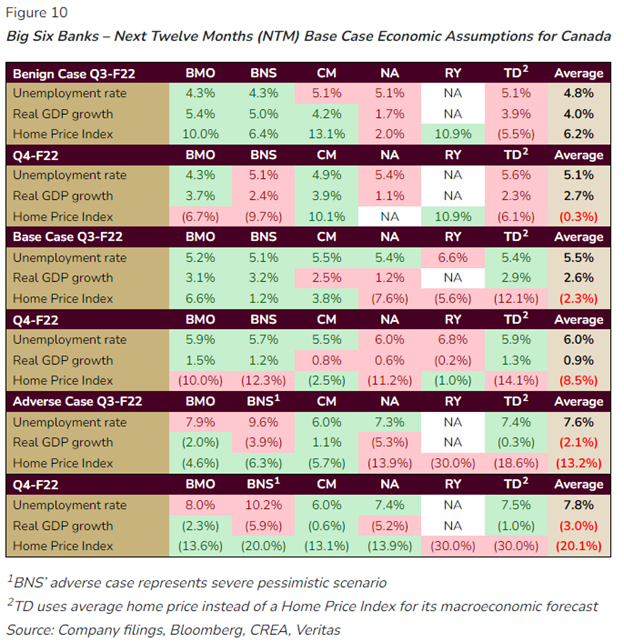

These assumptions are made for two scenarios: a base case, the most likely outcome in the bank’s opinion, a benign case, and an adverse case for GDP, house prices and unemployment.

It would make sense for banks to take a more cautious approach now, as many households face much higher payments when mortgages reset at five-year maturity. Variable rate mortgages are supposed to reset monthly, but some of the banks keep those payments static, even if mortgage interest is not fully covered. But even those static payment mortgages will be reset at some point over the next five years.

Most mortgages will reset within three years.

Here are assumptions from October 31 2022:

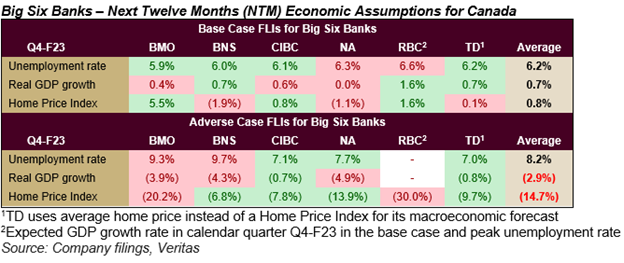

And the numbers just released last week for October 31 2023:

In the adverse case all banks assume there will be a mild recession.

But little has changed for the adverse case for Q4 2022 and Q4 2023

The unemployment rate changes from 7.8 to 8.2 percent.

The GDP decline improves from -3.0 to -2.9 percent.

And the Home Price index improves from -20.1 to -14.7 percent.

But with much higher interest rates, consumers are already struggling as mentioned in the latest results for consumer sales businesses like Canadian Tire.

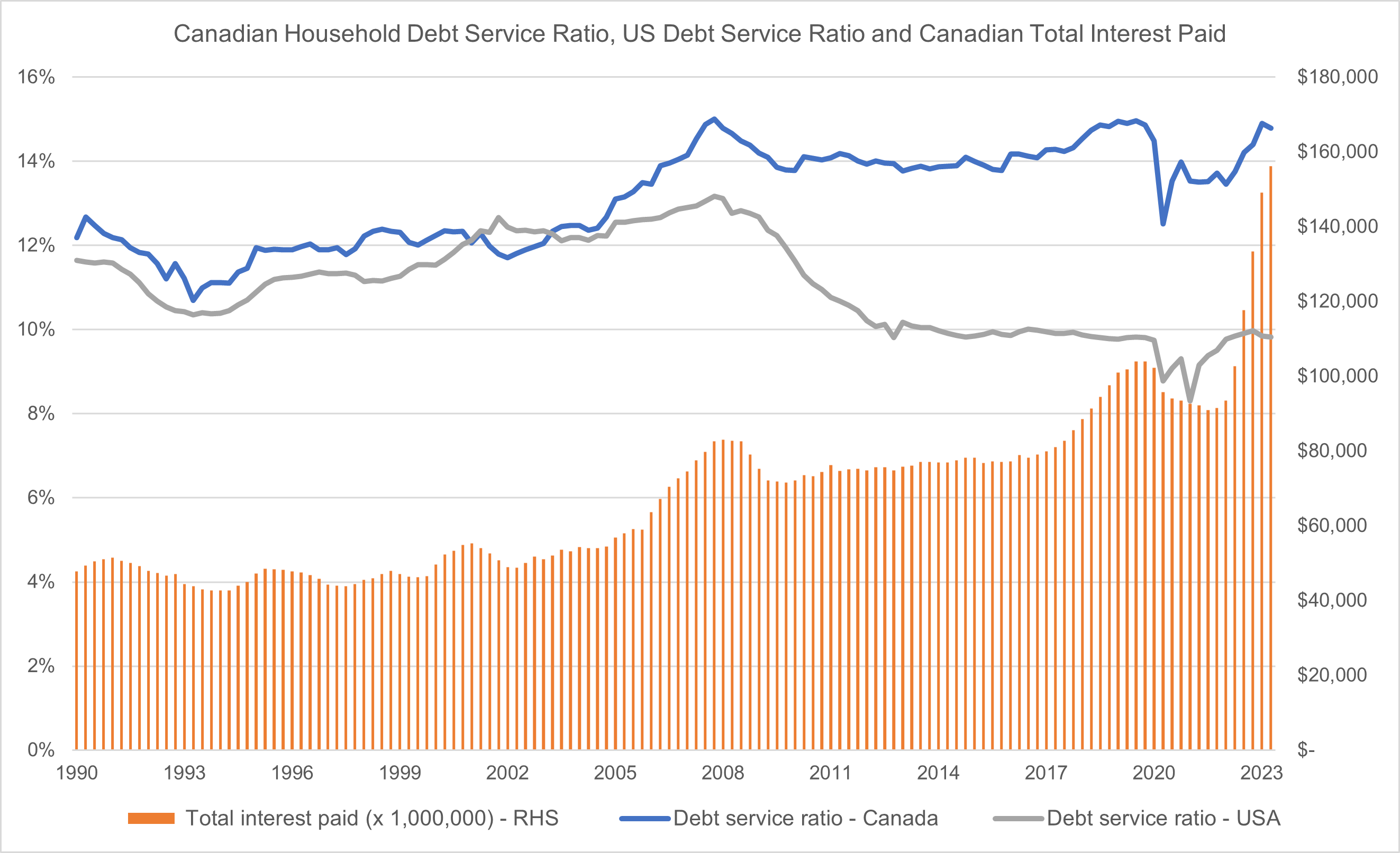

But when we look at changes that affect the household sector, we can see serious problems.

Sources: Statistics Canada, FRED – St. Louis Fed

While the household debt service ratio (DSR) in Canada (blue) has always been higher than in the U.S (gray)., we see a substantial improvement in the U.S. after the Global Financial Crisis in 2008. Peaking at about 13 percent the DSR declined to about 10 percent and has remained there. On the other hand, the DSR for Canadian households stayed about 14 percent and in the latest report reached 14.8 percent.

But even more disturbing is total interest paid on debt by Canadian households (orange bar), which has shot higher, reaching $160 billion, more than double the amount paid in 2010.

This surge in interest payments has not shown up yet in the total Canadian debt service ratio because mandatory principal payments have not moved up yet. But those principal payments on mortgages will get reset for all mortgages in the next few years, and many families will be devastated. Some will be unable to meet those higher payments.

It is unfortunate that Canadian banks are unwilling to forecast this change. A more realistic assessment would allow them to prepare with larger loan loss reserves and higher capital buffers.

But increased provisions for credit losses, the inevitable result of more realistic assumptions, would reduce earnings.

Hilliard MacBeth

The opinions expressed in this report are the opinions of the author and readers should not assume they reflect the opinions or recommendations of Richardson Wealth or its affiliates. Assumptions, opinions and estimates constitute the author’s judgment as of the date of this material and are subject to change without notice. We do not warrant the completeness or accuracy of this material, and it should not be relied upon as such. Before acting on any recommendation, you should consider whether it is suitable for your particular circumstances and, if necessary, seek professional advice. Past performance is not indicative of future results. The comments contained herein are general in nature and are not intended to be, nor should be construed to be, legal or tax advice to any particular individual. Accordingly, individuals should consult their own legal or tax advisors for advice with respect to the tax consequences to them, having regard to their own particular circumstances.. Richardson Wealth is a member of Canadian Investor Protection Fund. Richardson Wealth is a trademark by its respective owners used under license by Richardson Wealth.

STAY INFORMED! Receive our Weekly Recap of thought provoking articles, podcasts, and radio delivered to your inbox for FREE! Sign up here for the HoweStreet.com Weekly Recap.

Hilliard MacBeth December 8th, 2023

Posted In: Hilliard's Weekend Notebook